Top stories

Call for Covid support - make your voice heard

Landlords are suffering as a result of the Covid pandemic, with the NRLA renewing calls for financial support. MPs are already asking questions in Parliament as a result of landlords’ lobbying and we need your help to make sure this continues.

Flats without cladding will no longer need EWS1 test

Owners of flats in buildings without cladding will no longer need an EWS1 form to sell or re-mortgage their property. Post-Grenfell the Government introduced rules requiring homes to undergo and external wall survey process know as EWS1.

Spending review: Sunak cuts housing support

Landlords have criticised the Chancellor for cutting the amount tenants relying on benefits will be able to claim to pay rent. The NRLA says it is a kick in the teeth for those renters and landlords struggling with arrears through no fault of their own.

New 2021 training schedule announced

The NRLA has revealed its new 2021 training schedule. With the future still uncertain as regards the Covid-19 pandemic, all classroom courses will now be taught in a virtual classroom, with the same expert trainers and opportunities to interact.

Green Homes Grant scheme extended by a year

The Green Homes Grant scheme, under which landlords can apply for a grant of up to £5000 to improve the energy efficiency of their properties, has been extended. The scheme was due to end on 31st March 2021 but will now continue until March 2022.

Carbon Monoxide rules: consultation launched

Private landlords in England will be required to install a carbon monoxide alarm in any room that has a fixed combustion appliance, for example a gas boiler or wood burner, under proposals unveiled as part of a new Government consultation.

Young 'forced to choose between rent debt and health'

Young people are being forced to choose between racking up rent debts and risking their health due to rules limiting the amount of money they can claim for housing benefit. These rules mean they have no choice but to live in shared homes.

Blog: Section 21: Going, going, gone

The NRLA has published its response to the Government consultation on its Renters Reform Bill. Here Paul Shamplina, Head of Property for Hamilton Fraser and Founder of Landlord Action shares his thoughts on the Government's proposals.

Blog: Wear and tear, what you need to know

Every landlord expects a general level of deterioration in a property over time. However, when it comes to end of tenancy, what is considered fair wear and tear? Head of TDS Adjudication Services, Sandy Bastin explains.

Blog: How to stay safe from scammers

The NRLA has received reports of prospective tenants who have been defrauded out of hundreds of pounds by criminals who have advertised a fake property to rent. Read our blog for a closer look and how to protect yourself.

New Article 4 toolkit and latest licensing updates

Find out about our new Article 4 toolkit, designed to help you understand and respond to local Article 4 direction proposals and catch up on any new local licensing scheme consultations launched in your area.

New virtual classroom courses and webinars

Welcome to your training and events guide for December. With our programme of classroom courses still on ice, here’s all you need to know about our virtual training and national and regional webinar dates this month.

Help and advice

Winter Maintenance letter for tenants

A landlord gave our advice team a call recently asking if the association had a standard letter he could send to his tenants outlining their property care responsibilities with winter on the way.

Covid-19: Viewings for groups of students

A landlord posted on our forum recently asking fellow NRLA members how to safely organise a viewing for a group of students that were interested in renting out his property next year.

How to: Refresh a tired looking kitchen

Refreshing your rental's kitchen does not need to break the bank, and in this blog we will take a look at some inexpensive improvements you can make to give it a new lease of life.

Tax courses from the NRLA Training Academy

December’s training focus is on tax. We run a number of tax courses covering everything you need to know as a landlord when it comes to inheritance tax, property tax and capital gains tax.

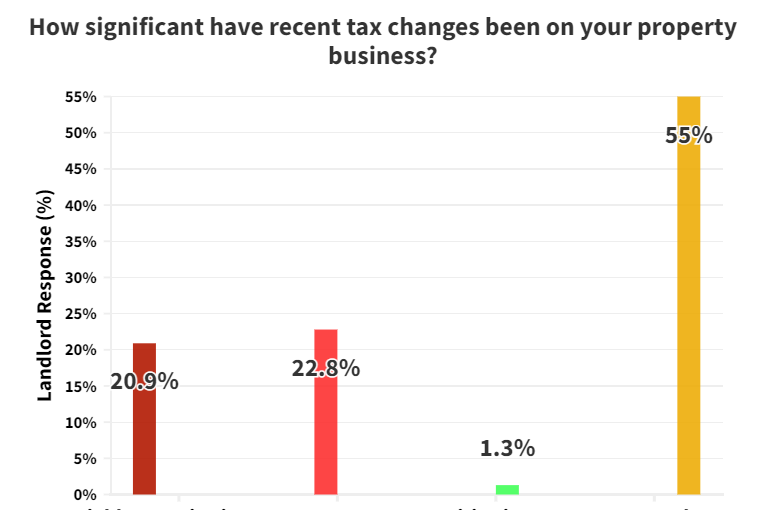

Research

Almost half the landlords responding to the NRLA's latest landlord survey said Capital Gains Tax has already had a negative impact on their lettings business, with almost 60% holding onto property for longer than planned. To read more about the findings click here.