Smart Currency Exchange

Using a Smart Currency Exchange could save you money when transferring funds abroad and keep your finances protected.

When sending money between two countries, even the smallest movement in the currency markets can lose you a significant amount of money. Smart Currency Exchange can stop this from happening.

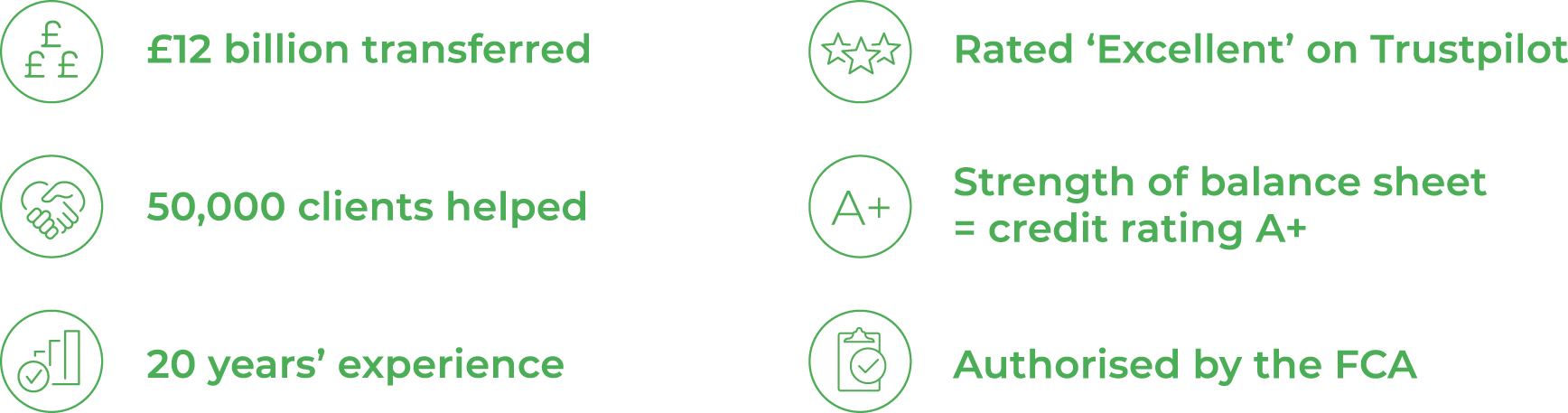

Since 2004, Smart Currency has helped more than 50,000 clients protect over £12bn of transfers from the dangers of exchange rate fluctuations.

What can Smart Currency Exchange help with?

- Overseas property purchases and sales

- Making regular payments overseas

- Property maintenance and mortgage payments

- Receiving rental income

- Wealth management

- Business and investment

- Transfers to family members overseas

- School or college fees

- And much more.

As soon as you open your free account with Smart Currency Exchange, you’re assigned a personal account manager to help provide guidance on currency markets for the latest information on exchange markets and what that means for your transfer. Account managers are available directly by phone, so you won’t have to navigate a call centre.

Case study

Case Study: Locking-in costs using a regular payment plan

As a landlord with rental properties overseas, managing mortgage payments can be challenging. A Regular Payments Plan (RPP) from Smart Currency Exchange simplifies this process and offers significant benefits. An RRP functions like your personal assistant, automating your transfers at a rate of your choice. You can either opt for a locked-in rate or the day's exchange rate. This not only saves you time but also helps you avoid missed payments. Furthermore, it protects you from currency fluctuations. So, if the pound takes a dip, there's no need to worry. Your payments will remain the same. So, if you've got properties overseas or international transfers on the horizon, give Smart Currency a call and find out how an Regular payment plan can help you. (NRLA), helping hundreds of members manage their international transfers like pros.

Why use Smart Currency Exchange:

Review

I recently used Smart Currency Exchange on the advice of a financial advisor. They provided a very efficient, speedy service and gave clear instructions for a first-time user. It was reassuring to be assigned a personal advisor who was extremely helpful. I will definitely use their services again in the future.

NRLA has partnered with Smart Currency Exchange, a currency specialist, to help you get the most from your currency exchange needs. Inquire now to find out how Smart Currency Exchange can save you money.

Smart Currency Exchange Limited is authorised by the Financial Conduct Authority under the Payment Services Regulations 2025 (FRN 504509) for the provision of payment services. Smart Currency Exchange Limited is also authorised and regulated by HM Revenue and Customs under the MLR no 12198457. The information provided is solely for informational purposes and should not be regarded as a recommendation to buy or sell. All information is obtained from sources believed to be reliable and we make no representation as to its completeness or accuracy.

Articles

Thinking of buying a holiday home abroad this year?

Anyone in the process of buying property overseas will, at some point, need to make a foreign transfer to pay for their property. NRLA partner, Smart Currency Exchange gives us some pointers.