Growing the private rented sector would boost Government coffers by £10 billion

Increasing the supply of homes for private rent would boost the Government’s coffers to the tune of £10 billion, equivalent to almost the entire Affordable Homes budget, according to the National Residential Landlords Association (NRLA).

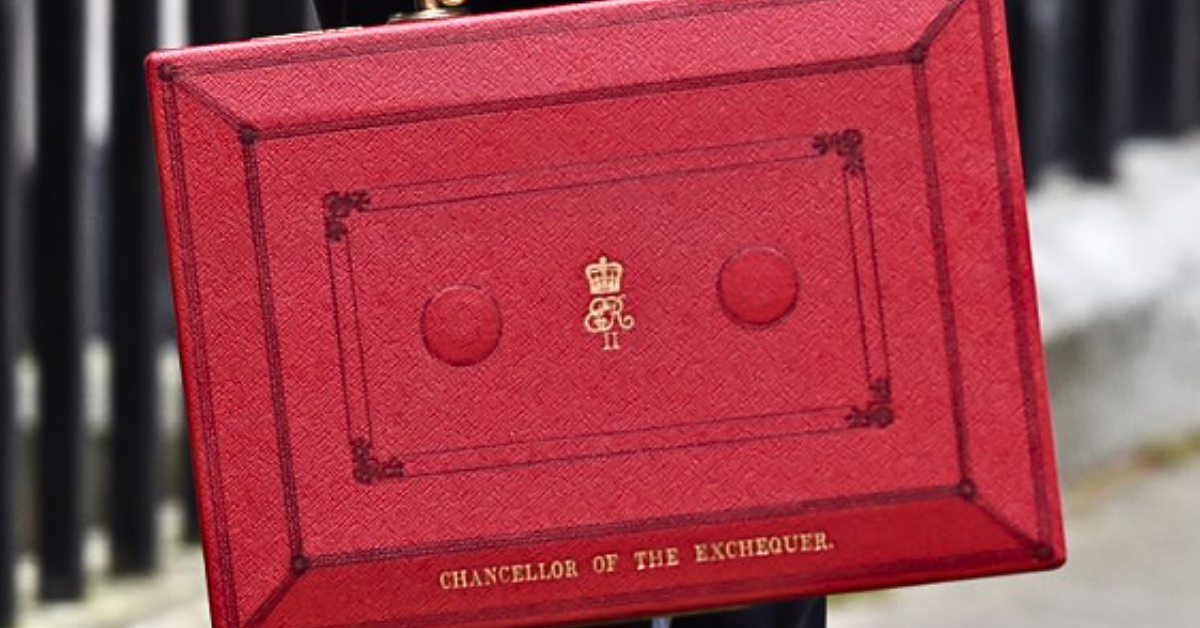

The assessment follows the submission of the NRLA’s proposals to Government ahead of the Budget on 6th March, amidst a supply crisis in the rental market. Research findings suggest that an average of 11 prospective tenants now make enquiries about every available property to rent.

Independent analysis by Capital Economics also reveals how scrapping the three per cent stamp duty levy on the purchase of additional homes would see almost 900,000 new private rented homes made available across the UK.

As a result of increased income and corporation tax receipts, Capital Economics’ modelling indicates this would lead to a £10 billion boost to Treasury revenue over the same period. For context, this is the equivalent of almost the entire £11.5 Affordable Homes Programme budget for 2021-26.

The Stamp Duty Levy was introduced in 2016 with the then Chancellor, George Osborne, arguing that it would prevent landlords squeezing out families who want to become homeowners. His reasoning was refuted by the London School of Economics which argued that “nationwide only a minority of sales to landlords involved bids from both types of buyer.”

The NRLA is calling for the Chancellor to scrap the Stamp Duty Levy at the Budget.

Its views have been shared by Director of the Institute for Fiscal Studies (IFS), Paul Johnson, who warned in a piece for The Times that: “The more harshly that landlords are taxed, the higher rents will be.”

Ben Beadle, Chief Executive of the National Residential Landlords Association, said: “The Chancellor needs to pull out all the stops to tackle the housing crisis.

“Growing the private rented sector is not only vital if tenant demand is to be met, but it would also provide a substantial boost to Treasury coffers, enabling it invest in vital public services.

“It makes no sense to discourage investment in desperately needed private rented accommodation. Inaction will only result in more misery for prospective renters.”

-ENDS-

Notes:

The NRLA’s Budget submission can be downloaded here: https://www.nrla.org.uk/download?document=1703

The modelling by Capital Economics can be found on page 28 of its report at: https://www.nrla.org.uk/capital-economics-report.

According to Rightmove, letting agents are receiving an average of 25 enquiries about every available home to rent. Details can be accessed at: https://www.rightmove.co.uk/news/articles/property-news/rental-tracker-25-lettings-enquiries-every-home/.

The Government’s budget for the Affordable Homes Programme for 2021-2026 is £11.5 billion. See https://www.gov.uk/government/publications/dluhc-accounting-officer-assessments/affordable-homes-programme-2021-2026-accounting-officer-assessment.

In November 2015 the then Chancellor, George Osborne, announced a 3 percentage point stamp duty levy on the purchase of additional homes. He told the House of Commons: “Frankly, people buying a home to let should not be squeezing out families who can’t afford a home to buy. So I am introducing new rates of Stamp Duty that will be 3 per cent higher on the purchase of additional properties like buy-to-lets and second homes.” See https://www.gov.uk/government/speeches/chancellor-george-osbornes-spending-review-and-autumn-statement-2015-speech.

The argument that landlords are pushing other buyers out of the market was challenged in May 2016 when a report by the London School of Economics noted that: “The (very limited) research into direct competition between investors and private owner-occupiers has found that nationwide only a minority of sales to landlords involved bids from both types of buyer.” See page 5 at: https://www.lse.ac.uk/business/consulting/assets/documents/Taking-stock.-Buy-to-let.pdf.

In a recent article for The Times, Paul Johnson, Director of The Institute for Fiscal Studies, noted: “The more harshly that landlords are taxed, the higher rents will be. One of the reasons that private rents have risen so much is that government policy has substantially increased tax payable by private landlords. Even more than the price of owner-occupation, high rents in and around London and other thriving cities prevent young people moving from elsewhere to take up well-paid, highly productive jobs.” The article can be accessed at: https://www.thetimes.co.uk/article/its-time-to-stamp-on-a-tax-that-penalises-landlords-and-renters-lmqtxtlfg.

Further information about the NRLA can be found at www.nrla.org.uk. It posts on X @NRLAssociation.

For further information contact Ed Jacobs by emailing [email protected] or telephone 0770 6386 773.

The NRLA’s press office can be contacted by emailing [email protected] or by calling 0300 131 6363.