Energy efficient landlords: investment without reward

Introduction

Each quarter the NRLA invites landlord members to participate in our policy research programme. Each quarter between 1,300 and 2,000 members give their views on a range of policies, initiatives and proposals which might be having an impact on their business.

A recent survey (2020, Quarter 4) looked at the topic of safety and standards. The more specific context for this research was the recent government consultation on Improving the Energy Performance of Privately Rented Homes in England and Wales.

Levels of energy efficiency investment in the wider PRS

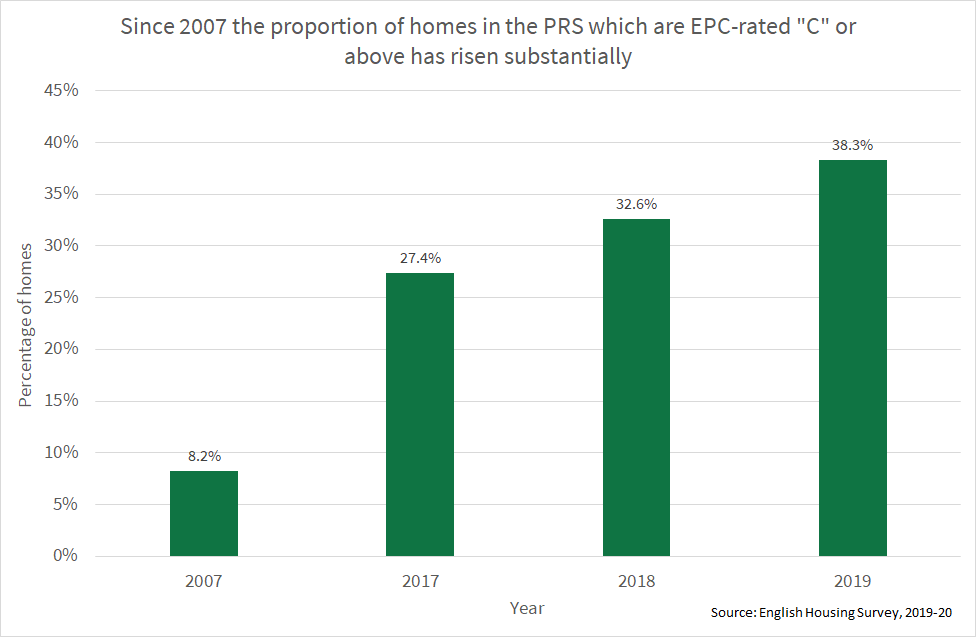

Figure 1 below shows how the profile of PRS housing has become much more efficient in recent years:

Figure 1: Proportion of PRS housing having an EPC rating “C” or above, various years

The proportion of properties in the PRS which meets the EPC standard of “C” or above has risen almost five-fold in the last twelve years. Some of this changing pattern reflects the energy efficiency of new housing.

However even in the most recent year, the EHS finds almost 45% of homes in the PRS were pre-World War II. Meanwhile, only 12% of the stock of homes in the PRS were built after 2003. One must therefore conclude that the bulk of this gain has been a result of landlord investment - rather than shifts in the type of housing stock which is available in the PRS.

NRLA members and their energy efficient investments

Our Quarter 4 survey asked landlords about recent investments in energy efficient measures for their properties.

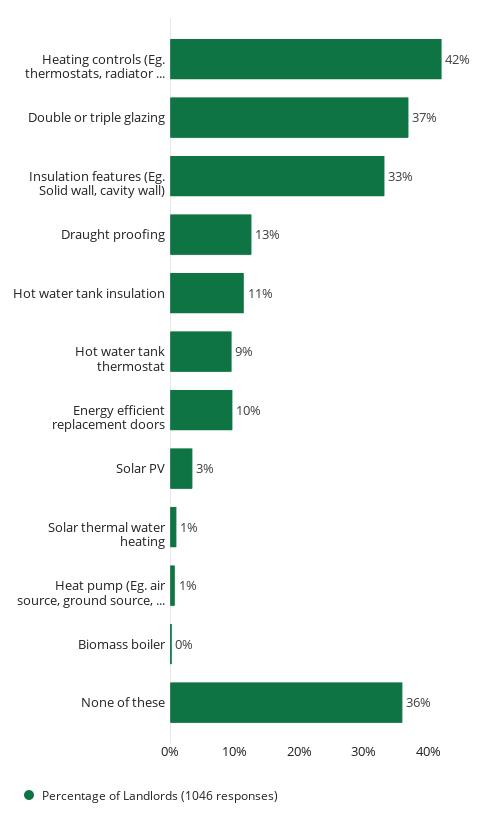

The survey found almost two-thirds of landlords had made recent energy saving investments. Table 2 below shows landlord investment across various types:

Figure 2: Proportion of landlords investing in energy efficient measures (multiple-response)

The chart shows the diversity of landlord expenditures. These range from quite simple interventions such as hot water tank insulation or heating controls to more expensive investments, for example double glazing or wall/floor insulation.

The key point is that landlords are investing. For most (64%) of those landlords who did not say they had made recent investment, the main reason was the current EPC rating on their properties met required standards.

Government consultation and future proposals

In September 2020 BEIS launched a consultation (which closed in January), proposing to amend the energy efficiency regulations for the PRS in England and Wales. The core proposal (subject to a range of caveats) being to raise the minimum EPC rating for rented property to band “C”. If enacted in line with the consultation, this change would be phased in between 2025 and 2028.

As Figure 1 shows, at present around 40% of homes in the PRS meet this standard. Fewer than half the landlords surveyed believed all properties in their portfolio would meet this standard by 2028.

It is the practicalities of achieving this standard which is the most vexing for landlords, especially for those who have larger portfolios across a mix of property types.

Over half of the landlords surveyed concluded either the age of individual properties and/or the costs to bring the property to a “C-band” essentially make it impractical to achieve the standard.

Impact of any new legislation

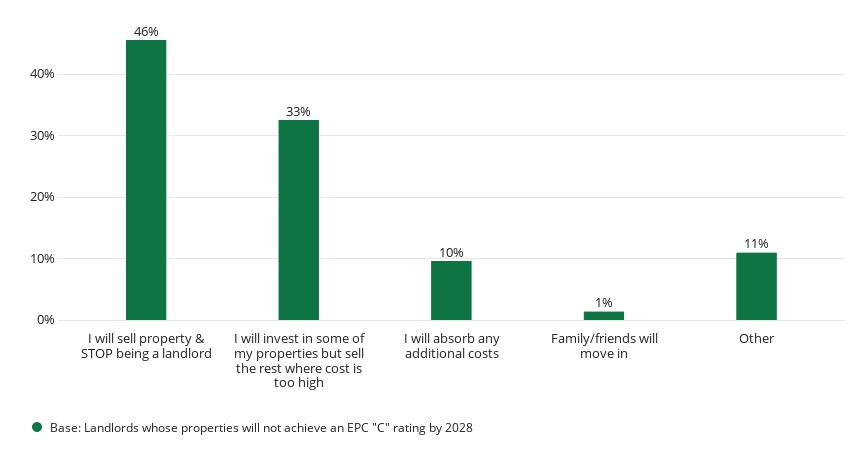

Those landlords who did not think their properties would meet this “C” standard by 2028 were asked how they would respond. Figure 3 sets out these responses:

Figure 3: Landlords’ likely reaction to increasing minimum EPC rating in PRS

From the above, almost half of landlords concerned about meeting this standard will simply sell and exit the market and a further one-third will reduce their holdings to fund investments elsewhere in their portfolio.

Several of my properties are flats in social housing blocks. All have new boilers and double glazing, but I can't get C rating without doing measures like solid wall insulation which is impossible for one property within a block.

Conclusions

Landlords operating in the PRS have made tremendous strides to raise the Energy Efficiency levels of the properties they let. The proportion of PRS properties in the highest efficiency bands has risen almost five-fold in a fifteen year period. What’s more, landlords are continuing to invest in their properties.

However, many landlords see it as impractical and uneconomic were the “C” level to become a floor target for the PRS. Figure 3 above shows the potential consequences of such a move.

Note that exit is also built into many of the “Other” strategies in Figure 3 above. As a result, it could be 80-85% of landlords who presently let property which is not at an EPC “C” level could sell or reduce their holdings.

This would mean the problem of energy efficient housing is transferred to owner occupiers through property sales.

Despite the failings of the Green Homes Grant programme, it remains the case that supporting landlords through meaningful grants and voucher programmes will have a greener impact than forcing landlords to transfer property to owner occupiers.

The consequence of imposing targets could be a loss of choice and higher rents in the Private Rented Sector. This would be most notable in areas of the country where housing stock is older – most notably those rural areas where stock is older and affordable housing for owner occupiers is scarce.