Landlords shine brightly... but energy efficiently

This deep dive into the 2019 Quarter 3 survey reflects on the landlord community’s investment in pushing up the energy efficiency of their properties.

This blog post identifies members of landlord organisations like the RLA as being at the vanguard of investment.

With much more needed to be done, there is a buisness case for a mechanism to bring forward landlord investment. The survey clearly shows an opportunity for a policy which would have demonstrable impact in what is at present, a beleagured supply-side community.

Introduction

Energy efficiency and the promotion of energy efficient homes is a priority for government. Energy efficiency in the home is taken to mean using less energy to provide the same amount of electric lighting, heating and general energy services.

A household is said to be in fuel poverty if:

- it has required fuel costs that are above average (the national median level), and

- were that household to spend the necessary amount on fuel, they would be left with a residual income below the official poverty line.

To move towards the eventual elimination of fuel poverty the Clean Growth Strategy set a target to upgrade as many houses to EPC Band C by 2035. More information on EPC Bands can be found here.

Promoting good practice to landlords and identifying opportunities to improve the EPC rating of properties in the Private Rented Sector (PRS) – via the most cost-effective mechanisms – has been a key feature of the RLA’s service offer.

So too is working alongside Government – as well as lobbying and campaigning – to develop incentives to landlords which will encourage and bring forward investment in their properties to bring the PRS up to standard.

Impact of Policy

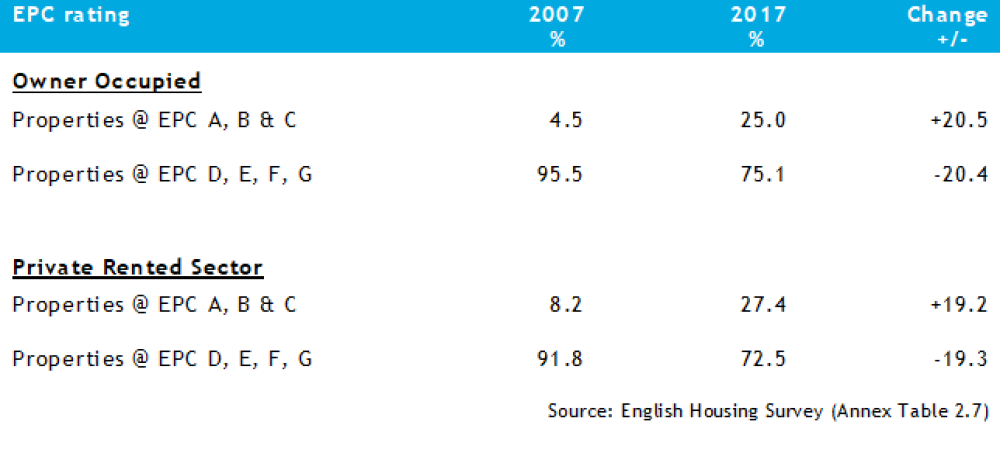

Table 1 below shows a summary of the changes in EPC rating over the last ten years (the most recent for which data is available) in owner occupied houses and homes in the Private Rented Sector:

Table 1: EPC Rating – Owner-occupied & PRS 2007, 2017

The table shows the proportion of homes in the PRS in the most efficient EPC bands (A, B and C) has increased from less than 10% (8.2%) to over a quarter (27.4%) in the ten years up to 2017.

The improvement in the PRS has kept pace with that of owner-occupied homes. This perhaps is in contrast with the common stereotype of landlords, reluctant to invest in their property and allowing tenants to meet the cost of living in fuel and energy-inefficient dwellings.

RLA Members – ahead of the curve

Over the last twelve months the RLA, through its State of the PRS research series has asked landlords (predominantly, but not entirely, members of the RLA) about their portfolio investments in energy efficiency and its impact.

In the Quarter 4, 2018 survey 47.2% of landlords reported the typical EPC rating for the properties they let were either A, B or C-rated.

Following a direct request from Whitehall, we also asked landlords in the 2019, Quarter 3 survey about EPC ratings. Almost two-thirds (64.0%) of landlords reported in this survey that the properties they let were at the A, B or C-standard.

These figures are not directly comparable to the English Housing Survey data. Nor were the questions landlords were asked the same in each survey.

However, irrespective of the detail the conclusion which can be pieced together is clear: the promotion of good practice through voluntary membership organisations is having a beneficial effect on the energy efficiency agenda.

Explaining motivations for investment

Our 2019 survey highlights the following:

- Almost half of landlords (46.0%) stated they had invested in energy efficiency measures over the last twelve months.

- A much smaller proportion (14.8%) definitely stated they were going to make investment in the next twelve months/two years. However, a substantial proportion of landlords – over 40% – could be classed in a “maybe” category.

The survey findings draw attention to two main reasons landlords were investing, or considering investing, in further energy efficiency measures:

- Firstly, there is a clear business case for such investment – landlords gave a variety of business reasons – for example to attract tenants or to maintain property values.

- Secondly almost 60% (57.1%) of landlords making energy efficient investments were doing so because of the wider, climate-based benefits of doing so.

Nor is this investment insignificant – over a third of those landlords who have made an investment invested over £2,000 in improving energy efficiency per property.

Again, this finding challenges a common misconception of landlords. It also highlights how a combination of market economics and concern for wider global issues come together to raise property standards.

The public sector role: overcoming barriers to investment

Public intervention IS however needed to continue this work. The housing stock generally – across owner occupiers too – remains well short of the government’s target to combat fuel poverty and reduce carbon emissions.

With landlords having previously made investment in items such as window glazing, boilers and insulation, it is not surprising they see the capital costs for future outlay prohibitive. For many the improvement in EPC from further expenditure is now marginal.

The research shows that whilst landlords will take a green option when it is time to make an investment – which may be replacing a boiler or windows or a front porch – making their homes green is not itself a strategic objective for their business.

The efforts landlords have made to get their property to this level should be recognised with the offer of carrots – and not sticks – to encourage landlords to move their portfolio even further forward in terms of energy efficiency.

Definitely NOT another

Government needs to recognise that previous attempts to stimulate energy improvements have largely passed landlords by.

Our 2018 survey showed less than 5% of landlords had obtained grants to help meet their cost of their investment – indeed, more landlords had taken out personal loans to fund energy efficiency improvements than had accessed Government support.

In this year’s survey, when asked about possible tax or grant incentives:

- Almost 80% of landlords agreed, depending on the fine print, that some form of support would lead to an increase in investment in energy efficiency.

- Crucially, there was considerable support amongst those landlords who are not planning to make further investment. Nearly three-quarters (70%) of this group stated they would reconsider were such a scheme available.

The last finding is crucial: it allays fears of such a policy simply being substitution of private funding by the public purse.

Conclusions

Private landlords have demonstrated a willingness to invest heavily in energy efficient measures. Responsible landlords, many of whom are members of organisations such as the RLA, have a positive attitude to such investment. The evidence is a marked contrast to the perception of landlords which has been framed by individual cases of bad practice.

There is still much to do.

Very few landlords have previously taken advantage of incentives through public schemes. There exists an opportunity for government to both bring forward planned investment and to encourage investment among those landlords not even planning to do so.

A properly funded national scheme, be that tax or grant based, would have demonstrable policy impact which would be easy to measure and evaluate against a clear counterfactual (current take up implies we are essentially at the “Do Nothing” policy selection).

Our survey findings show that the possible policy deadweight (through the presence of substitution effects) would be outweighed by the additional investment such a scheme would trigger.

This is an opportunity for a new Government to utilise the private sector to meet its very public carbon emissions and fuel poverty targets.