Rental prices and real wages - the gap continues to grow

Introduction

The NRLA Research Observatory tracks approximately 35 datasets which help create a dynamic picture of the Private Rented Sector (PRS).

Trends in private rental prices, published by the Office of National Statistics (ONS), provides one of the strongest barometers of the PRS.

This post looking at recent trends in rental prices in the private rented sector was first published in the NRLA newsletter in June 2020.

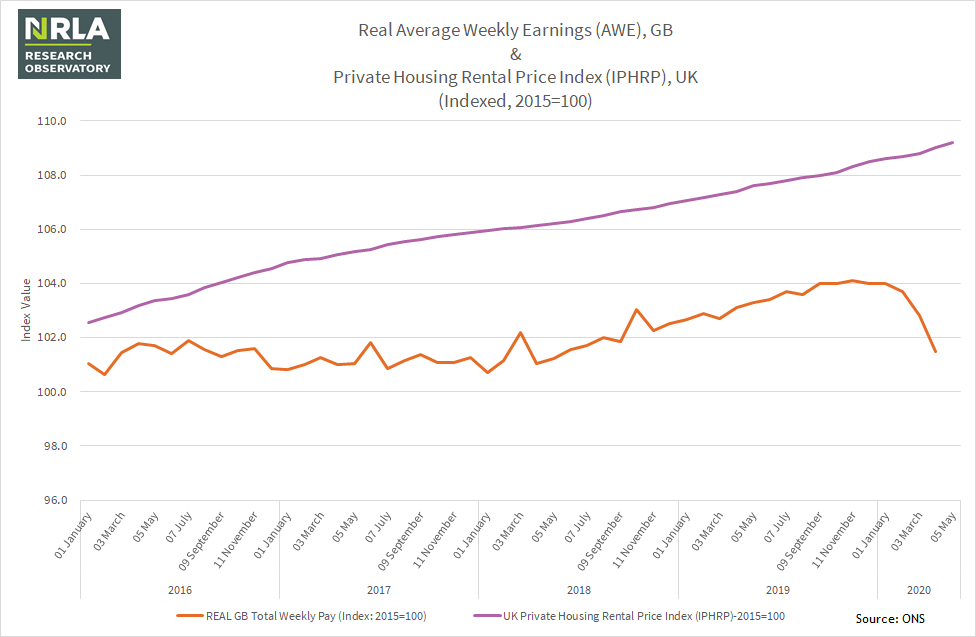

Chart 1: Private rental prices and real wages - indexed

Wages slump in wake of Covid-19

This chart highlights one of the key pressures on the economy as a result of coronavirus.

It shows the growth in real wages (allowing for inflation) against the growth in the national measure of rental prices as calculated by the Office of National Statistics.

This measure is the catchily named Index of Private Housing Rental Prices (IPHRP). This is a measure of inflation like the (much) better known RPI or CPI. The NRLA monitor how this measure of inflation – which is of particular interest to landlords – compares to other measures on a monthly basis. There is also a region-based analysis on our website.

Chart 1 above however compares the growth of rental prices against real wages. To make this comparison easier, prices and wages are “indexed”. So, the current index value of rental prices is 109.2. This means that since 2015, rents have increased by 9.2% - less than 1.5% growth per year.

What is clear from the longer trend path is that if there is a case that private sector housing has become more expensive, it is because real wages have simply not kept track with this measure of inflation. Data in the observatory shows the IPHRP is roughly at the same level as other inflaton measures.

Addressing affordability requires looking down the other end of the telescope. It is not the case that rents are too high, but wages are not keeping pace with inflation.

Stalling wage growth

After a period of growth, real wages stalled at the start of 2020.

In March – the final week of which saw the economy lock-down with the coronavirus – real wage growth was 0%. April however saw real wages reduce dramatically – lay-offs, redundancies and furlough mean average real wages across the economy are now 1.7% lower than in May 2019. This puts increasing downward pressure on rents.

Rental prices have continued their modest rises for several reasons:

Firstly, tenancies are fixed. Our research shows most tenants have either paid rent as normal or have agreed temporary arrangements through the coronavirus crisis. It simply takes time for rental prices to adjust.

Secondly, landlords have been under such strain absorbing the costs of changes in policies such as tenant fees, changes in the tax system and local licensing, they are simply no longer able to hold back prices.

Summary

This chart and analysis shows that the affordability of rental properties is very much a function of tenant income and not a product of landlords seeking to increase rental income above the rate of inflation. Addressing this misconception underlines the importance of campaigning on behalf of landlords - and looking beneath the headlines for evidence and facts.