Don't worry - tenants love you!

Introduction: The 2022 tenant survey

Twice a year the NRLA undertakes a tenant survey. The tenant survey provides the NRLA crucial evidence on the state of the Private Rented Sector (PRS) as well as a user perspective on landlord-tenant relationships.

This survey was conducted in July & August of 2022 with over 2,000 tenants taking part. All were tenants in the PRS – a few were lodgers, whilst a handful were living with friends or family. Most however rented from one of three groups:

- An independent landlord (or couple)

- The corporate or company sector

- Rented through a letting agency

An independent market research company (Dynata) undertook the market research, the NRLA drafted the survey.

After recent covid-based surveys and focus on arrears, this time tenant satisfaction, property standards and energy efficiency were the key topics. Tenants were also asked about concerns over rising utility bills. This blog post look at some of the survey's key findings.

Tenant Satisfaction

Tenants were asked to rate their present landlord on a scale of 0 (the low score) to 10 (the high score).

- Across England & Wales 56% of tenants scored their landlords 8, 9 or 10 (In Wales alone, this figure rises to 65%).

- Only 8% of tenants gave a score of 0, 1, or 2 across England & Wales. Despite coverage elsewhere, an overwhelming proportion of tenants are happy with their landlord.

There is more good news for NRLA members: Levels of satisfaction in renting from independent landlords is greater than from other providers in the PRS.

Throughout the survey the levels satisfaction tenants expressed with independent landlords was greater than that from tenants renting either directly from corporate/company landlords (including so-called "Build-to-Rent" operators) or via letting agents.

Are Tenants receiving rent increases?

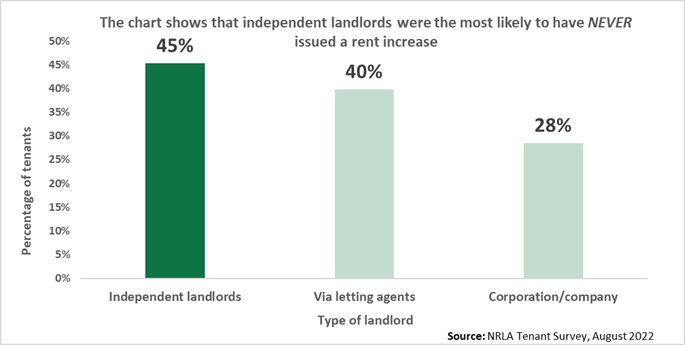

The two charts below show an analysis of annual rent increase as reported by tenants. Again we have split these between independent landlords, corporate “build-to-rent” landlords and those who let through an agency.

The chart below shows the proportion of tenants who stated they had never experienced a rent increase.

Note that only tenants who had lived in a property for more than a year were asked this question. So, every tenant below has lived at least one full year in their present property.

Chart 1: Percentage of tenants who have NEVER been issued a rent increase

Thus, almost half (45%) of all tenants who let from independent landlords stated they have never experienced a rent increase.

Though not shown, for tenants who have been in their property for more than 5 years, almost one third have never had their rent increased. When this five-year group is broken down into landlord type the results are as follows:

- For corporation landlords 23% of long-term tenants had never experienced a rent increase

- For agent landlords 27.3% of long-term tenants had never experienced a rent increase

- For those renting from independent landlords, 36% of long-term tenants had never experienced a rent increase

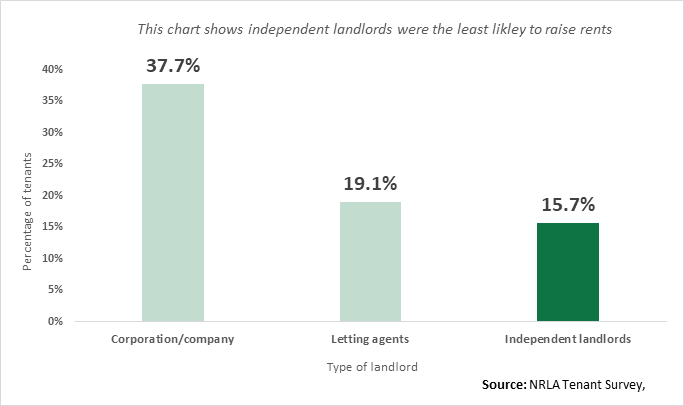

The chart below meanwhile shows the proportion of tenants who DO report annual rent increases. This again is broken down by landlord type.

Chart 2: Tenants who have their rent increased annually

This chart shows just 16% of independent landlords increase tenant rents on an annual basis. Tenants who rent from corporations were more than twice as likely to report rent increases of this regularity (38% doing so).

Are Tenants complaining about property standards?

One aspect of the Renters Reform Bill is a pledge to extend the Decent Home Standard which presently encompasses social housing to the PRS. The English Housing Survey 2020-21 estimates that 79% of homes in the PRS already meet this standard.

Tenants were asked whether they had recently had (or tried) to raise a complaint about their landlord or the standard of their property. Results showed that a clear majority of tenants have no complaints about the property standard or their landlord.

- The majority - 71% - of tenants had never had to raise such a complaint.

- Just 13% of tenants had raised a complaint with their current landlord, 9% with a previous landlord and 3% with both current and previous

Note that tenants renting from independent landlords are, again, even more satisfied:

- Over 75% (77%) of those presently renting from independent landlords have never had to raise a complaint.

- Just 10% of this group (the largest group in the survey) have had to raise a complaint with their current, independent landlord.

The high overall satisfaction ratings given by tenants to their landlords indicates most tenants are happy with the standard of their property and their landlord.

Of those that have had to raise a complaint, the findings reveal that:

- Over 60% (61.4%) have had their complaint “fully” or “partially resolved”.

This indicates landlords are keen to maintain good relations with tenants and keep high property standards.

Are Tenants struggling to find a property?

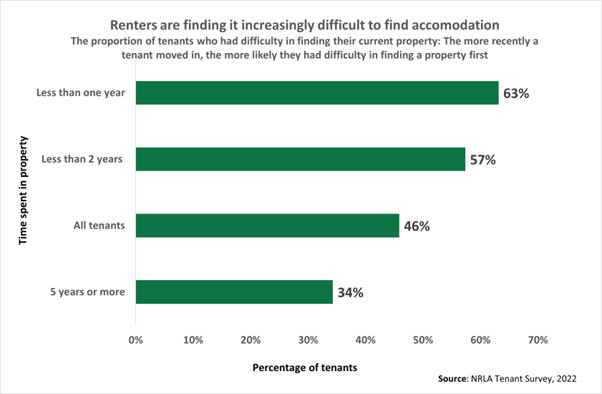

The survey sought to find out about tenant’s property needs and results highlighted that a clear proportion of tenants are finding it increasingly difficult to secure a tenancy on a property they want.

The chart below shows that 46% of all tenants surveyed reported having difficulty securing their property. The more recent a tenant has moved into their property, the more likely they are to have experienced difficulty in finding somewhere appropriate.

Chart 3: Tenants who experienced difficulty in finding a property

The chart shows that:

- Only 34% of tenants who have been in their property for more than 5 years reported having difficulty in their search.

- Tenants who had been in the property for less than a year were almost twice as likely to have reported difficulty in their search (63% had difficulty).

Reasons for difficulties

Of those tenants who experienced difficulties, the top three reasons cited were as follows:

- Lack of choice at price point (60% of tenants identified this as a problem)

- Quality or value of available options at price point (48%)

- Competition for accommodation (41%)

(Note: multiple responses were allowed for this question)

The big recent change has been in “competition for accommodation”. Just 37% of tenants who moved in five or more years ago cited “competition for accommodation” as a difficulty in finding a property. This rose to 53% of tenants who moved into their property within the last year.

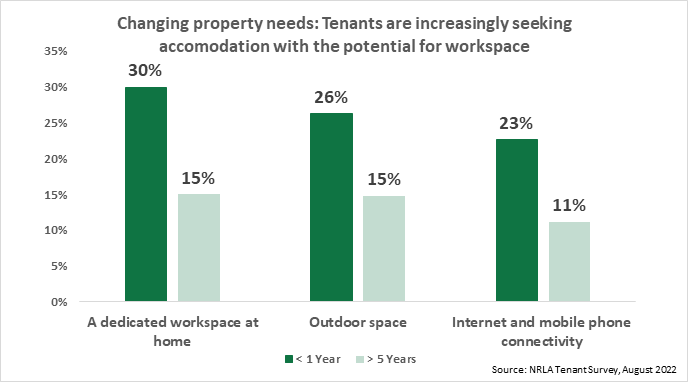

Changing property needs

The impact of the Coronavirus prompted a change in what we prioritise when looking for a property. With a shift towards more home working, tenants were asked whether their property needs had changed since the pandemic. Results showed that over one third (37%) reported spending more time working from home.

Many tenants cited placing a higher priority on:

- Access to outdoor space

- Having a dedicated home workspace

- Internet access

The graph below shows those tenants who have moved into their property within the last year place a higher priority on these three features.

Chart 4: Changing tenant needs - priorities of tenants who moved in less than 1 year ago, compared to more than five years ago

Summary

Strong Landlord Tenant relations

An evaluation of the findings of this tenant survey tells a story of strong landlord-tenant relations and that overall tenants are happy with the standard of their rented property. This is most true when we look at tenants who rent from an independent landlord.

Tenants in this group are the least likely group to experience annual rent increases and the most likely to have never been issued a rent increase. Tenants renting from independent landlords are also the most likely to have never raised a complaint. This may explain why independent landlords were given the highest satisfaction scores when compared to tenants renting from a letting agent or a corporate landlord.

Changing property needs and supply issues

Findings also reveal a shift in what tenants are prioritising when sourcing a suitable property. Work patterns have changed since the pandemic for a sizable chunk of renters. For landlords this means a potential opportunity to offer housing that reflects the increased demand for work-at-home space. Office-studios, workshops and non-domestic kitchens are all examples of the type of space now being demanded.

Whilst large numbers of tenants are reporting changing property needs, renters across the board are finding there is a lack of choice out there in the PRS. The lack of choice at a given price point indicates that there may be a problem with the supply of suitable properties. Findings show that this issue is becoming increasingly prevelant – comparing tenants who have recently moved into their property to longer-term tenants.

Final comment

A lack of supply in the PRS is colliding with changing market needs. The number of properties available in the PRS is declining and the result is a shortage of property which matches tenant wants. This is only going to get worse as landlords sell property and exit the market.

It would be unwise to ignore the role that increased legislation has played and will continue to play in the context of decreasing supply of PRS accommodation. The conclusion is another component of the housing market is feeling the strain.

Policy should be retooled towards encouraging a varied supply of housing in the sector, and, equally importantly, sourced from the independent landlord with whom tenants enjoy a relationship.