Landlord Confidence Index (LCI) no.5: 2020 Q1

Our Landlords’ Confidence Index (LCI) aims to provide a snapshot of landlord confidence.

The LCI attempts to capture the motivations underpinning landlords’ key business decisons.

It is being produced at a time when landlords face pressure from government: tax changes, new regulations and the threat of adverse legal reforms are now threatening the supply of homes in the Private Rented Sector (PRS).

Page 1

Page 1

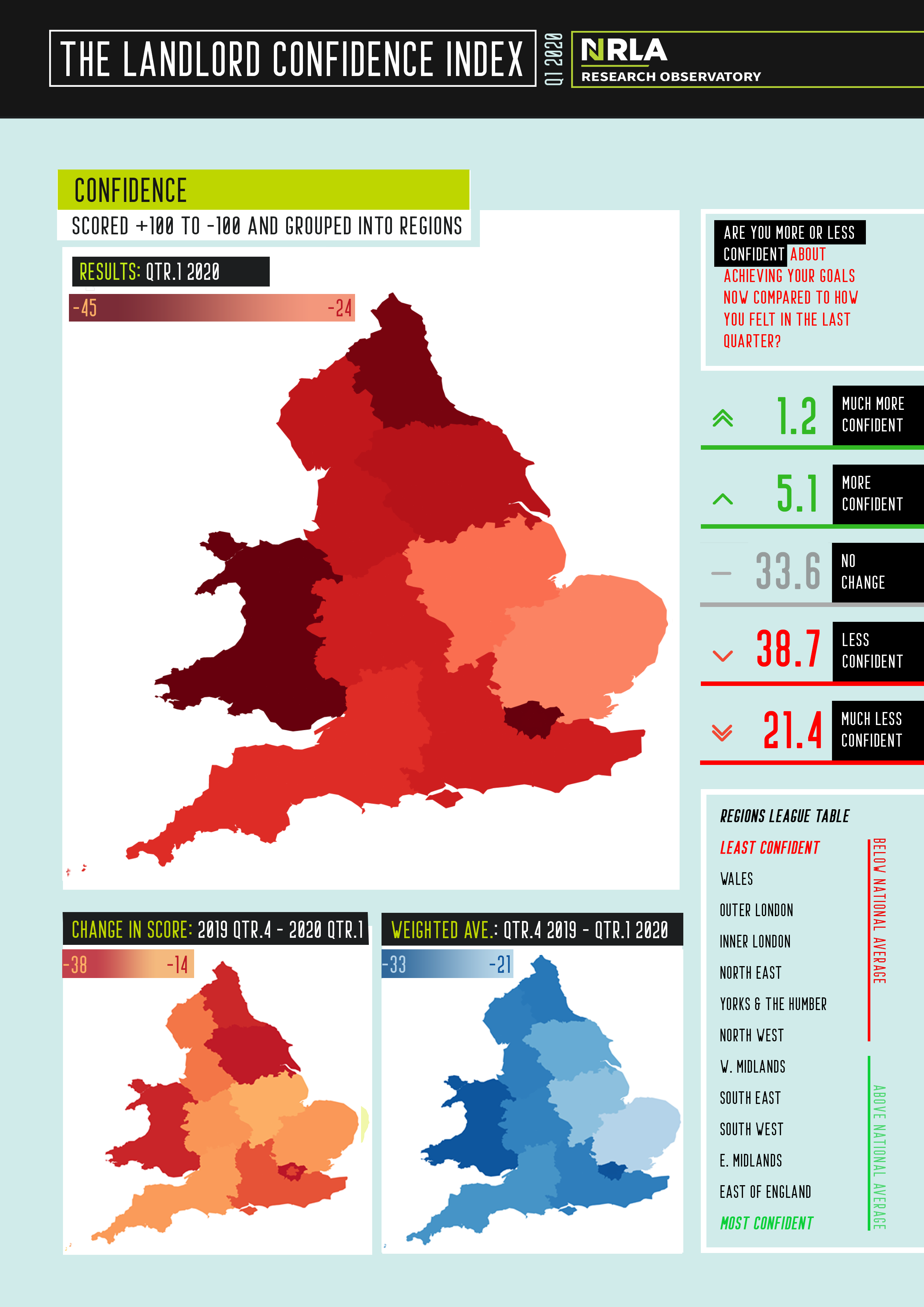

Main Chart

Low levels of confidence are the norm across the country – every region is typified by low levels of landlord confidence.

Before this survey the lowest ever regional LCI score was -42.9 (Outer London, 2019 Q3). However North East (-43.8), London (Inner (-44.9) & Outer (-45.1) & Wales (-45.2) all recorded lower LCI scores this quarter.

Wales has therefore now recorded the lowest ever LCI score.

With a confidence score of -24.8, the East of England was by some margin the region with the least low confidence score (it cannot be said they are the “most confident”).

Change in Confidence

Outer London and Yorkshire and the Humber are the two regions in which confidence has fallen the most.

East of England and the East Midlands; the latter is a region in which rental prices have consistently grown above the national average during 2019 are the two regions where confidence has fallen the least.

Weighted average

The weighted average over the last twelve months aims to iron out one-off spikes and dips in confidence.

Since it has been possible to produce a true, four-quarter index, these are the lowest weighted confidence scores yet recorded.

London – Inner & Outer are the two lowest scoring regions on the weighted average Confidence Score – as they were in Q4 2019.

Page 2

Page 2

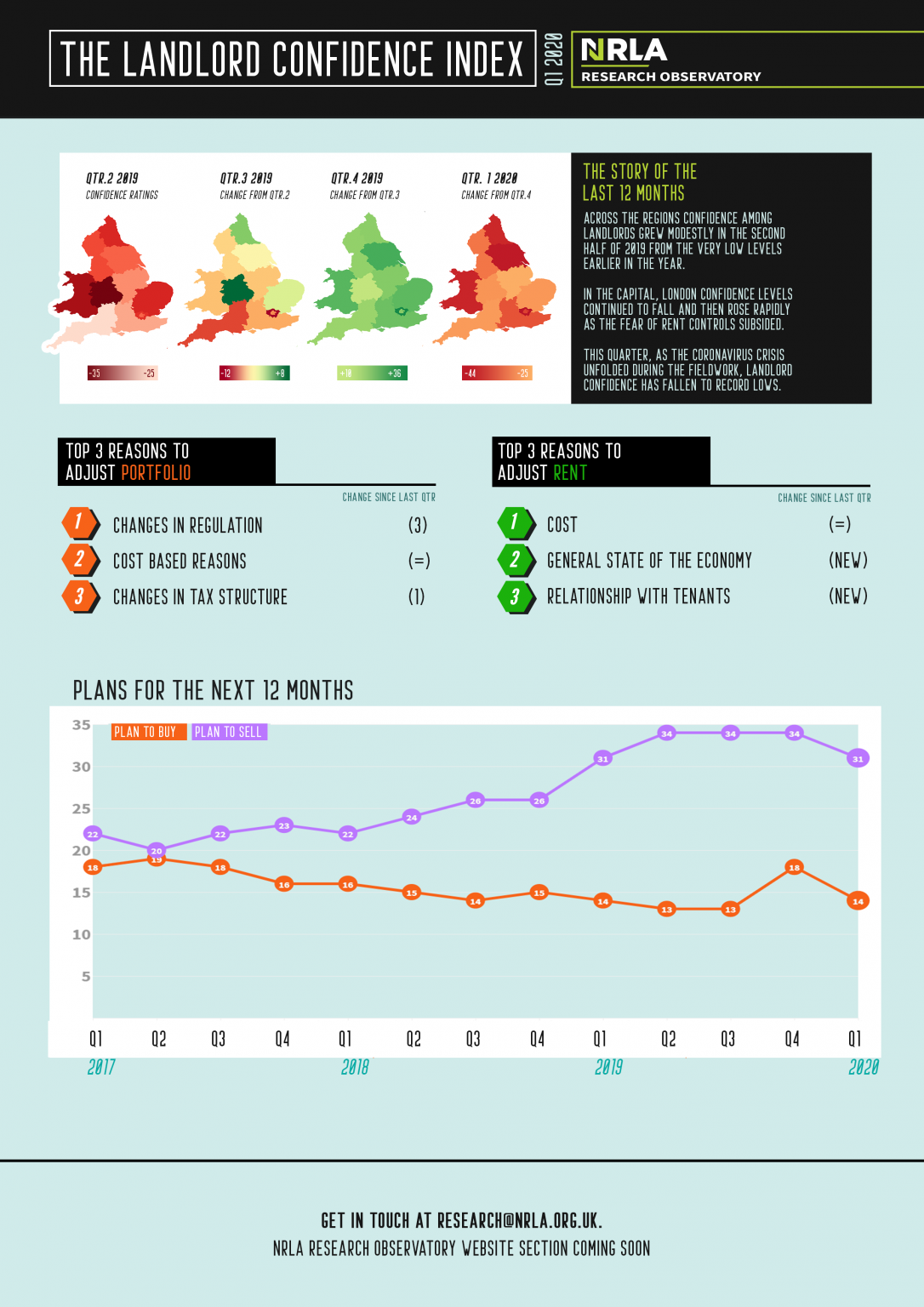

Four-quarter review

As the commentary reflects – in the regions, as 2019 progressed, there was evidence of a turn in confidence. This should not be overstated: throughout this period, more landlords felt less confident compared to the previous quarter than the proportion feeling more confident. This was the case for each quarter in 2019.

The gap between the two was however did narrow, especially in Quarter 4 – the fieldwork for which took place following the General Election.

Coronavirus however, brought to an end any hope for a period of political and economic stability – landlords are facing a period of near-unprecedented uncertainty and a need to make crucial business decisions.

Making key business decisions

Compared to Quarter 4, a smaller proportion of landlords sold property and a smaller proportion of landlords bought property (there is a caveat in that once a one-property landlord sells and is no longer a member of the NRLA this survey will not capture their action).

The same motivations are prompting the decision to buy and sell as in previous quarters.

Almost 70% (68.6%) of landlords have kept rents at the same level over the last twelve months. This is the highest proportion since the LCI began.

The decision to maintain rent levels is increasingly becoming a function of landlords’ concern with the economy (and finding new tenants at current rent levels) and the desire to retain current tenants. In most rented properties, landlords and tenants have a positive relationship.

Plans for the next twelve months

For the first time since this data was collected, both the proportion planning to buy and the proportion planning to sell property has fallen. This is clearly a function of the uncertainty facing property markets, demand and the wider PRS.

Landlord Confidence Index Q1 2020

Landlord Confidence Index Q1 2020