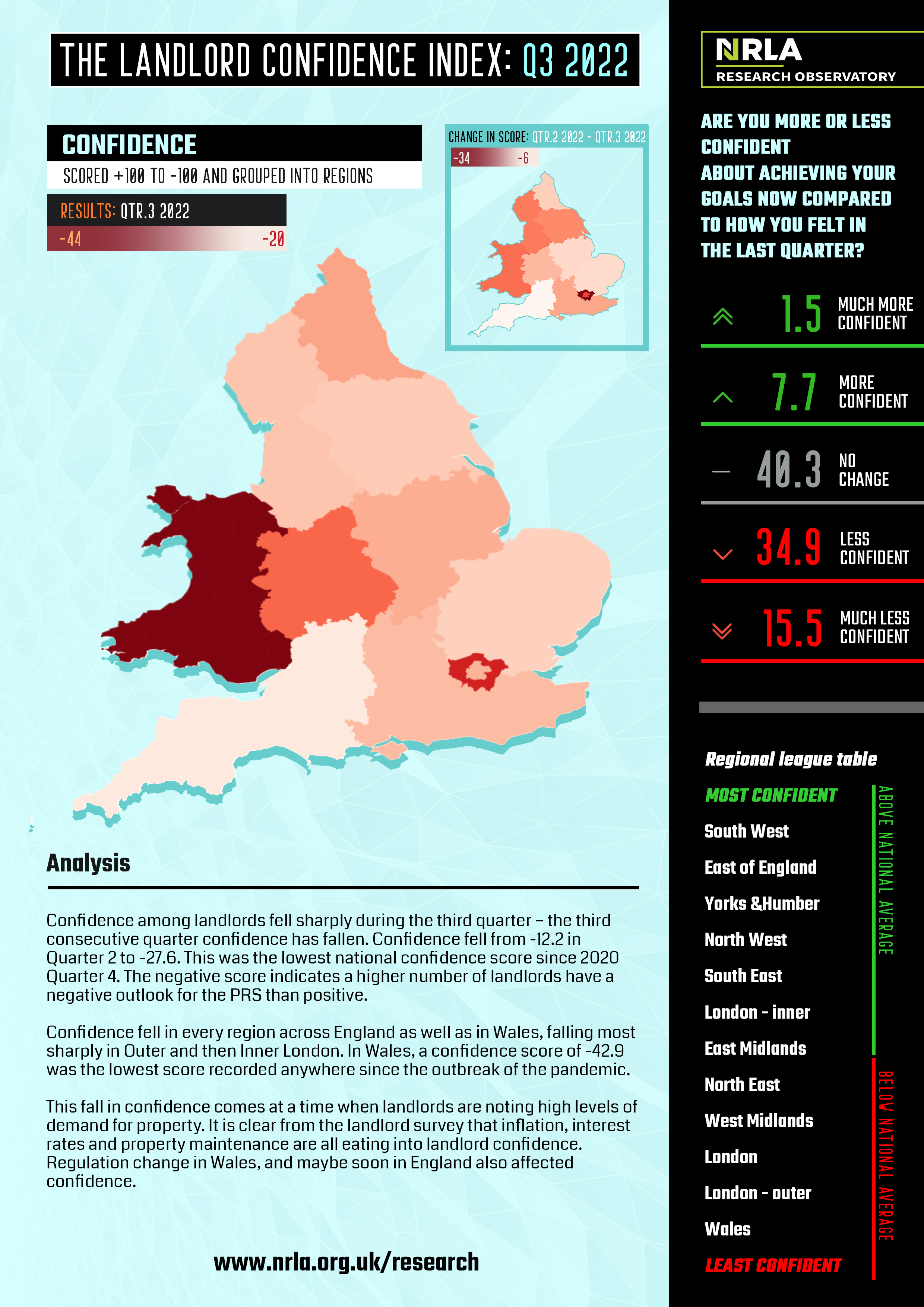

Landlord Confidence Index (LCI) No.15: 2022 Q3

Page 1

Page 1 - additional commentary

Quarter 3 is the quarter in which landlord confidence dived. The fall is in the face of worsening, worrying macro-economic conditions and sector-specific concerns in the form of regulation change.

The fall in confidence takes the barometer back to levels experienced in the Covid-era. In London, though confidence among landlords in Inner London remains above the average, the fall in confidence from a neutral -3.8 to this quarter’s -26.5 is near-precipitous. However, in Outer London, where confidence has fallen over 32 points, the collapse was even more dramatic.

Only in the South West - where rental price inflation has consistently been among the highest – has confidence been even close to constant this quarter (a 6-point fall).

Page 2

Page 2 - additional commentary

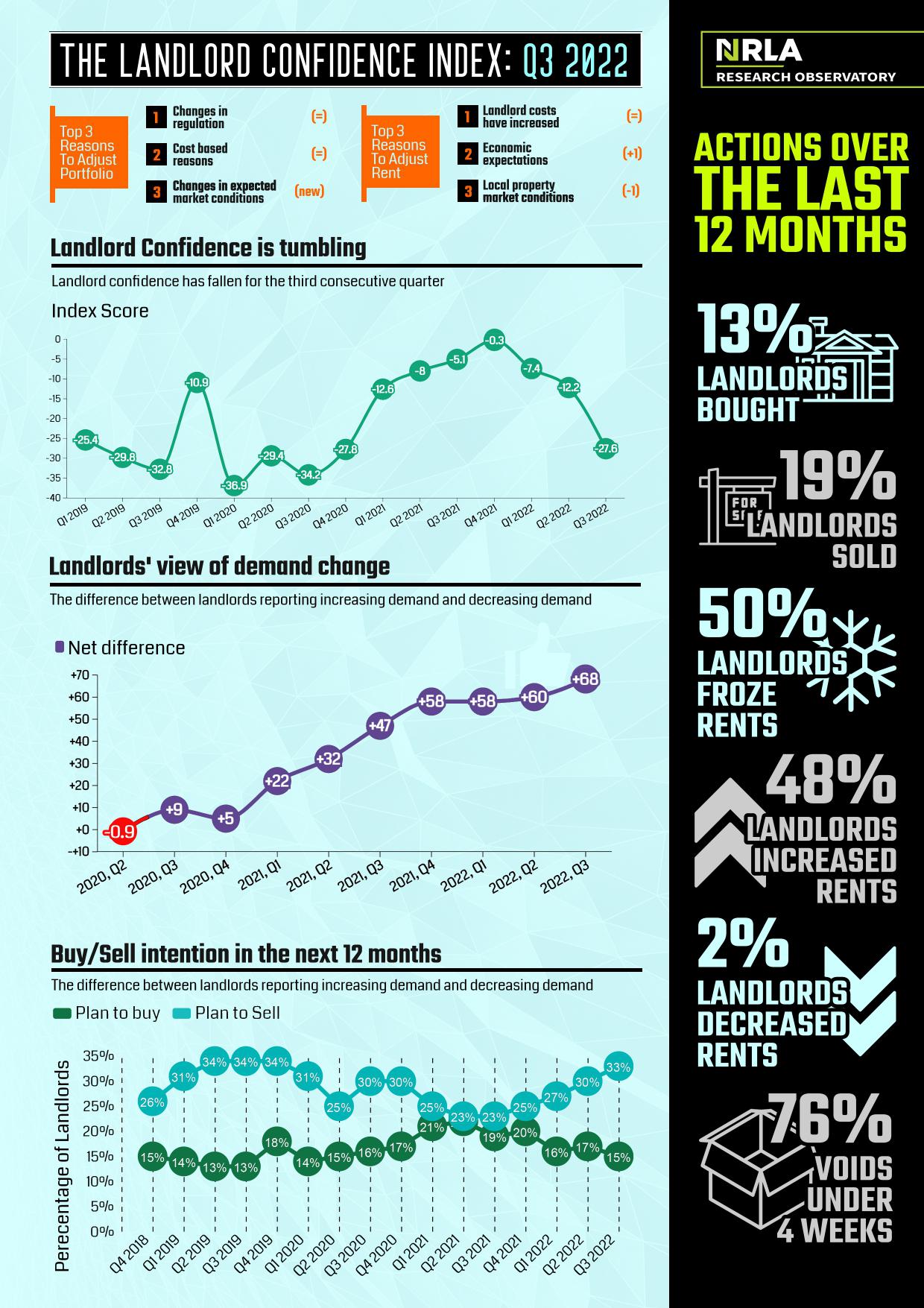

Key factors driving this fall in confidence include the changing costs and regulatory environment. Economic expectations and anticipated changes in market conditions also feature as key factors. Given this quarter’s fall in confidence, a chart plotting the ups – and now downs – in confidence over time is useful. It shows the recovery in confidence through 2021 has now been wiped out for the reasons described on Page 1.

This falling confidence is taking place against a backdrop of [observed] rising demand – landlords noticing demand for private rented property increasing. Just 3% of landlords reported demand falling among would-be tenants compared to 71% noticing demand rising.

Nevertheless, more landlords are planning to sell, and fewer planning to buy, than has been the case for quite some time.

One landlord in five (19%) have sold property in the last twelve months – and this will not include many landlords who have exited the market, and so probably no longer a member who completes our surveys.

It is now almost 50:50 between landlords holding rent levels constant and landlords increasing rents. The former has fallen, and the latter has risen dramatically. This is a product of costs and economic expectations. In 2019 Qtr 2 (before the pandemic) 31% of landlords stated they had increased rents over the last twelve months, whilst 65% stated they had held rents constant.