Landlord Confidence Index (LCI) No.16: 2022 Q4

Page 1

Page 1 - additional commentary

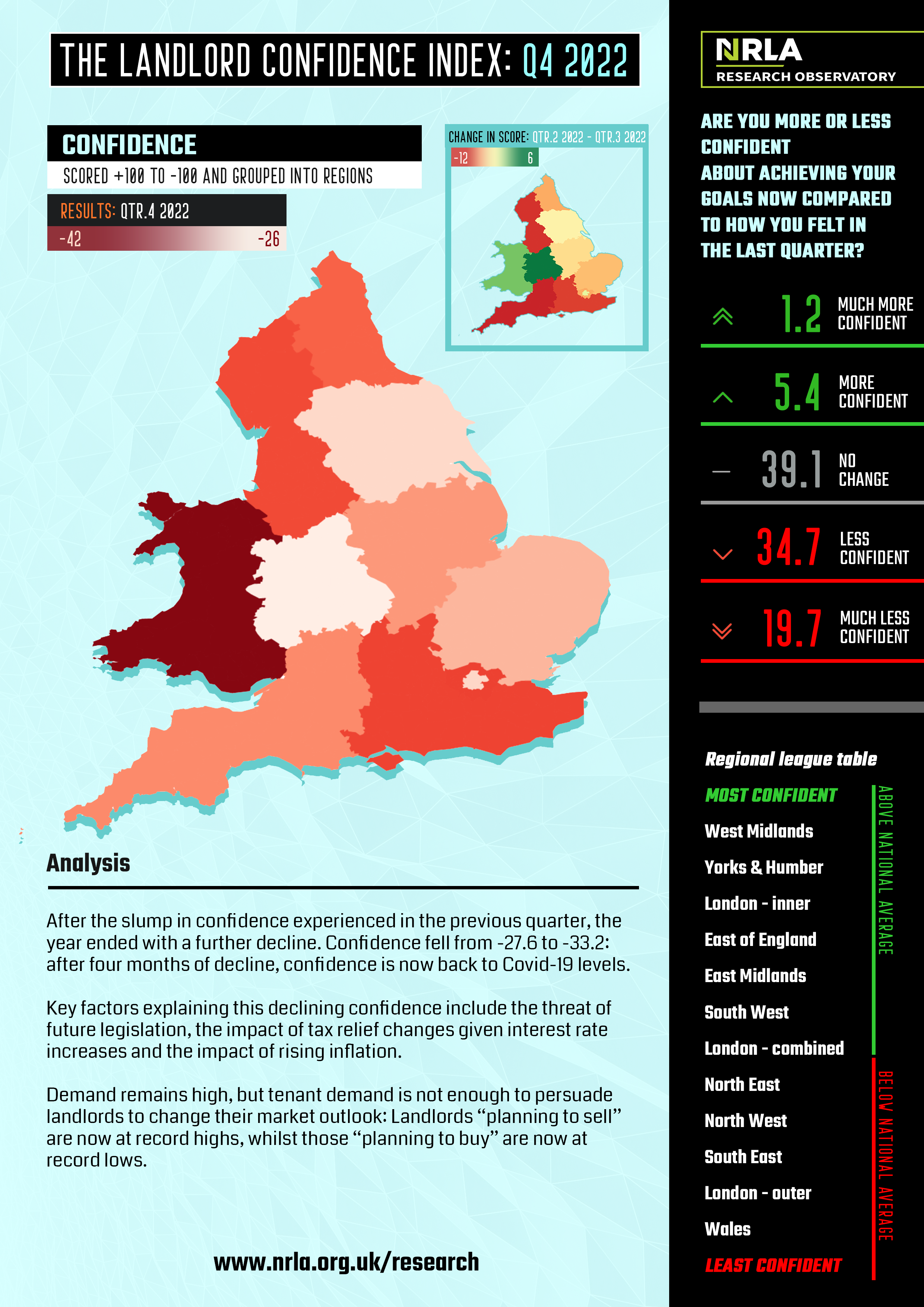

After the slump in confidence experienced in the previous quarter, the year ended with a further decline. Landlord confidence is now back to Covid-19 levels. Confidence fell from -27.6 to -33.2.

Closer analysis shows the biggest falls in confidence were in the South West, the North West and then the South East. Confidence grew slightly in the West Midlands, and by the smallest of fractions (well within an error margin) in Wales and Outer London.

Even though there was a (very) small increase in confidence in Wales and Outer London, the table shows confidence in these areas are the lowest and the furthest below the England & Wales average.

Page 2

Page 2 - additional commentary

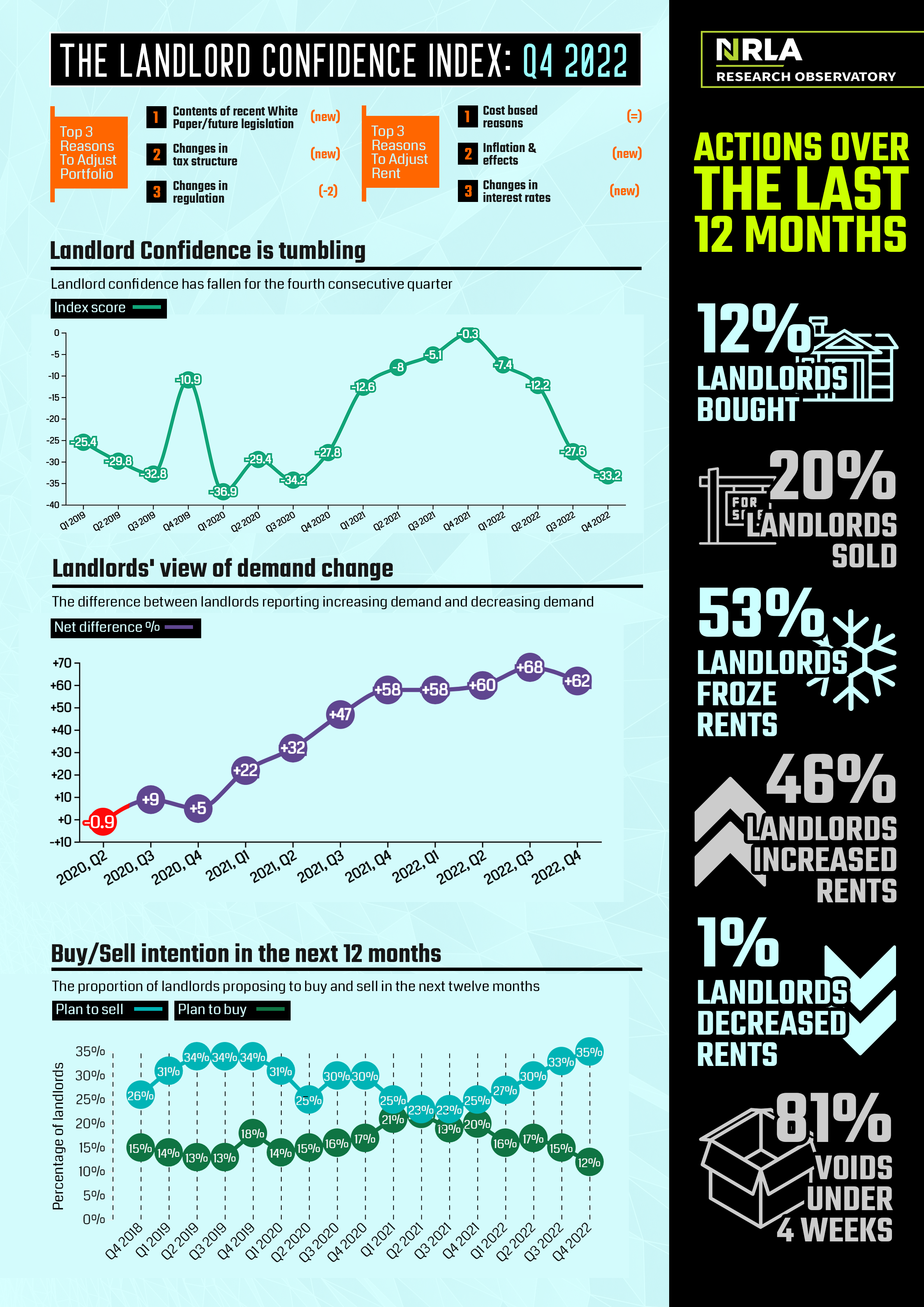

The data presented on page two of the LCI gives an indication of the reasons behind this trend of falling confidence. Those making adjustments to their portfolio and rent were asked about the factors underpinning their decisions:

Regulation changes and the fears about future change are driving the decision to sell property (among those landlords classed as “sellers”, these become even more prominent factors), whilst costs, inflation and interest rates are the factors driving rent increases.

Whilst confidence is falling, demand is rising. Note however the net difference between landlords reporting increases in demand and those noticing demand is falling is itself narrowing. This is not a big change (from +68 in Qtr 3 to +62 in Qtr 4) but it may be the start of the PRS finding a new equilibrium.

However, the next challenge for the PRS is set to be a falling supply of houses: The final chart on this page shows (i) the proportion of landlords planning to buy property in the next twelve months (12%) is now at record lows, whilst (ii) the proportion of landlords planning to sell property in the same period (twelve months) is now at a record high.

When looking at what landlords have done over the last twelve months, there is more notable news which is evidence of strains in the PRS:

The proportion of landlords who have bought in the last twelve months is not at record lows, but it is approaching those levels. Levels of buying is now down to pandemic levels.

However, the proportion of landlords who have sold (20% selling property over the last twelve months) is now at record highs (Note this is an underestimate – for example landlords with one property who sell will (probably) cease to be a member of NRLA and so won’t be included in the sample).

For the first time since the LCI began, over 50% of landlords stated they had raised rents over the previous twelve months. At the same time the proportion of landlords holding rents constant fell below 50% for the first time. The evidence presented in the LCI underlines the importance of “cost push” factors driving rents – rather than “demand pull” factors.