Deep Insight Nick Clay 08/01/2020

Buy-to-Let figures highlight nervous mood among landlord-entrepreneurs

Analysis

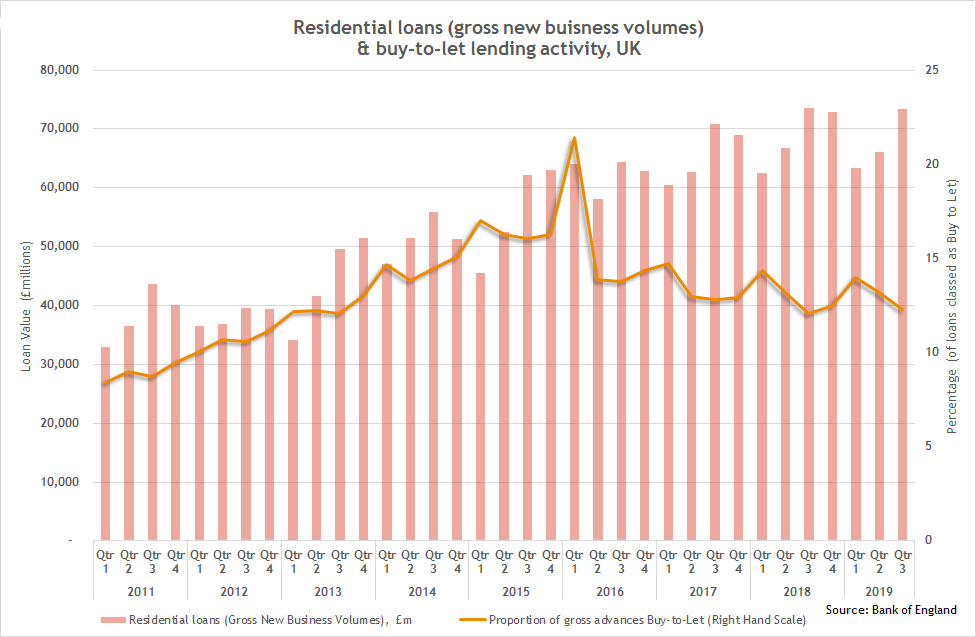

Chart 1 below shows the gross value of new residential loans, as well as the proportion of residential loans going into the buy-to-let market.

These flows are focused on the smaller, individual investor and so provide an insight into confidence in the PRS segment served by NRLA members.

Chart 1: Residential loans & BTL lending (Up to Q3 2019)

- Out of the nine years in the Chart above, Quarter 3 lending volumes have been the highest of the year on seven occasions. This is the case – so far- in 2019.

- Lending volumes were higher in 2019 Q1 than the same quarter in 2018. However for Q2 and Q3, volumes in 2019 were lower than the 2018 equivalents. Note these figures are unadjusted for inflation.

- Because lending volumes rise in the third quarter, it is not surprising to see the overall proportion of advances in the BTL market dip. This has happened in 2019 too with the proportion of new advances for BTL purposes falling. The fall was from 13.2% in Q2 to 12.3% in Q3.

- However, this “dip” in BTL lending is more pronounced here than seasonality alone would imply: there is a clear cyclical downward trend.

- The proportion of loans for BTL in Q3 2019 is up slightly compared to Q3 for 2018 (12.3% c/w 12.1%). Overall lending volumes have fallen slightly (£73,306m vs £73,473m in Q3 2018). At best therefore, one could say the BTL market is holding constant.

- On the upside, we have identifed above the Q3 proportion of BTL lending is slightly higher in 2019 than 2018. This is the first time the proportion has risen since Q3 2015 (when the proportion of BTL lending rose to 16.1% from 14.5% in Q3 2014). This current modest rise is at a time of stalling volumes when comparing like-for-like on a quarter basis.

This post was authored by Nick Clay of the NRLA. The views, analysis and interpretation of the data are his and not necessarily those of the NRLA.

Note that the data presented here is subject to revision. Sand updates. Such revisions may render the analysis null and void in the future.