Making Tax Digital for Landlords

Landlords will be required to use Making Tax Digital for Income Tax if they have an income of over £20,000. Our guide below outlines what it is, if you are affected and when, and how to comply with the new rules.

- Making Tax Digital will impact sole-trader landlords with income over £20,000.

- Landlords will need to sign up for MTD on the HMRC website and complete the relevant registration.

- Landlords will be required to submit quarterly income/expenditure summaries alongside a Final Declaration.

Making Tax Digital is a Government initiative to modernise the tax system, by requiring businesses to keep and submit records of their property income and allowable expenses digitally.

If you fall under the remit of the scheme you will need to use special Government-approved software that is Making Tax Digital-compatible to file your tax return digitally.

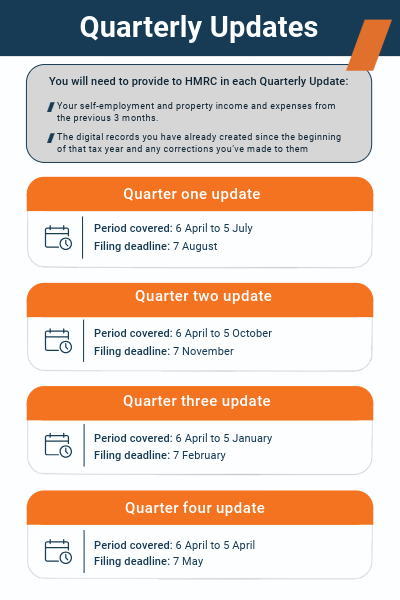

Making Tax Digital will require you to submit quarterly updates – rather than just the annual return that is standard at present – with the documents due for submission on the 7th of August, November, February and May each year.

An additional final declaration, similar to the current Self-Assessment return, including any non-business income and will then need to be submitted by the current 31 January deadline to confirm the accuracy of your submissions, and to allow you to claim any allowances or reliefs.

This end of year declaration must also be sent to HM Revenue and Customs (HMRC) via the new software — with submission by any other means banned.

Join the NRLA for just £125 a year and get expert support, resources, and advice to stay compliant and manage your properties with confidence.

Landlords with annual turnover from either self-employment or property below the VAT registration threshold can apply a three-line accounts approach to that income source. Three-line accounts allow digital records to simply be tagged in your chosen MTD software as either “income” or “expense”, rather than the specifying the type of income or expense. The one exception is where a landlord incurs residential property finance costs, such as mortgage interest, which must always be categorised separately.

Joint property owners can make use of the three-line accounts approach if eligible.

All sole-trader landlords who earn more than £20,000 a year (from both properties and self-employment combined) and pay tax via Self-Assessment will be affected, with the compliance dates depending on that income.

- From 2026: Landlords with annual income of £50,000 or more in the 2024-2025 tax year must comply

- From 2027: This is extended to landlords earning £30,000 or more annually

- From 2028: The new rules apply to landlords with income of £20,000 or more per year.

Landlords will need to start using Making Tax Digital for Income Tax from April 2026.

Only self-employed income and rental income is included in the above figures. Employment (PAYE) and pensions are not included.

Records for self-employment income will need to be kept separate.

Determine Eligibility for Making Tax Digital

Landlords should confirm if they are required to comply with Making Tax Digital using the thresholds provided above. You can comply voluntarily if your income does not meet the threshold.

How to register for Making Tax Digital

Landlords will need to sign up for MTD on the HMRC website and complete the relevant registration.

Select Making Tax Digital Compatible Software

Landlords are required to choose a making tax digital compatible software– you can check for suitable systems on the HMRC website.

Maintain Digital Records

Landlords should use their preferred MTD software to digitally record all business income and expenses.

Submit Quarterly Updates

Landlords are required to provide income and expenditure summaries from their chosen system to HMRC within one month of every quarter-end date. HMRC will use this data to estimate your tax liability.

If a property is jointly owned, gross income will be determined by the share of income from the property (this will usually be based on ownership share). For married or civil partners, this defaults to 50/50 unless declared otherwise in the Declare beneficial interests in joint property and income form (Form 17) to HMRC.

Joint property owners can make use of the three-line accounts approach if eligible.

For example, a property has a gross rental income of £100,000. The income is split 30/70 between Partner 1 and Partner 2. Partner 1 (gross income of £30,000) will be required to use an MTD software from 2027, whilst Partner 2 (gross income of £70,000) will be required to use an MTD software from 2026.

Limited company landlords are not affected and will continue to pay corporation tax.

The Government has confirmed it will bring forward legislation to finalise exemptions by April next year. These will be offered to taxpayer groups ‘who would face disproportionate barriers in operating Making Tax Digital’.

According to the guidance, you're automatically exempt and cannot sign up for Making Tax Digital for Income Tax if you are a:

- trustee, including a charitable trustee or a trustee of non-registered pension schemes

- person that does not have a National Insurance number — this only applies for a tax year where you do not have a National Insurance number on 31 January before the start of that tax year

- personal representative of someone who has died

- Lloyd’s member, in relation to your underwriting business

- non-resident company

You will also be able to apply for an exemption from using Making Tax Digital for Income Tax when the applications process opens if:

- it’s not practical for you to use software to keep digital records or submit them — this may be due to your age, disability, location or another reason

- you are a practising member of a religious society (or order) whose beliefs are incompatible with using electronic communications or keeping electronic records

If HMRC has also previously confirmed you're exempt from sending online returns for Making Tax Digital for VAT, you should contact them when the application process opens. HMRC will perform some checks, and if your circumstances have not changed, they will confirm you're exempt from Making Tax Digital for Income Tax.

HMRC is increasing penalties for late submissions and payments, emphasising the importance of submitting returns properly and on time.

From April 2026, this will take the form of a points threshold system. One penalty point will be applied for each missed deadline. If you reach the points threshold of four points, a financial penalty will be imposed. Late payment penalties will also become proportionate with rates based on when the outstanding amount is paid.

You are encouraged to familiarise yourself with Making Tax Digital requirements ahead of time. Our partners, RITA, have also developed a useful MTD for income tax guide outlining the new rules.

The Government has produced a Making Tax Digital (MTD) for Income Tax toolkit to help landlords and letting agents prepare for changes up ahead. The toolkit, produced by HMRC includes:

- An overview of the changes, who is affected and how to prepare

- Links to detailed guidance

- FAQs and answers

- Communications resources such as an agent checklist, videos and printable posters

You should also make sure your software is compatible with the system, so you are ready. Broadly speaking the software will need to allow you to:

- maintain business records as required by the regulations

- finalise your taxable business income and submit your declaration at the end of the tax year

- communicate with HMRC digitally through their API (application programming interface) platform.

- prepare and send quarterly updates and statements to HMRC from your tax records

You can check your software — and find out more about compatible systems here on HMRC’s website.

Finally, you can also consider undergoing some training to really familiarise yourself with the requirements of Making Tax Digital for Landlords. The NRLA offer a training course which you can find out more about by clicking the button below

Join the NRLA for just £125 a year and get expert support, resources, and advice to stay compliant and manage your properties with confidence.

If you have become a landlord for the first time, such as by inheriting a property, you won’t need to use Making Tax Digital for Income Tax until after you’ve submitted your first Self-Assessment tax return for the rental income.