GetGround

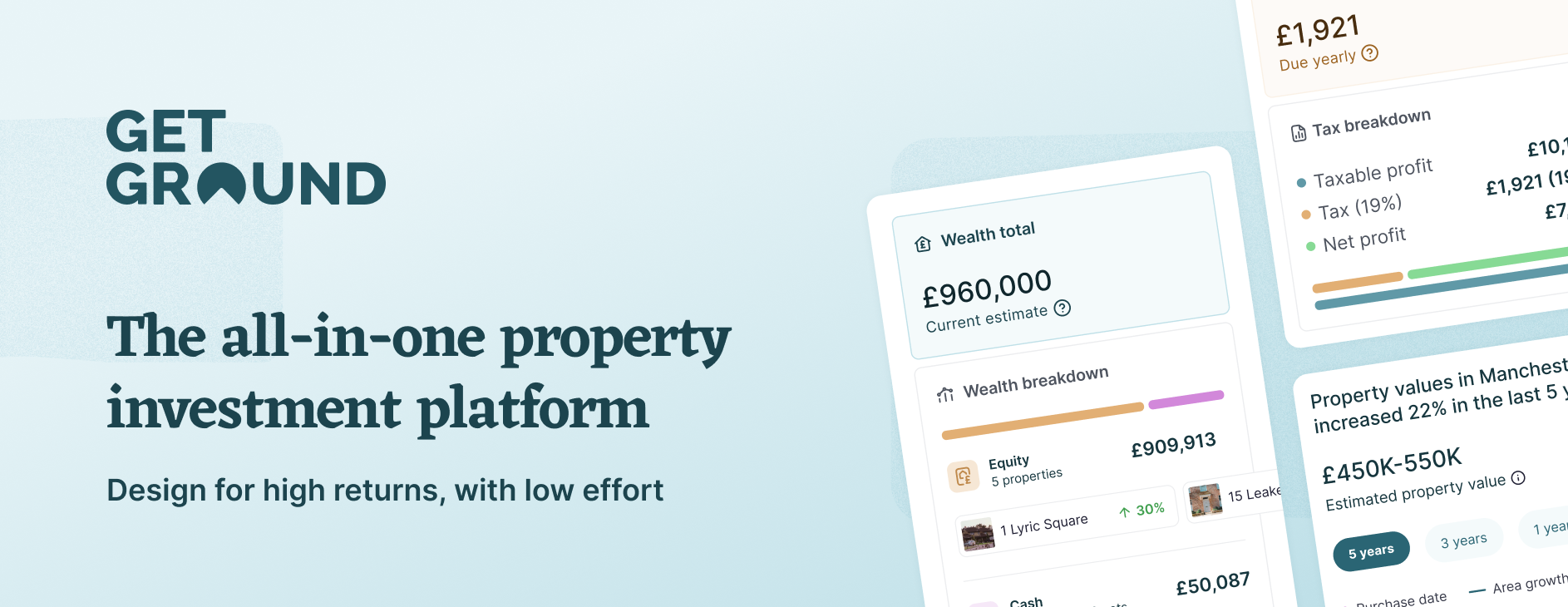

Being a landlord means liaising with multiple different points of contact for every step of your property investment journey. This could get tough if you’re a new investor, an overseas investor, or have multiple properties.

GetGround aims to make property investment simpler and more accessible. That’s why they facilitate your buy-to-let property investment experience from all angles, from setting up your company all the way to selling it when the time comes.

All this comes with a platform to manage your property investment journey as you go through each stage.

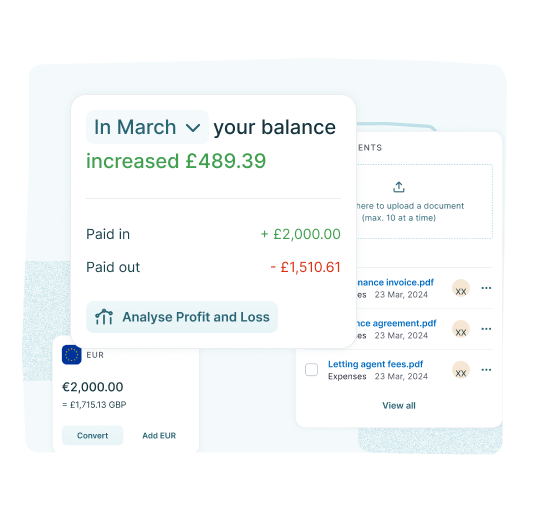

Access accounting and tax for your buy-to-let company

Focus on growing your investment returns while GetGround handles the accounting and admin for your limited company for only £29 (+VAT) per month. Receive a completely digital accounting experience and unique insights into the performance of your investment. This includes:

-

Complete limited company accounting services

-

Account management and financial tools

-

Unique insights into your portfolio performance

Don’t have a limited company yet? We can set one up for you. With all the admin and legal documents taken care of, design your company in just half an hour and we’ll take care of the rest.

Find your next high-yield buy-to-let property

-

Access a marketplace of buy-to-let investment opportunities and access dedicated support to find a property that meets your property investment goals. This includes:

-

A collection of vetted new build developments, tenanted secondary properties and unique opportunities to purchase company shares

-

All different rental property types, from HMOs to short-term lets and everything in between

-

Get support from a dedicated consultant to view dynamic projections, cash flows and returns

-

Track your process online, from anywhere, and always know what’s coming next

Don’t just take our word for it…

We have a community of over 30,000 investors who trust us

We are very happy with GetGround UK for their continuous support in our UK Properties investment. Starting from opening a Holding Company to additional Subsidiary companies to purchasing our properties and the many details of managing our companies financial and regulations. GetGround UK has it all and they were always very prompt, efficient and supportive of all our inquiries and help needed. Kudos to the entire GetGround UK Team. Thank you all!

Excellent service and cost-effective for limited company work. Thank you.

I had a great experience working with GetGround to set up my UK company for purchasing a buy-to-let property. The process was clear and smooth - I only needed to apply it online. Their team was very responsive to any questions I had, which made things much easier for me. As an overseas investor, this service gives me a peace of mind.

Articles

How landlords are evaluating UK properties with AI property analysers

NRLA partner, GetGround, has developed AI Property Analyser, a free tool designed to give landlords clear, decision-ready insights in minutes. Built specifically for the UK buy-to-let market, it combines financial modelling, local market intelligence and AI-driven strategy recommendations into a single, easy-to-use platform.

Buy-to-let market index

NRLA partner, GetGround has compiled a report to help us better understand the performance of the UK buy-to-let market on a quarterly basis in a simple way. This should help landlords make more informed decisions and access buy-to-let done better.

How economic factors can affect UK landlords

Property investment is deeply intertwined with the broader economic landscape, from property prices to renter demand, there are a variety of economic factors which influence property investment performance. Investors who can understand and react to these changes have the potential to remain or become profitable, while those who turn a blind eye might risk losses and weaker performance. NRLA partner, GetGround gives us some insight.

Should you invest in HMO properties in the current buy-to-let market?

Property investment and the market surrounding it come with constant changes and challenges. Houses in Multiple Occupation (HMOs) offer a unique opportunity to maximise rental income and diversify your portfolio with an alternative investment strategy. Although HMOs come with many benefits, it’s important to be aware of their nuances and complexities. In this article, NRLA partner GetGround, explores the potential rewards of HMO investing as well as the risks involved.

The UK property market and buy to let in 2025

The UK property market has been a cornerstone of wealth creation and financial security for investors. Property investment continues to hold significant appeal despite facing challenges such as shifting economic conditions, regulatory changes, and evolving buyer preferences in recent years. NRLA partner Getground, unpacks the key trends and insights shaping the UK property landscape in 2025.