Budget fails to tackle housing crisis

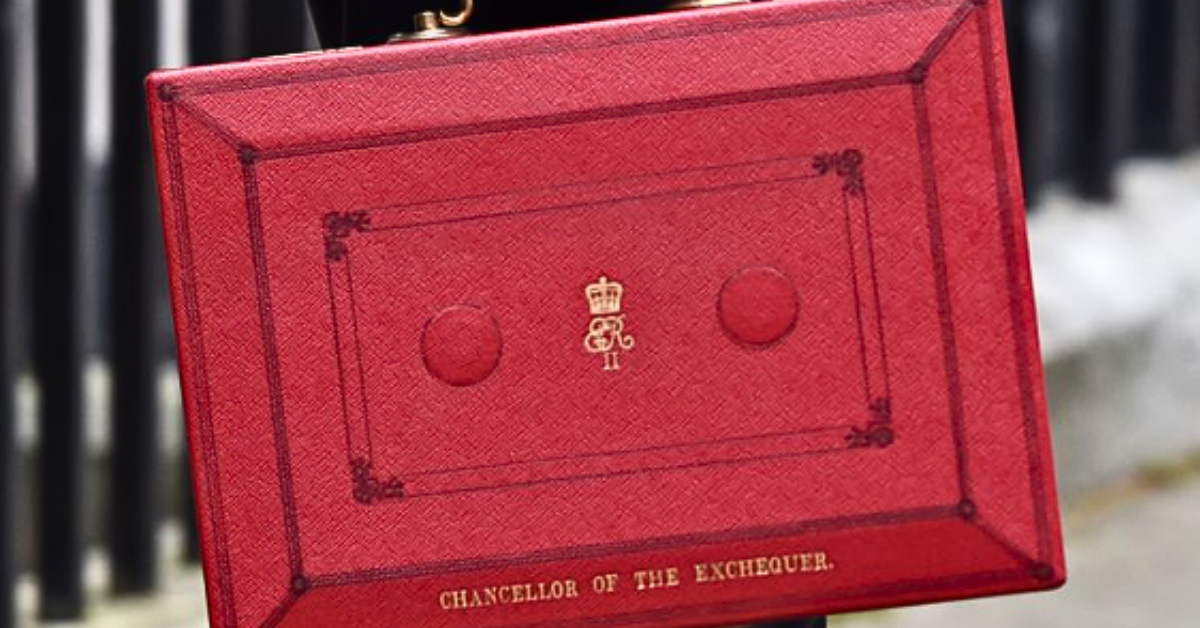

Following its delivery by Chancellor Jeremy Hunt MP in the House of Commons earlier today, the National Residential Landlords Association has responded to the key aspects of the 2024 Budget.

This year’s Budget announced (among several other changes) the following fiscal changes:

• Capital Gains Tax will be reduced from 28% to 24%;

• National Insurance to be paid by workers will fall by 2p;

• The furnished holiday lets tax regime is now set to be abolished.

Further to today’s announcement, as it has done in recent months, the NRLA will continue to campaign for the Government to introduce pro-growth policies which will help address the market’s ongoing supply crisis.

If you would like to read the Budget in its entirety, click here to access the whole document.

Responding to the Budget, Ben Beadle, Chief Executive of the National Residential Landlords Association, said:

“The Chancellor has once again ignored calls to revitalise long-term investment in quality rented homes in favour of tinkering at the margins for short-term gain.

“Increasing taxes on holiday lets and cuts to Capital Gains Tax will make no meaningful difference to the supply of long-term rental properties. Meanwhile, those reliant on housing benefits still do not know if their benefits will be frozen from next year or not.

“With an average of 11 tenants chasing every home for private rent, social housing waiting lists at 1.3 million, almost 110,000 households in temporary accommodation and the number of first-time buyers slumping, the Budget needed to tackle the housing crisis once and for all. What we got was a deafening silence.

“This was a missed opportunity to make providing new homes to rent and buy the priority it desperately needs to be.”

If you would like to check out the Budget’s contents in full, click here to read for the document in full.

-ENDS-

Notes

- This year’s Budget can be found on HM Treasury’s website here.

- The Budget has announced that from 6th April 2024, the higher rate of Capital Gains Tax for residential property disposals will be cut from 28% to 24%. This will have only a limited impact given the CGT allowance for the 2023/24 tax year fell by more than 50% from its 2022/23 threshold of £12,300 to £6,000. It will fall to £3,000 as of 6th April this year. Further information can be found here.

- There are 11 prospective tenants enquiring about every available home to rent according to Rightmove.

- The most recent Government data shows that were 1.29 million households on waiting lists for social housing as of 31st March 2023.

- Additional figures from the Government show that there were 109,000 households were in temporary accommodation on 30th September 2023.

- Houses purchased by first time buyers in the final quarter of 2023 were down 23% compared to the same quarter in 2022 according to UK Finance.

- Further information about the NRLA can be found at www.nrla.org.uk. It posts on X @NRLAssociation.

- The NRLA’s press office can be contacted by emailing [email protected] or by calling 0300 131 6363.