NRLA Mortgages partner with lender Paragon Bank to offer shared exclusive products for members

Whether you are looking to expand your property portfolio, raise funds for further property investment or property improvements - we are here to help.

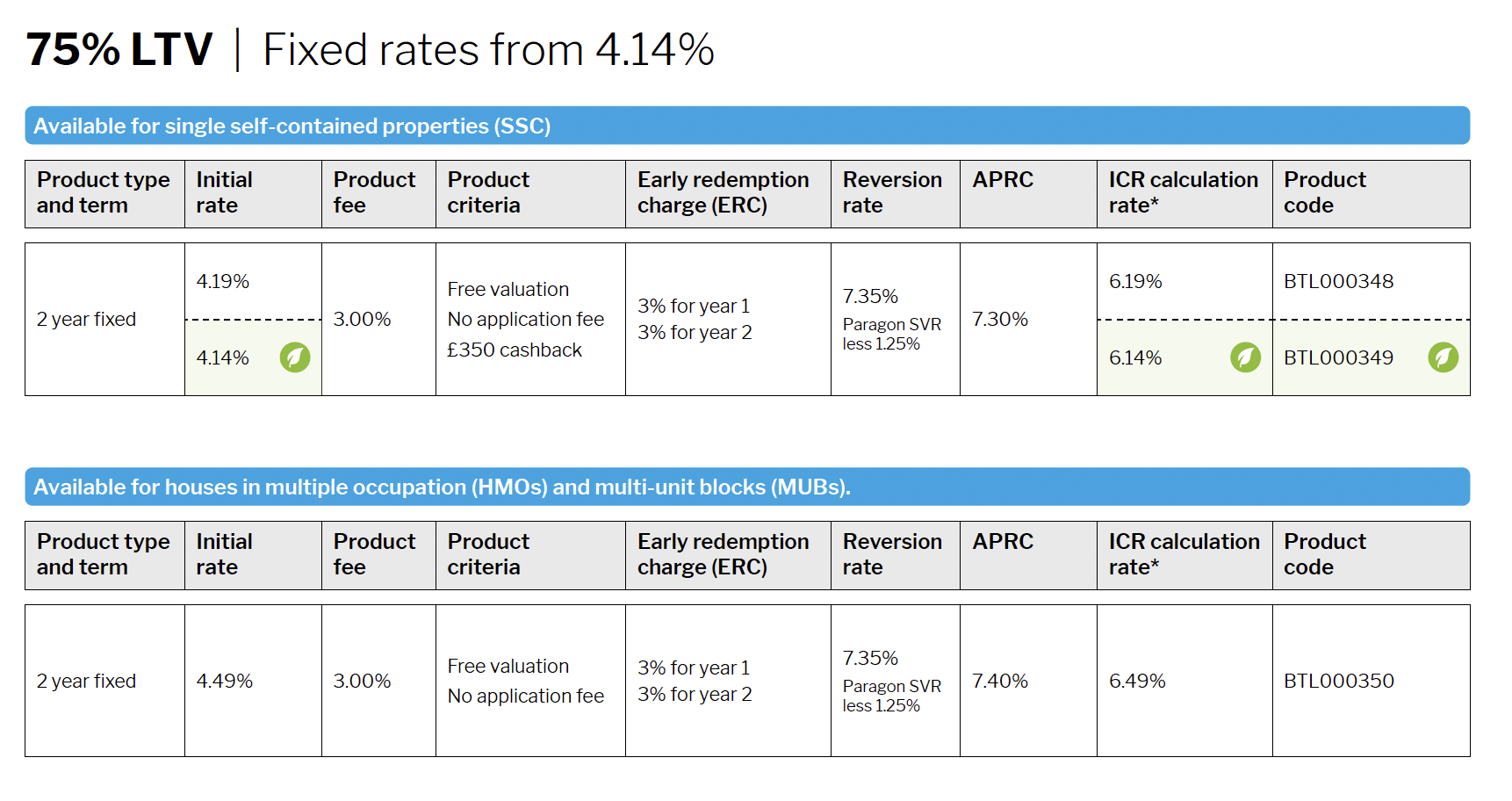

This shared exclusive range of products is aimed at landlords and developers investing in single self-contained (SSC), houses in multiple occupation (HMOs) and multi-unit blocks (MUBs). Paragon Bank and NRLA Mortgages are excited to offer members shared exclusive access to 2-year fixed rates, on the Paragon 75% Range.

All semi-exclusive 2 year-fixed rate (SSC) products offer a free valuation, no lender application fee and £350 cashback (£350 cashback not available on Paragon core range products).

The 2 year-fixed rate (HMO/MUB) product offers a free valuation and no lender application fee (usually £299 on Paragon core range products).

Check out the product details below for more information (correct as of 01.09.25):

Interested? Contact NRLA Mortgages today:

We've teamed up with 3mc Limited (UK) who can advise on a wide range of mortgages, including exclusive deals not available direct from the lender. To discuss options suitable to you, call direct on 0161 341 0581, email [email protected].

Reasons to use NRLA Mortgages:

- Over £1 billion in mortgage applications have been processed for NRLA members.

- Reduced broker fee for NRLA members: £395 for the first application and then £295 for all subsequent applications.

- Access shared exclusive buy-to-let and residential products available to NRLA members.

- Full support, including help with mortgages for unusual property and tenancy types, including HMO properties with tenants in receipt of housing benefit.

If you are interested in the above or wish to receive advice about a mortgage, then please contact us and we will direct you to 3mc who are specialists within this area. 3mc will support you throughout all the steps of the process and can even help you to find mortgages for unusual property and tenancy types, including HMO properties with tenants in receipt of housing benefit. All for a fixed broker fee of no more than £395 for NRLA members.

Important Information

Facts correct at time of publishing. All calls are recorded for training and monitoring purposes.

Please note lenders have different minimum criteria requirements and not all landlords and property types will qualify for this specific product. The actual APRC rate available will depend upon your circumstances, please ask for a personalised illustration. For further information contact NRLA Mortgages.

This is an advertisement only and in no way should be viewed as a personal recommendation or advice. Before a recommendation of the suitability of the product can be given, we will direct you to 3mc (UK) Limited who can provide specialist mortgage advice. As part of this they will ask questions so that they can fully understand your circumstances before giving advice.

NRLA Mortgages is a trading name of LPTE Limited which is an Introducer Appointed Representative of 3mc (UK) Limited who is Authorised and Regulated by the Financial Conduct Authority and is entered on the FS Register under reference 302992. Please note: 3mc can advise/arrange Business Buy to Let (BBTL) and Consumer Buy to Lets (CBTL). Of the two, only Consumer Buy to Lets are regulated by the FCA.

THINK CAREFULLY BEFORE SECURING OTHER DEBTS AGAINST YOUR HOME. YOUR HOME MAY BE REPOSSESSED IF YOU DO NOT KEEP UP REPAYMENTS ON YOUR MORTGAGE. ANY PROPERTY USED AS SECURITY MAY BE REPOSSESSED IF YOU DO NOT KEEP UP REPAYMENTS ON YOUR MORTGAGE.