Unlocking the power of fractional property investment

Bill Greaves of fractional property investment firm, Cahootz, explains what landlords need to know about about fractional property ownership.

For landlords and property investors in the UK, the quest for diversification, reduced barriers to entry and efficient management have always been important. With changing market dynamics, the rise of fractional property investment presents an intriguing opportunity to supplement traditional property ownership.

Fractional ownership offers a blend of benefits that not only enables diversity across location and property type, but also provides a means to streamline investment without additional time commitments. In this article, we delve into the advantages of fractional property investment and how it can enhance your portfolio.

Diversification and Reduced Risk

One of the most significant advantages of fractional property investment is the ability to diversify portfolios across different locations and property types.

Traditionally, owning multiple properties across diverse areas required substantial capital and increased management efforts. Fractional ownership enables you to invest in a wide variety of properties, from homes in more rural areas to high-end central London apartments, without the need for a significant upfront investment. This diversification helps mitigate the risk associated with a single property and protects against market fluctuations in specific areas, ultimately increasing the stability of investment portfolios.

Lower Entry Costs and Increased Affordability

Property ownership in the UK has become increasingly expensive, making it challenging for aspiring landlords to enter the market. Fractional property investment offers a solution by reducing barriers to entry and making real estate investment more accessible. Instead of needing substantial capital to purchase an entire property, fractional ownership allows you to purchase a fraction (an ordinary share in the company owning that property) lowering the upfront cost. By pooling resources, investors gain access to properties that would have otherwise been out of reach, which opens new opportunities for investors.

Invest without a mortgage

Interest rates play a crucial role in property investment, as they directly impact mortgage costs and return on investment. As interest rates fluctuate, the cost of borrowing to finance property purchases can increase, eating into profit margins. However, fractional property investment offers a way to invest in property without leverage.

By purchasing property without leverage, you eliminate the need for financing and the associated interest payments. This approach allows investors to focus on generating consistent rental income and long-term capital appreciation.

Professional Management and Hassle-Free Experience

Fractional property investment provides a hassle-free experience through professional management. When investing in fractional ownership, property management tasks such as finding tenants, rent collection, property maintenance, and legal compliance are handled by experienced property management teams.

These professionals have the expertise and resources to ensure efficient operations and maximise the return on investment.

By relying on their services, investors can have peace of mind knowing that their properties are in capable hands without taking on additional time commitments.

Get in Cahootz

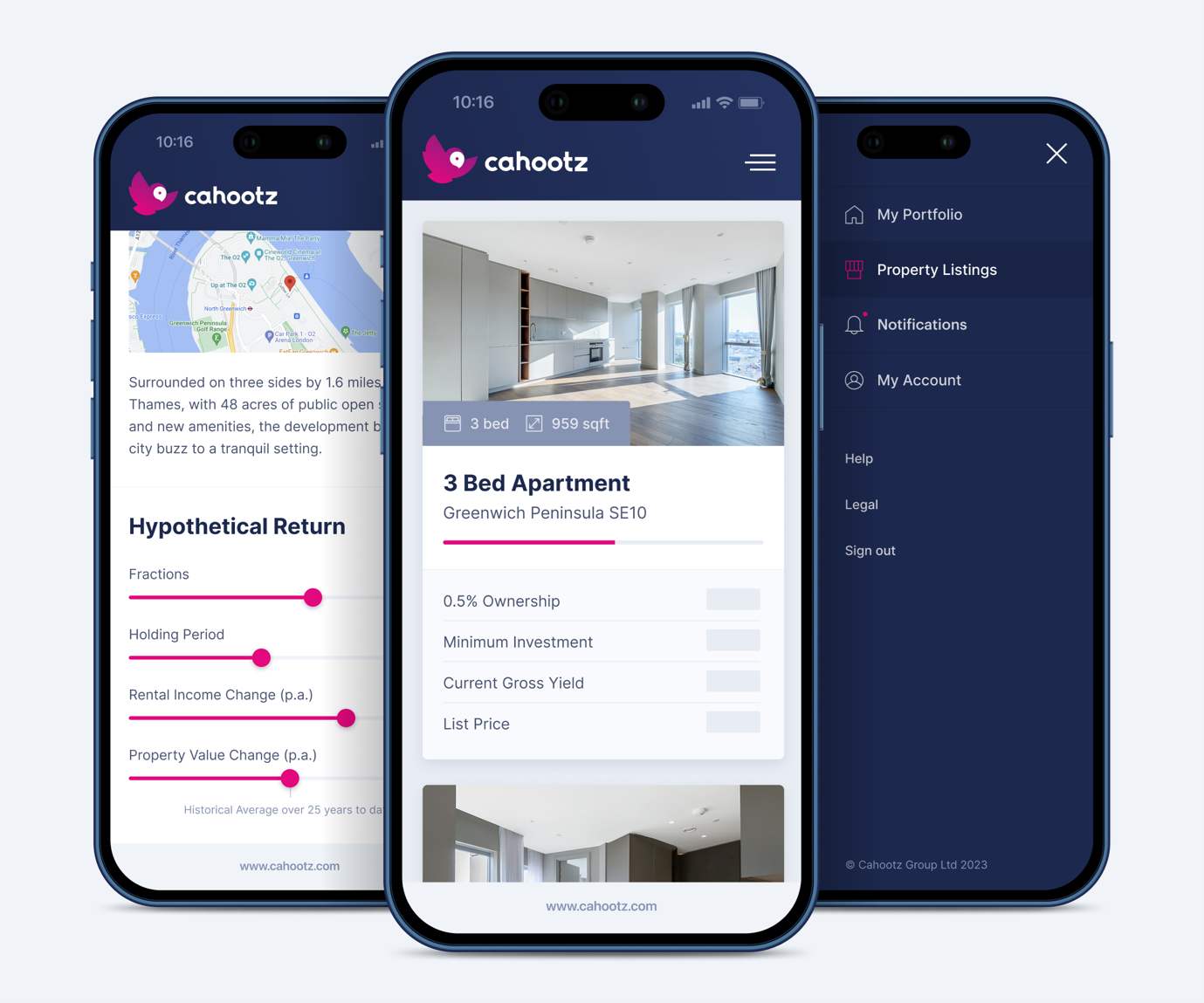

Fractional property investment firm, Cahootz, provides access to London residential real estate via its online platform.

Once onboarded investors can access properties in central London and purchase fractions, which provide the holder with a relative share of net rental income and any capital appreciation earned.

With Cahootz, fractions represent ordinary shares in an SPV, each of which owns in individual property, providing investors with direct ownership of the asset. Each fraction represents 0.5% ownership of a property, which allows investors to access high-value London property with less up front (compared to single ownership) and diversify their portfolio further as a result.

Cahootz has recently partnered with developer Knight Dragon to offer fractional ownership of luxury rental properties at Greenwich Peninsula, London. The £8.4bn development is the largest regeneration project in Europe, transforming over 150 acres of land into a new urban neighbourhood with 17,000+ homes and 48 acres of green, public space. More than 5,000 people already call the Peninsula home, with thousands more soon to come.

Conclusion

Fractional property investment offers existing and aspiring landlords and property investors in the UK an opportunity to diversify their portfolios, reduce entry barriers, offset interest rate risks, and streamline their investment without additional time commitments. While fractional ownership is not a replacement for traditional property investment, it serves as a valuable supplement that enhances the overall investment strategy.

Cahootz offers investors a route into fractional property ownership via its online platform where investors have the ability to begin their property investment journey, or add diversification to existing portfolios.

To find out more about fractional property investment visit www.cahootz.com

Important Information

This document is a financial promotion issued by Cahootz Group Limited (company number14413674, Cahootz). Cahootz is an authorised representative (FRN 997439) of Prosper Capital LLP (Prosper), which is authorised and regulated by the Financial Conduct Authority (FCA) with firm reference number 453007. Neither Cahootz, Prosper nor any of their affiliates or group companies provides any advice or recommendations in relation to any investment in this document. If you have any doubt about the suitability of the investment, or you require financial advice, you should seek a personal recommendation from an appropriately qualified financial advisor that does give advice.