Taxing times ahead for landlords (despite evidence)

Introduction & Context

At the end of the financial year 2019-2020, government debt was equivalent to 84.6% of gross domestic product (GDP).

Covid-19 then struck and debt levels have further increased. The ONS estimate government borrowing since the financial year-end in March has been £208bn up to the end of September. In the same six-month period in 2019, borrowing was just £34bn.

Public debt rose in the first six months of the financial year to reach £2,059.7 billion at the end of September 2020, or around 103.5% of gross domestic product (GDP) - the largest debt to GDP mountain since 1960. At the same time, the jobs impact of Covid-19 means that central government tax receipts and National Insurance contributions have both fallen.

Last year’s Conservative election manifesto stated that there would be no increases in the rates of Income Tax, National Insurance or VAT for the whole of this parliament. In addition, there was a clear manifesto commitment to maintain the pensions “triple lock”.

To stick to these pre-pandemic promises, the Chancellor, if he is indeed committed to reducing debt in the short term, will need to find different ways of raising tax. There has been much speculation in the press that the Chancellor of the Exchequer is eyeballing a range of other taxes, in particular Capital Gains Tax (CGT), as a mechanism to help pay for the response to coronavirus crisis.

How likely is this course of action and what would be the impact of rapid increases in CGT? This post looks at some of the evidence collected from NRLA members.

The Office of Tax Simplification & Capital Gains Tax

Throughout November, media attention has focused on opportunities to raise CGT. This has been prompted by the publication of a report from the Office of Tax Simplification (OTS) which focuses on CGT reform and identifying “areas where the present rules can distort behaviour or do not meet their policy intent”.

Among the report’s conclusions are:

- A policy of reducing the differences between CGT and Income Tax would best eliminate “distortions to behaviour” – the conclusion being to link CGT rates to income tax rates

- Reducing CGT allowances from their present level

- Changing the linkage between Inheritance Tax and Capital Gains Tax to (i) eliminate “double reliefs” and (ii) revise rules on capital gains uplift on death.

What landlords tell us about tax

The NRLA’s quarterly survey series – In Focus – asked landlords a series of questions about their tax status and their views on a range of possible tax changes.

The first key point to make is that almost 80% (79%) of landlords opt to organise their landlord businesses via self-assessment. This rises to 93% of landlords who rent a single property.

In addition, over 40% of members do not have an accountant, choosing to manage their landlord income tax liability themselves. This means members are very much in the front line when it comes to dramatic changes in policy – which the OTS recommendations certainly represent.

The survey specifically asked landlords about their support for the recommendation to align CGT rates with Income Tax bands. Two thirds of landlords (66.2%) are opposed to such a measure whilst just 5% supported the idea.

Likely impacts of CGT on landlords’ businesses

Capital Gains Tax is certainly something which weighs heavily on the minds of landlords. Almost half (43.7%) believe the tax has had a negative impact on their business.

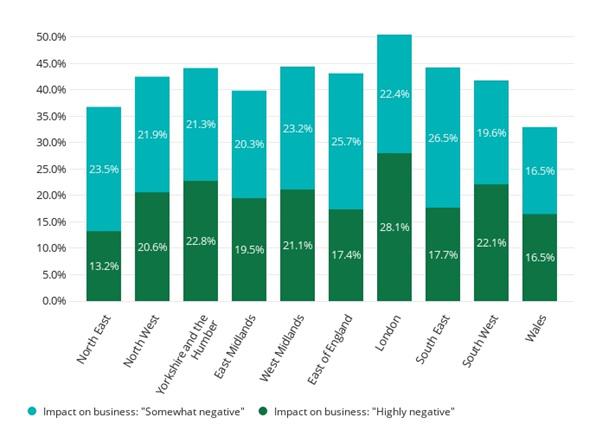

Chart 1 below shows, region-by-region, the proportion of landlords who feel the tax is either “highly negative” or “somewhat negative” to their business:

Capital Gains Tax is certainly something which weighs heavily on the minds of landlords. Almost half (43.7%) believe the tax has had a negative impact on their business.

Chart 1 below shows, region-by-region, the proportion of landlords who feel the tax is either “highly negative” or “somewhat negative” to their business:

Chart 1: Regional variations in the impact of CGT

Not surprisingly CGT was most likely to be viewed negatively by landlords who have properties in London than other areas of the country.

Over 28% of London-based landlords saw CGT as “Highly Negative” – more than twice the percentage in the North East (13.2%).

CGT and time horizons

Those landlords who intend exiting the PRS in the next five years are also most critical of Capital Gains Tax. Over 40% (40.2%) of those landlords planning to exit in the next two years views Capital Gains Tax as “highly negative”.

Those landlords who bought their last “to let” property more than five years ago were also amongst those most likely to view Capital Gains Tax negatively: over 25% (25.2%) of those who bought their last “to let” property more than ten years ago view the tax as “highly negative”.

How CGT has distorted long term planning

Whilst these views could be dismissed as a simple, human response to paying tax, there are policy implications.

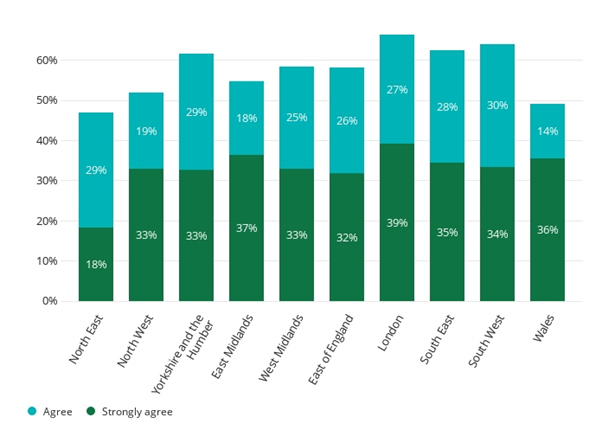

Chart 2 below shows the percentage of landlords who feel CGT has meant they “have held property longer than…. envisaged” when they became a landlord:

Chart 2: Proportion agreeing they held property for longer because of CGT

In every region, bar one, at least half of landlords felt CGT had led them (and implicitly will contiunue to lead them in future) to hold onto property longer than they envisaged when they first became landlords. In London, this holds true for two-thirds of landlords.

Across the country as a whole 59% of landlords agreed that their time horizons had been changed because of CGT and they were holding (or would hold) property longer than they had planned to do so when they first became landlords

Note that even comparing different groups of landlords this view is strong: irrespective of age, gender, portfolio size or time horizon, CGT has resulted in landlords holding property for longer than envisaged.

Potential response to future change

Before the establishment of the NRLA, the RLA provided evidence that CGT could distort decisions landlords take. With this distortion come potentially negative effects on the Private Rented Sector.

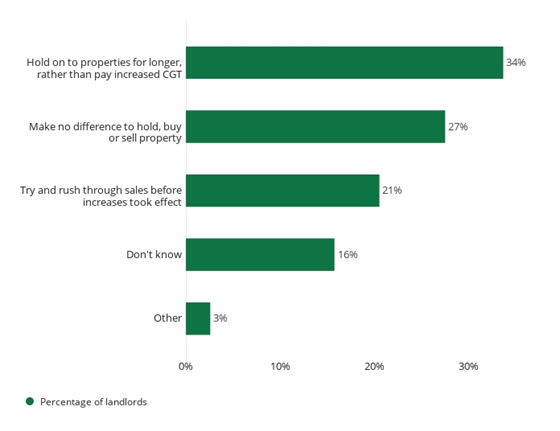

In this survey of members, more evidence of these negative impacts exists. Table 3 looks at the strategies landlords would employ were the Chancellor to decide to raise CGT rates:

Chart 3: Likely landlord strategies in event of CGT rises

Just over a quarter of landlords (27%) stated CGT rises would make no difference to their portfolio decisions. Over half of landlords would however opt to hold onto properties (34%) or rush through sales before any changes (21%), if they had the opportunity.

Landlords with a multiple property portfolio are more likely to opt to hold on to properties compared to those who own one property – just 26% of these landlords stated they would hang on as an alternative to paying a higher CGT bill. This is a preferred approach for younger landlords (under 55) – 40% of landlords in this age band stated they would adopt this strategy.

Conclusions and NRLA actions

Unfortunately, yet more misery could be inflicted on landlords as the Chancellor looks to raise taxes. Last year we put forward analysis which indicated CGT breaks for property sales with tenants in situ, as well as sales to tenants all had support.

Past research has also indicated over 40% supported the idea of a CGT tax window. Given the responses here such a window before an increase could be revenue raising. Many landlords will be adjusting their business strategies should CGT become more stringent and rates increase.

Current tax forecasting models underestimate the receipts HM Treasury receive from CGT. It is noteworthy that the OBR (i) forecast sharp incrreases in revenues from CGT as well as Inheritance Tax and Stamp Duty Land Tax at current rates. The OBR also conclude that (ii) the value of turnover in the housing market has a limited effect on CGT receipts (a 1% increase in house prices generating just £50m addiitional CGT receipts).

Finally, it is noteworthy that the Financial Times (27/11/20) reported 'Treasury enjoys boost in capital gains tax receipts'. This seems to be, at least in part, a response by investors to the current debate.

In developing proposals for the 2021 Budget, the NRLA must be mindful of the nation’s financial situation. Simple calls for tax cuts will hold little sway. There must be evidence that such action will either increase revenue, or deliver on the Government’s wider agenda.

When it comes to housing, the Conservative Government wish to arrest the recent decline in home ownership rates and improve security and affordability in private renting.

The NRLA will, therefore, look for smarter use of property taxes, rather than blanket increases. The latter penalise small, independent landlords, many of whom took a decision to develop their business as a pension alternative.

It seems unlikely, in any case, that such an increase in CGT on residential property would deliver significant tax income for the Government. If landlords don’t sell, then there is no capital gain and no tax payable to the Government!

It is clear, however, that some landlords do want to sell, driven by greater regulation, increasing taxation and the impending abolition of s21. Targeted cuts in CGT, perhaps for sales to tenants in occupation and first time buyers would allow these landlords an orderly exit from the sector.

The abolition of s21 is also problematic. There is a premium on vacant possession and if the Government is to avoid tenancies being ended by landlords seeking to sell, then it must take action to incentivise the market for tenanted properties. Both SDLT and CGT reductions could be used to incentivise sellers and buyers.

This paper benefited from policy inputs and discussions with John Stewart from NRLA. Chris Norris also provided valuable comments and ensured the paper stuck to its key points.