Fixed rate mortgages - landlords highlight their role in PRS shake-out

Introduction

The strain many landlords are under as interest rates rise continues to be a threat to the PRS. It is a strain the NRLA has documented through its quarterly consultation programme and other landlord research. The data has presented an unfolding crisis, which could hit the PRS much more than Covid-19.

This crisis may be generated by rising interest rates, but it is exacerbated by fixed term deals. This post looks at those landlords who have, in turn, BTL finance and fixed rate deals. The research presented here focuses on those landlords who have fixed term deals drawing to an end. These landlords are more likely to take action which, whilst perfectly rational, has implications for PRS housing supply.

About the research

The NRLA quarterly consultation programme is the largest regular supply-side survey in the PRS. In Quarter 2 just over 1,100 NRLA members took part in the consultation, undertaken on-line. This blog post looks at recent data from NRLA landlords generated through this study. At the time of writing the quarterly In Focus has yet to be published, but will be found here.

The quarterly research programme also informs the NRLA's Landlord Confidence Index, and some of the data in this post can be found here.

Context: The role of rising interest rates

Recently, the NRLA blog reviewed evidence on disappearing landlord profitability as a result of rising interest rates. At the time that research was undertaken, base rates were 4.25%. Now (writing in early September 2023) base rates are 5.25%.

The NRLA wrote at that time: “….base rates at 5% is something of a tipping point for many landlords…. the PRS is reliant upon landlords' fixed term mortgage deals not expiring in the immediate future.”

Note that the post cited above referred to a study (the NRLA’s 2022, Quarter 3 consultation) in which 64% of landlords had Buy-to-Let (BTL) finance. The 2023 Quarter 2 study on which this post draws, has 62%: It is reasonable to conclude the two studies have samples which are broadly comparable to each other.

In this year’s Quarter 2 consultation, the NRLA asked landlords when their fixed term deals were due to expire. This is a complex question: some portfolio landlords hold multiple deals, many consolidate finance, others have different types of mortgage finance and so on.

The NRLA phrased the question in its most simple terms, and asked landlords to think only about the nearest date at which their next BTL fixed-term (if they have fixed-rate terms) deal expires.

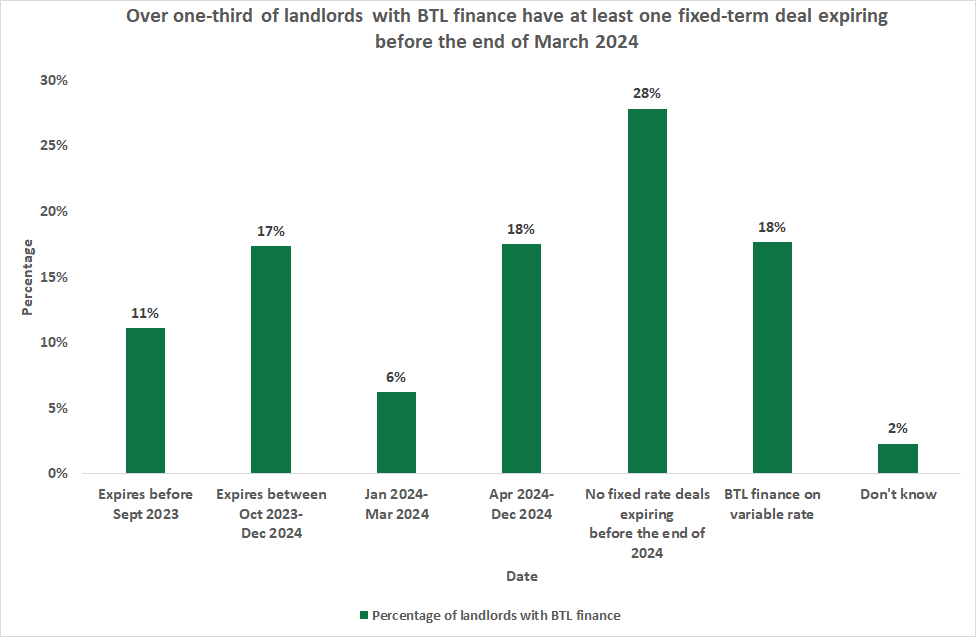

Chart 1 below, highlights the impending expiry of many fixed term deals:

Chart 1: When a landlord's next fixed rate deal is due to expire

The data shows:

- Over one-third of landlords (34%) with BTL finance have at least one fixed term deal expiring before the end of March.

Many of these landlords will either have looked at or locked into new fixed rate deals: a cursory glance at comparison websites indicates best buy deals are presently (early September 2023) typically 5%+ and are often linked to a de facto minimum rental income requirement, imposed by the interets rate cover ratio.

Landlords' response

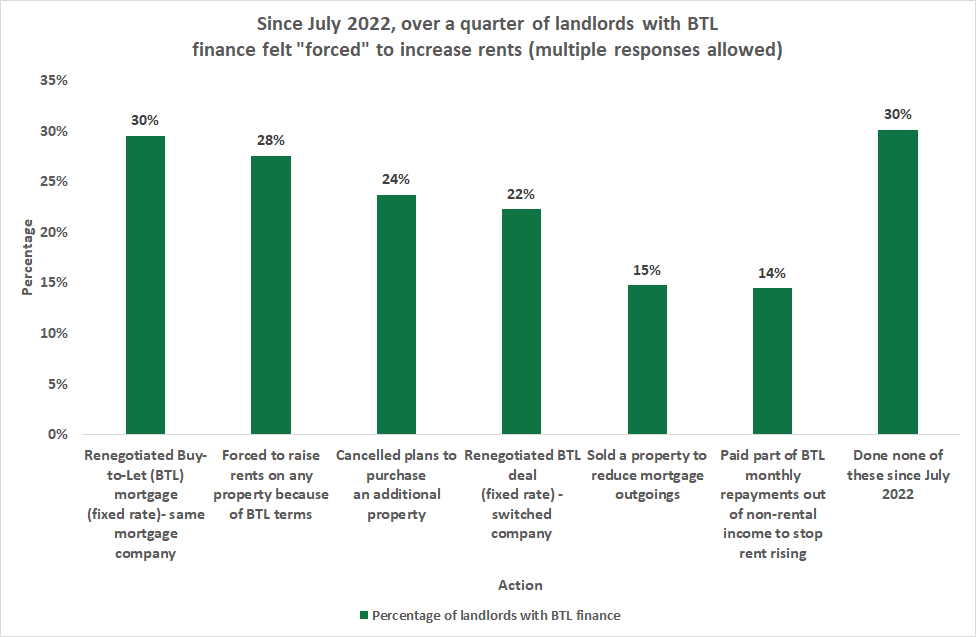

Chart 2 below, also drawing on data collected in the 2023 Quarter 2 consultation, shows how these landlords are responding. Again, only those landlords with some kind of mortgage finance are included:

Chart 2: Recent actions taken by landlords with BTL finance

This data focuses specifically on the period since July 2022, when inflation started rising and base rates had risen above 1%. By March of 2023 when base rates had risen to 4.25%. Most landlords with BTL finance – 70% - had taken on at least one of the actions outlined in Chart 2, including:

- Almost one-third (30%) of landlords had renegotiated new fixed rate deals with their current providers.

- One in five landlords (22%) had switched lenders when refixing their repayments

- Note that these are not mutually exclusive groups – some landlords will have done both.

For many the Terms and Conditions (T&Cs) of the renegotiation will have meant rent rises:

- Almost 30% (28%) of landlords with BTL finance stated they had been “forced” to raise rents as a result of the BTL terms and conditions.

- Furthermore:

- A substantial proportion of landlords (14%), decided to at least part-cover some of the rent increases themselves.

- These are often imposed because of lenders’ T&Cs.

- This can effectively be viewed as a “rent subsidy”.

This rent subsidy response will have been seen by landlords as a preferable strategy to raising rents beyond what they see as a fair rent, at a level their current tenants can afford.

Wider impacts of interest rates on the PRS, landlords and tenants

The Landlord Confidence Index provides a regular snapshot of the motivations underpinning landlord decision making. In recent editions the proportion of landlords raising rents has risen to record levels. At the same time, the proportion of landlords selling or planning to sell has also risen (whilst landlords buying more property has correspondingly fallen). These contrasting trends make a mockery of the "greedy landlord" accusation.

Consider the data presented below, two dates are presented. The data is regularly collected from NRLA landlords each quarter:

(a) The proportion of landlords who reduced holdings in the previous 12 months

(b) The proportion of landlords who are planning to reduce holdings in the next twelve months

(c) The proportion of landlords who typically raised rents in the last twelve months

(d) The proportion of landlords stating they will typically raise rents in the next twelve months

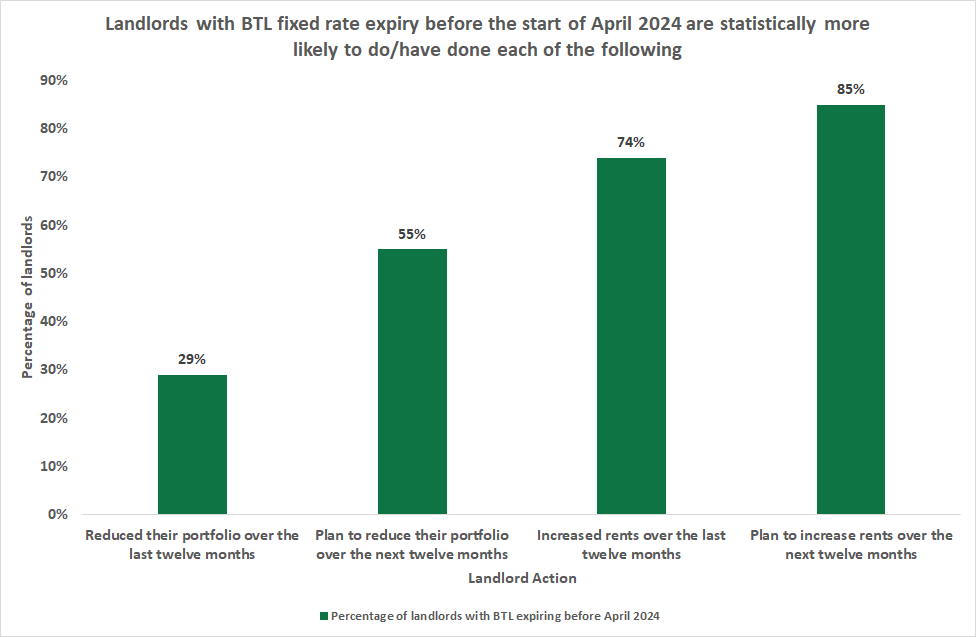

The added influence of fixed term deals due to expire

Chart 3 shows the same data as above for the most recent data - here however, only for those landlords who have a fixed-term deal due to expire before the beginning of April 2024 are included:

Chart 3: How landlords with impending BTL fixed rate expiry have acted

On each of the above measures, landlords with BTLs on fixed rate deals that are close to expiry were more likely than their peers to action – and also plan to action – rent increases and portfolio reductions.

Impact of fixed term expiry on Section 21 activity

As a final point the consultation asked landlords in England whether they had issued a Section 21 since July of last year:

- Across the whole sample, 24% of landlords had issued a Section 21 notice in this time frame.

- However, amongst this smaller group of landlords with fixed term deals due to expire, 33% have done so.

- Again, this is a statistically significant difference.

Summary & policy conclusions

Summary

Correlation is not the same as causation. This research note is not saying the imminent end of fixed term deals is exclusively causing the current strains in the PRS. However, there is a correlation. It is a relationship which is entirely consistent with reality and rational behaviour:

Increasingly nervous landlords respond to the imminent end of their fixed term deals by selling property (reducing supply) and/or raising rents in response to the need to cover mortgage repayments - which are then being further jacked up by lenders' T&Cs on interest cover.

That these actions are not part of a long-term strategy would seem to be underlined by the increased use of Section 21 – this enables landlords to free up property before that property is put on the market for a rapid sale.

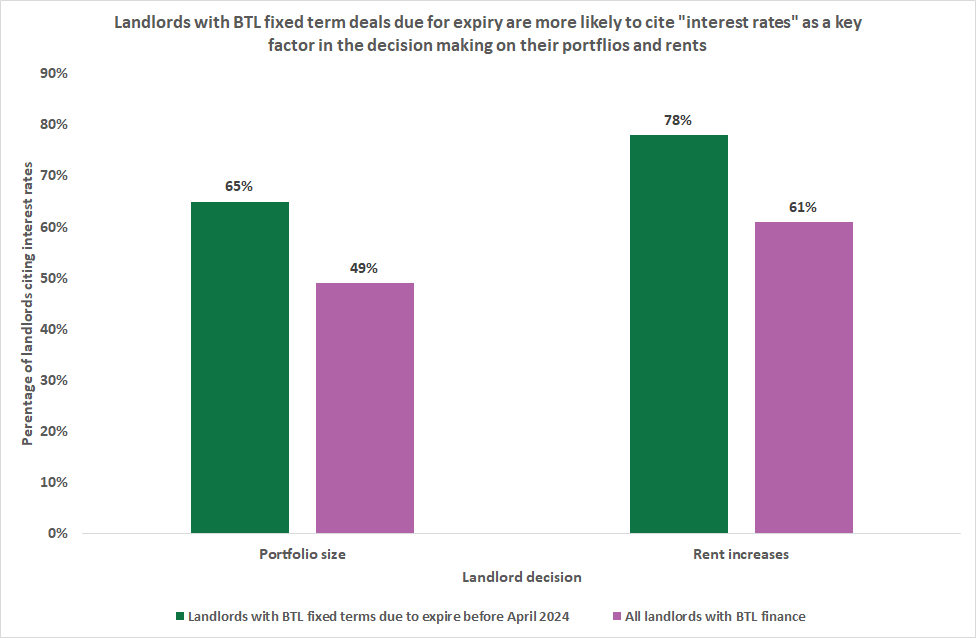

Chart 4 below underlines the role interest rates play in landlords' current decision making:

Chart 4: The influence of interest rates

This final chart shows that whilst interest rates are a key factor for many landlords who have BTL mortgages, for those with fixed term deals shortly to expire, interest rates is an even greater factor in decision making.

Interest rates are forcing landlords to take rational decisions which are proving to be to the detriment of the sector as a whole.

- Note the differences in Chart 4 above are statistically significant.

Role for policy

From the evidence presented here, there are two conclusions for the development of future policy:

- The role of minimum interest cover requirements imposed on many – but not all – BTL lenders needs to be recognised. The rapid rise of interest rates is pushing up rents way above what was previously thought to be the market rate.

- The prevelence of these T&Cs on loans in any one local neighbourhood, effectively drives up the market rate. This has implications elsewhere in the economy.

- In its efforts to get inflation down, temporary action could be taken on these T&Cs to allow landlords to minimise rent increases when interest rates rise.

- There should be greater incentives to encourage those landlords who wish to sell, to do so with tenants in-situ and/or to other landlords. This would help sustain PRS property volumes and give tenants added security.

- These incentives would reduce the likelihood of a landlord taking back possession of a property as a fixed term deal draws to a close.