NRLA tenant survey: separating facts from fiction

Summary

The NRLA has been researching and reporting the impact of Covid-19 on the Private Rented Sector (PRS). It has done this through surveys of both landlords and tenants.

In the Spring of 2021, the NRLA commissioned the global market research and data analytics company dynata to undertake a survey of tenants residing in the PRS. The survey was undertaken in May 2021. Over 2,000 (2,022) tenants replied.

Questions focused on tenants’ labour market experiences during the pandemic, issues around rent, paying rent and tenant arrears. The survey also looked at the future plans of tenants.

This blog post reviews some of the survey’s key findings.

This is the third survey of tenants the NRLA has run since the pandemic began. The results have been consistent across these surveys. On the basis of the evidence collected here, around 7% of tenants have rent arrears. Total rent arrears across England & Wales is estimated to be £325m-£330m.

Section 1: About the sample

Some key features about the tenants who participated in the survey:

- Forty per cent (40%) were aged under 35. Over 55s accounted for 20% of the sample.

- The survey only sought responses from tenants in England & Wales. London was the region with the largest proportion of responses (18%) followed by the South East (17%) and the North West (11%).

- The North East had the smallest proportion of tenant participants – 4%. Note tenants living in Wales accounted for 5% of responses.

All of the sample lived in privately rented accommodation:

- Half the sample (50%) had tenants living in properties rented by a private landlord, 27% by a lettings/management agent and 17% in property owned by family or friends.

- Almost half (45%) rented a house and 34% a flat. Most of the remainder who responded to the question either lived in an HMO (7%) or as a lodger (9%).

Section 2: Covid-19 and tenants’ employment status

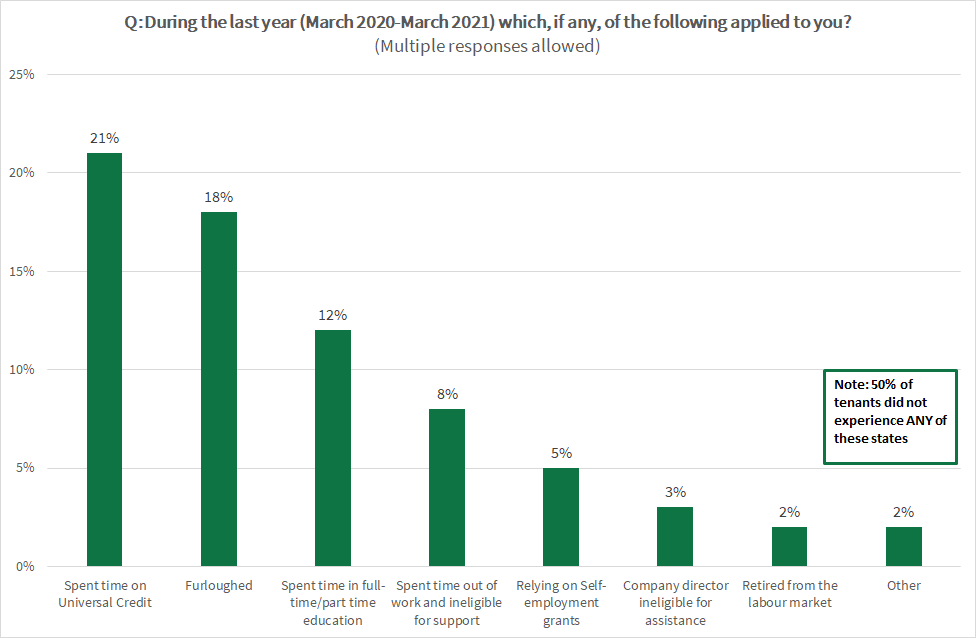

Chart 1 shows the proportion of tenants who have faced at least a period of time during the pandemic in at least one of the labour market states set out below.

Note that around half of all (50.2%) respondents replied “none of these" for the options charted below.

Chart 1: The economic journey tenants took during Covid-19

From the chart above:

- One-in-five tenants spent at least some time claiming Universal Credit.

- Two-thirds of these claimants claimed because of unemployment.

- Meanwhile, almost half of those claimed Universal Credit whilst in work

(These numbers do not sum because there is a considerable group who found themselves claiming Universal Credit both whilst being in work and then because they were out-of-work for a period as well).

- A similar proportion of tenants (18%) were placed on furlough for at least some of the Covid-19 period.

Around one-third of tenants who have been placed on furlough over the past year also claimed Universal Credit at some point.

Section 3: Covid-19 and tenant debt

Tenants in arrears

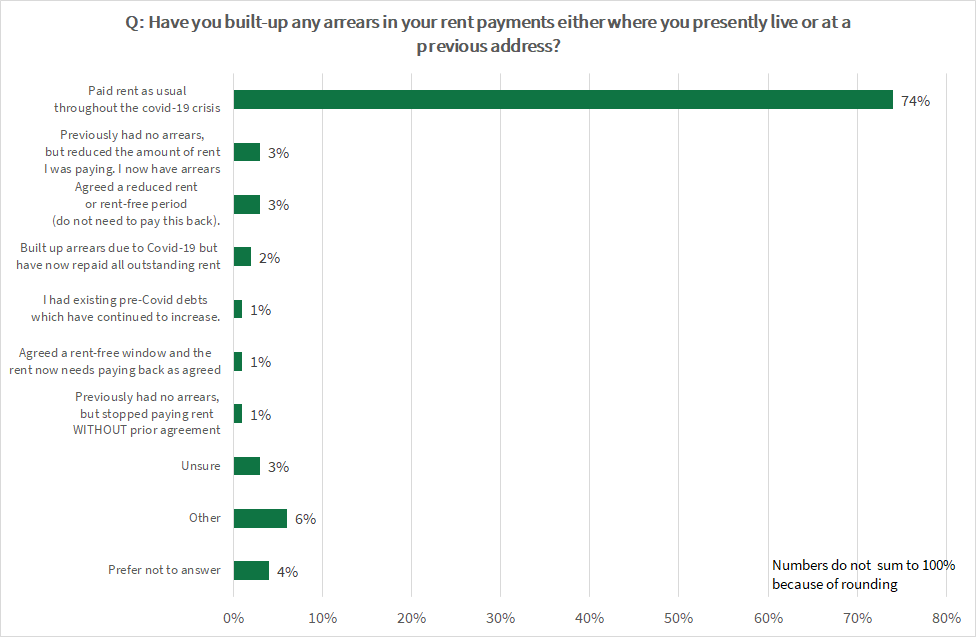

Tenants were asked whether, since Coronavirus measures were introduced (from 17th March 2020), they had built-up any rent arrears.

Tenants were asked to consider both their current address and any former address at which they had lived during this period.

Chart 2: PRS tenants and rent payment

For almost three-quarters (74%) of tenants they had been able to pay their rent as usual, unaffected by Covid-19.

In addition, there are smaller proportions of tenant who have either:

- Negotiated rent reductions (3%).

- Paid back arrears built up during Covid (2%).

- This means 80% of tenants have no arrears.

The responses indicate just over 7% of all tenants stated they were in non-negotiated arrears.* This is a slight increase from the November survey in which 6.2% of tenants described themselves in such arrears.

The size of rent arrears

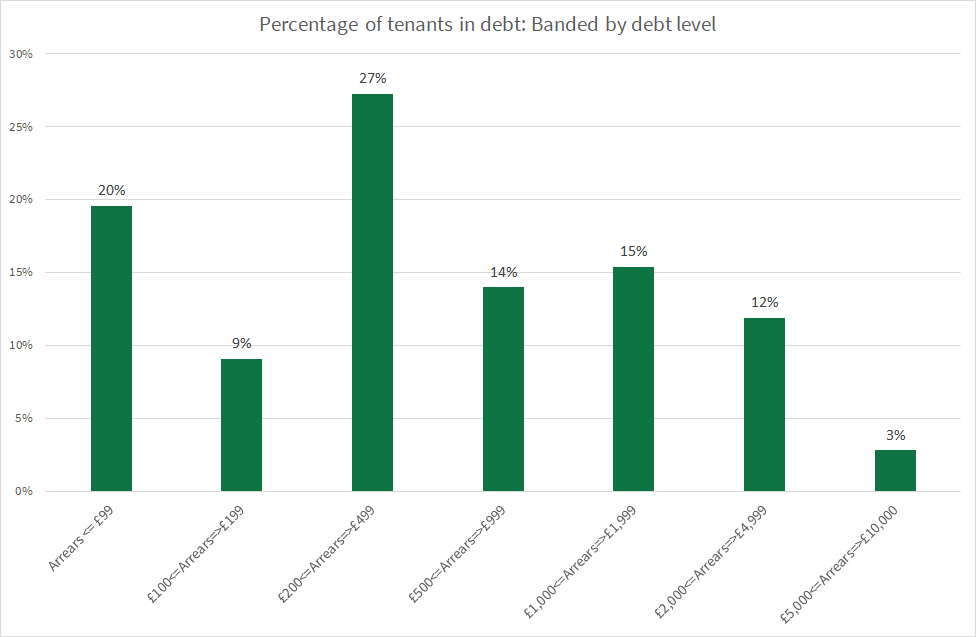

The NRLA have undertaken analysis of tenant debt from the data collected in this survey.

Note that where tenants have negotiated rent holidays or reductions and do not need to repay the difference, then they are excluded from this analysis i.e. they are not classed as “in arrears”. A profile of tenant arrears is presented in the chart below:

Chart 3: Levels of tenant arrears

The data collected from this group of tenants and presented above shows:

- Twenty per cent (20% in arrears, or 1.4% of all tenants) of tenants who are in arrears owe less than £100.

- More than half of tenants in arrears (56%,4%) owe less than £500.

- Fifteen per cent of tenants in arrears (15%, 1%) owe more than £2,000.

Closer analysis of the data shows:

- Mean debt (among tenants who are in debt) is £850.

- Median debt (again, among tenants who are in debt) is £400.

The difference is due to a large number of tenants having small sums of arrears (28% of tenants owe less than £100) - though this does not mean these sums are easy for tenants to repay.

At the same time, a few tenants owe large quantities of arrears – 7% of tenants in arrears owe £3,000+.

Through further analysis of the debt levels reported in the survey and widely available data on the PRS, the NRLA calculate that total arrears across England & Wales is in the order of £325-£330m. **

Section 4: Tenants & their future plans

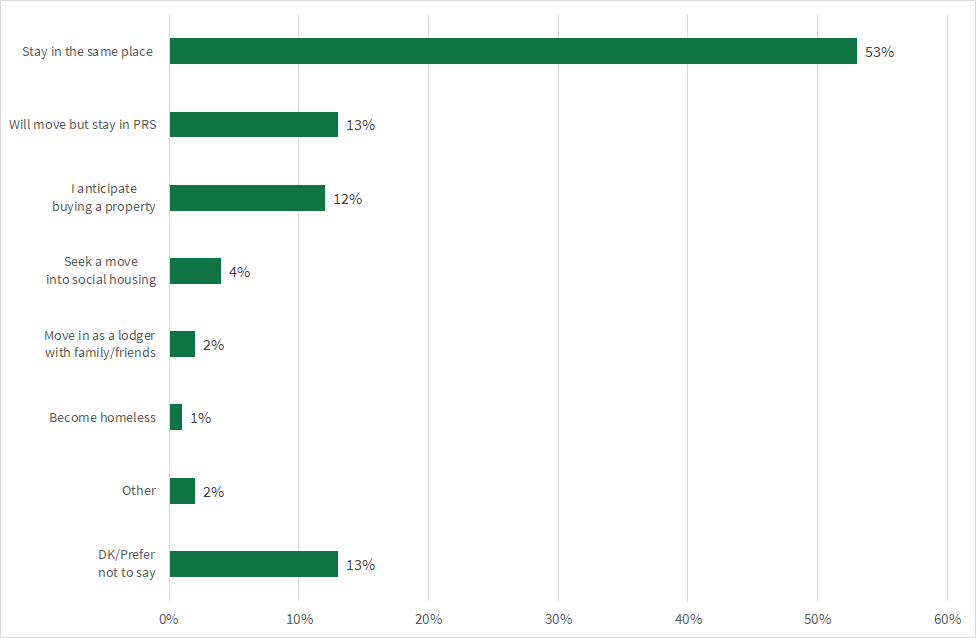

All tenants who participated in the survey were asked what their likely plans were for the next twelve months:

Chart 4: Tenant plans over the next twelve months (all tenants)

More than half of all tenants see themselves as remaining in the same place over the next twelve months.

Just 13% of tenants intend moving to another home within the PRS. This is an almost identical proportion to those intending to leave the PRS and purchase a property.

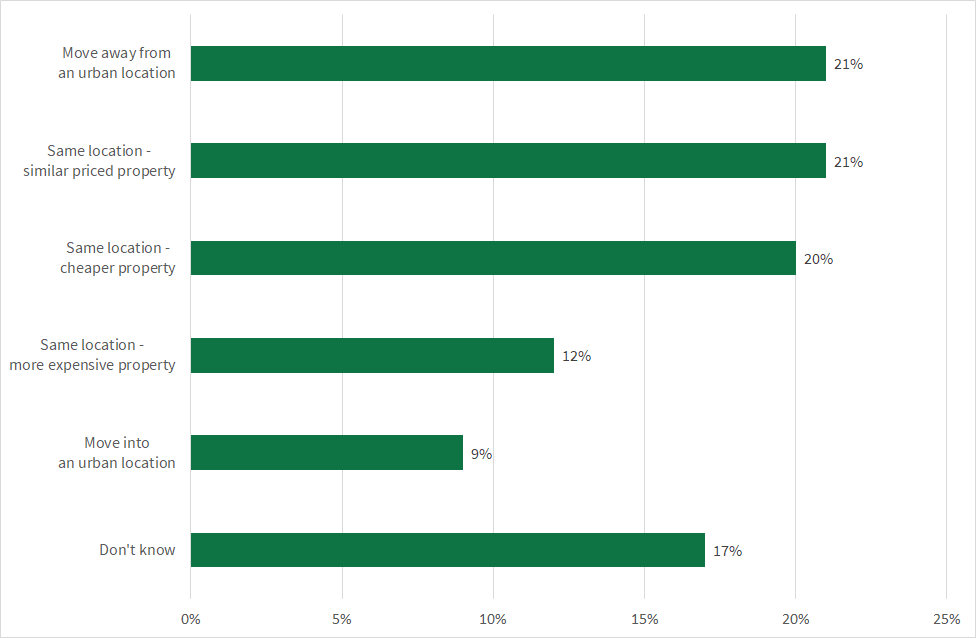

Those who foresee themselves remaining in the PRS but planning to move home were asked where they thought they would move to:

Chart 5: Likely destination of tenants planning to move

For more than half (53%) of tenants planning to move, the intention is to remain in the same location. Only a proportion (12% of the total) of tenants envisage moving to a more expensive property.

The key message which emerges from this chart however is the differences between those moving into, and those moving out of, urban locations:

Whilst over 20% (21%) of tenants planning to move intend moving out of an urban area, just 9% envisage moving into an urban area.

Summary

This is the third survey of tenants the NRLA has run since the pandemic began. The results have been consistent across these surveys.

The vast majority of tenants have been able to pay rent as usual throughout the crisis. Many tenants have benefited from their landlords agreeing to rent windows, reductions and deferments during the Covid-19 crisis.

On the basis of the evidence collected here, around 7% of tenants have rent arrears. Total rent arrears across England & Wales is estimated to be £325m-£330m.

There is a wide disparity between mean rent arrears and median rent arrears. This is because of the financial spread (distribution) of those rent arrears.

Around half of tenants surveyed envisage being at the same property twelve months after participating in the survey. A considerable proportion of tenants planning to move are planning to leave urban areas.

*13% of tenants responded “Don’t know/Unsure/Would rather not say”

** A spreadsheet showing these calculations is available for inspection by request

This blog post beneffited from comments on a previous draft by James Wood of the NRLA.