Landlords underpin tenant debt reduction

Introduction

The NRLA undertake two tenant surveys each year. A review of the previous survey can be found here.

This blog post looks at tenant debt (arrears) which have arisen as a result of Covid-19. Since the previous study, there have been two major events which may have had an impact on Covid-19 related arrears.

Firstly there has been the end of furlough - which was phased out before coming to a complete end in September 2021. In October the temporary uplift in Universal Credit also came to an end.

Using a similar calculation model as that use in the Spring, this blog post produces an updated estimate of tenant arrears and tenant households in debt.

May tenants' survey

The May survey asked tenants about their then-current labour market prospects and status; whether they had plans to move home; and what the impact of Covid-19 had been on their ability to pay rent.

That springtime survey reported the following in relation to tenant debt:

- Total tenant debt (arrears) was estimated to be £325-330m.

- More than half of tenants in arrears owed less than £500 with twenty per cent of tenants in arrears owing less than £100.

- At the other end of the debt scale, fifteen per cent of tenants in arrears owed more than £2,000.

Closer analysis of the data showed:

- Mean debt (among tenants in arrears at the time of the survey) was £850.

- Median debt (among the same group of tenants) was £400.

How has tenant debt changed during Summer-Autumn 2021?

Tenant debt levels has been influenced by a range of factors - Covid-19 and the various phases of lockdown, furlough, and the suspension of tenant eviction are all unique to 2020 and 2021. More recently furlough has ended, whilst the autumn brought the withdrawal of what was a temporary uplift in Universal Credit. This uplift, worth up to £20 per week for claimants, was withdrawn in October 2021.

Our regular landlord survey in Quarter 1 found that (i) over one third (35%) of landlords let to tenants claiming Universal Credit (ii) a substantial proportion of these landlords linked tenant claims to the pandemic economic fallout and (iii) had often themselves supported tenants through rent reductions, rent windows and rent write-offs.

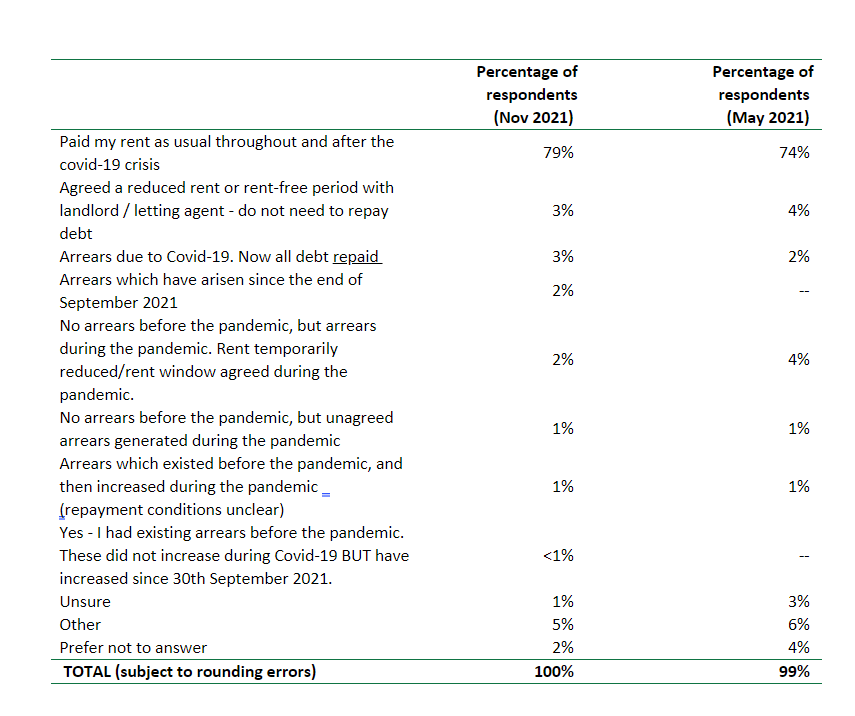

Table 1 below shows the various experiences of tenants in respect of tenant debt against this backdrop:

Table 1: Tenants in debt/not in debt by origin

This is a complex table which shows many of the pathways tenants have taken since the initial outbreak of Covid-19 in respect of paying rent and, in some cases going into arrears.

Since the springtime research, furlough came to an end as did the temporary uplift to Universal Credit uplift. These have added to the numerous pathways of covid-debt and covid-related debt first explored with tenants in that earlier May survey.

The key points from the table are:

- The majority of tenants – 79% - paid their rent as normal and on time. This seems to be a greater proportion than recorded in the previous May study. The other noticeable shift between the two surveys is the lower proportion of “unsure/other/prefer not to answer” responses in November compared to May.

- Immediately below, on the next two pathways, are tenants who have either repaid arrears or reached an agreement involving lower rent. Once these groups are included then 85% of tenants can now be classed as arrears free, compared to 80% in the spring. This aggregate is probably a better measure of "arrears free" tenants.

Tenants in Covid-arrears are falling…

Table 1 shows fewer than 4% of tenants replying to the survey in November had debts related to the Covid pandemic (which in the survey was defined as the period March 2020 to the end of September 2021). The equivalent figure in the springtime survey (when of course Universal Credit and furlough interventions were still running) was 7% of tenants.

It should be also noted that the three “no response” options at the bottom of Table 1 account for 8% of tenants this time around but a much larger 13% in the previous survey. It is not unreasonable that tenants in these groups are as likely to be paying rent (or agreeing rent waivers) as increasing arrears.

Taking this on board, it is easy to see that a case can be made that across the whole sample, the proportion of tenants who are in arrears is falling very quickly.

Applying the same model for calculation as in the May survey:

- The NRLA estimate there are approximately 200,000 households across England & Wales who remain in arrears following the outbreak of Covid-19 in March 2020. This is down from an estimate of 320,000 in the spring.

(These estimates are based on data from the English Housing Survey and StatsWales to estimate the number of PRS households in England & Wales).

…and so is the level of overall tenant debt

Further analysis of tenant arrears - which tenants themselves provide in the survey - indicate that in November:

- Rent arrears now stands at £260m (May: £330m)

- Now, 41% of tenants in debt owe less than £500 (in May this was 55%), meanwhile the proportion owing less than £100 has reduced to 11% from 19% of tenants in arrears in May.

- However, 15% of tenants in debt owed more than £2,000 in May. By November the proportion of tenants in this much debt had risen to 27%.

The NRLA estimate tenant arrears as a result of Covid-19 now stands at £260m (Calculation from data collected in Nov 2021). This is down from c£330m in May. Arrears in the PRS have fallen by around 20%.

In both surveys the proportion of tenants owing over £2,000 accounted for approximately 1% of all tenants surveyed. In other words:

- The numbers of tenants in debt have fallen.

- The amount of debt has reduced substantially – but not by as much as the number of tenant hosueholds in arrears has fallen.

- The number of tenants owing large sums to landlords remains constant.

The consequence is even though the quantity of both arrears and households in arrears have reduced, average levels of arrears have increased. The NRLA now calculate (for those tenants in debt):

Mean arrears = £1,270 (May estimate: £850)

Median arrears = £600 (May estimate: £400)

Will arrears continue to fall?

The data shows both the number and proportion of tenants in Covid-related arrears is falling. This is largely due to a reduction in relatively small (small: relative in comparison to, say, average wages) amounts of arrears.

There could be difficulties in driving down this level of Covid-related arrears down still further:

- There remain approximately 200,000 households in rent arrears either generated or added to since the onset of the pandemic in the spring of 2020. This being a reduction from over 320,000 in the spring

- Average levels of arrears are rising – those with high arrears are not falling in number.

- Around 40% of tenants currently in arrears are claiming Universal Credit.

- For those in receipt of Universal Credit at the time of the survey, around 60% said the decision to remove the temporary £20 per week uplift in Universal Credit would have an impact on their ability to pay their rent.

The implications of ending the £20pw Universal Credit uplift in the autumn of 2021 may therefore be profound for rent arrears. By which we mean both those which presently exist and those which may yet occur as a consequence of the emerging (at the time of writing) Omicron variant.

Final thoughts

As a final comment, it is notable there is negligible change in the two surveys in tenants who have repaid COVID-arrears with their landlord or are in the process of repaying arrears through agreement. Numbers are small, and so care should be taken to overreach on the analysis.

It is also striking that in May just over 2% of tenants had been served a notice that the landlord wished to seek possession of a property. But in November, this proportion had grown to 4% of tenants served notice at their current address.

However only one-tenant-in-seven who had been served notice (14%) cited rent arrears as a reason for that notice. (Fewer than 1% of all tenants surveyed had been served a notice for rent arrears in the last twelve months from either their current or their previous address).

It may be the case (the evidence here can be labelled “necessary but not sufficient”) that landlords are writing off or negotiating away rents owed as part of a “moving on” process with tenants – more than half of tenants who had been served a notice cited landlords taking back possession for personal, family or professional reasons..

This proposition isn’t so much based on “heroic assumptions” more the application of Ockham’s Razor: Few tenants have repaid arrears, there are few tenants facing eviction for arrears, yet tenant debt has fallen by 20% in less than a year. Write-offs must be at least part of the story here.

Whether landlords can financially (and emotionally) recover from these write-offs and continue to offer the same volumes of property in the PRS will be crucial to the supply of rented housing in the covid-recovery era.