Landlord Confidence Index (LCI) No.7: 2020 Q3

Our Landlords’ Confidence Index (LCI) provides a snapshot of landlord confidence and likely future changes in the Private Rented Sector (PRS). The LCI attempts to capture the motivations underpinning landlords’ key business decisons.

It is being produced at a time when landlords face pressure from government: tax changes, new regulations and the threat of adverse legal reforms are now threatening the supply of homes in the PRS.

Whilst the direct impacts of Covid-19 on managing and marketing property may now be becoming 'baked into' landlord expectations, (see our forthcoming Quarter 3 landlord survey), it may now be the impact of Covid-19 on the wider economy which is causing concern among landlords across England and Wales

Page 1

Page 1 - additional commentary

Main chart

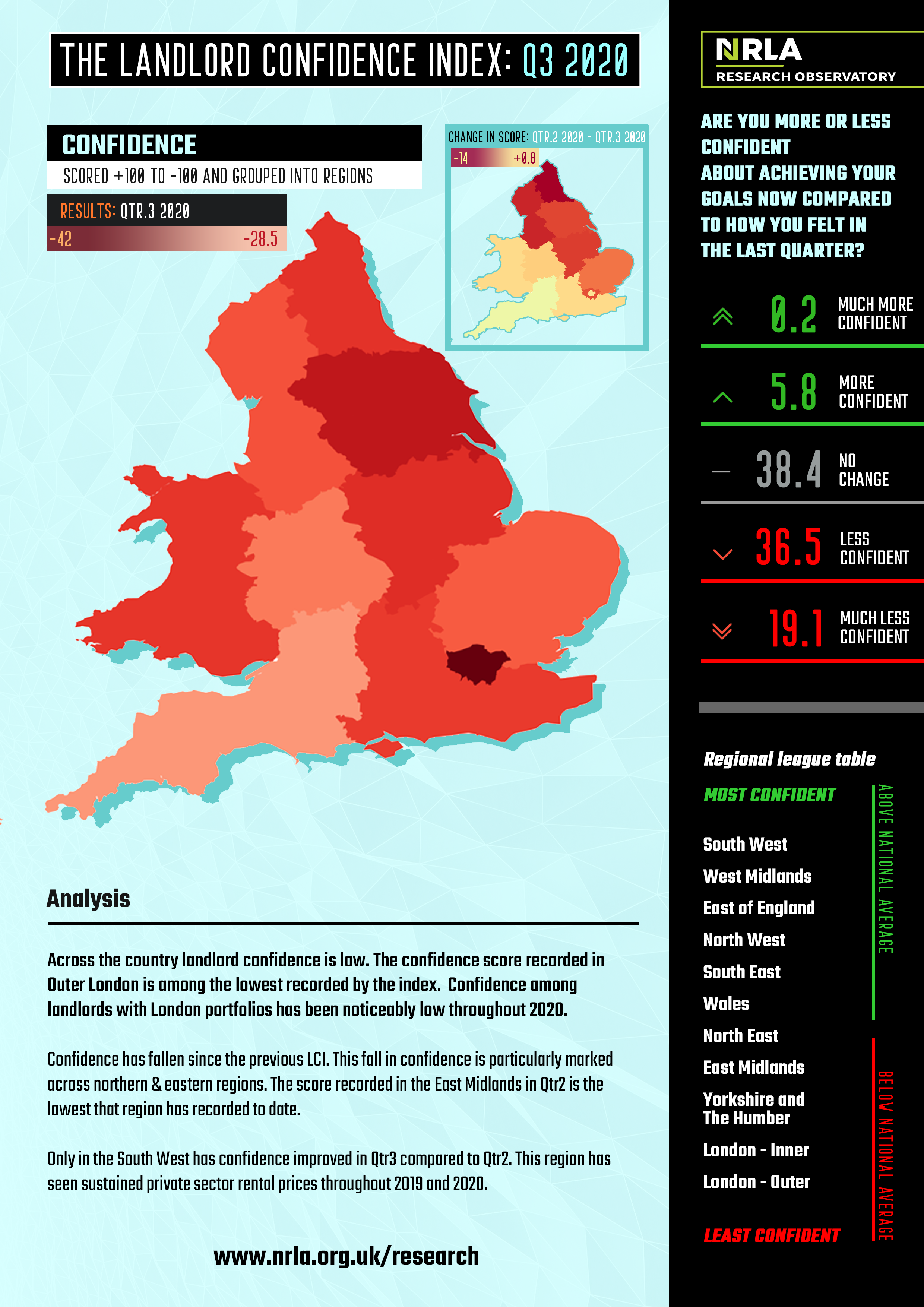

Nationally, the Landlord Confidence Index (LCI) scored -34.2 for Quarter 3. This was slightly higher than the record low for the index. This was a score of -36.9% recorded in Quarter 1 this year which overlapped with the Covid-19 lockdown.

Many regions are also revisiting the lows experienced at the onset of Covid-19. In the East Midlands and East of England, confidence is now lower than in Quarter 1.

Only in Wales has the confidence score significantly improved since the first LCI of 2020 (-33.7 now compared to -45.2 in Quarter 1), though the outlook remains gloomy.

Sidebar

The right-hand side of Page 1 highlights the low levels of confidence landlords have across England and Wales:

- Just 6% of landlords feel more confident now than they did in Quarter 2.

- Over 2,100 landlords responded to this question. Of these just 5 felt “Much more confident” now than they did in the previous quarter.

Additional analysis - Landlord confidence: weighted average 2019 Qtr4 - 2020 Qtr3

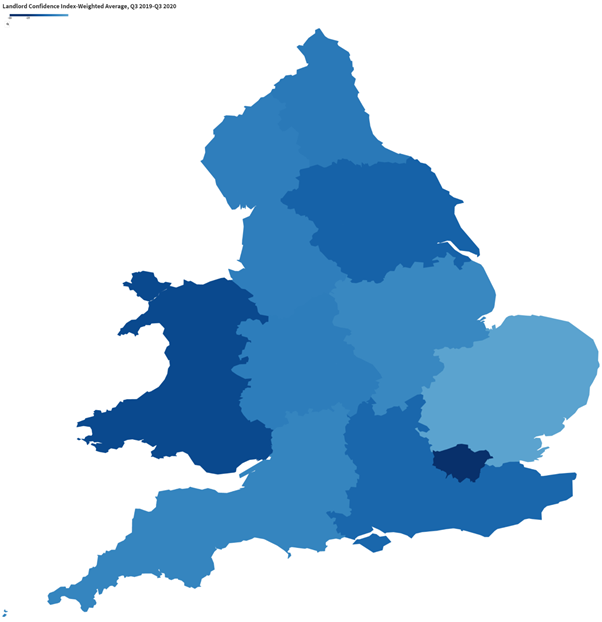

The above chart shows the weighted average of confidence scores recorded over the previous four quarters.

Landlords with portfolios based in London are those who have given the lowest scores most consistently over the last twelve months.

Both Inner London and Outer London have been among the regions at the bottom of the confidence index scores in three of the last four quarters. The scores reflect the particular challenges faced by the capital’s property market during the pandemic.

Yorkshire and the Humber is also among the lowest scoring regions on the weighted index. Yet in 2019 Quarter 4 this region scored the highest confidence score the LCI has recorded for any single region. This accentuates the decline in confidence in this northern region since the start of 2020.

At the other end of the scale, both the South West and East Midlands are among the regions where long term confidence is highest. This reflects the current dynamics of the private rented sector. These regions have experienced sustained rental price increases which have exceeded inflation levels throughout 2020.

Page 2

Page 2 - commentary

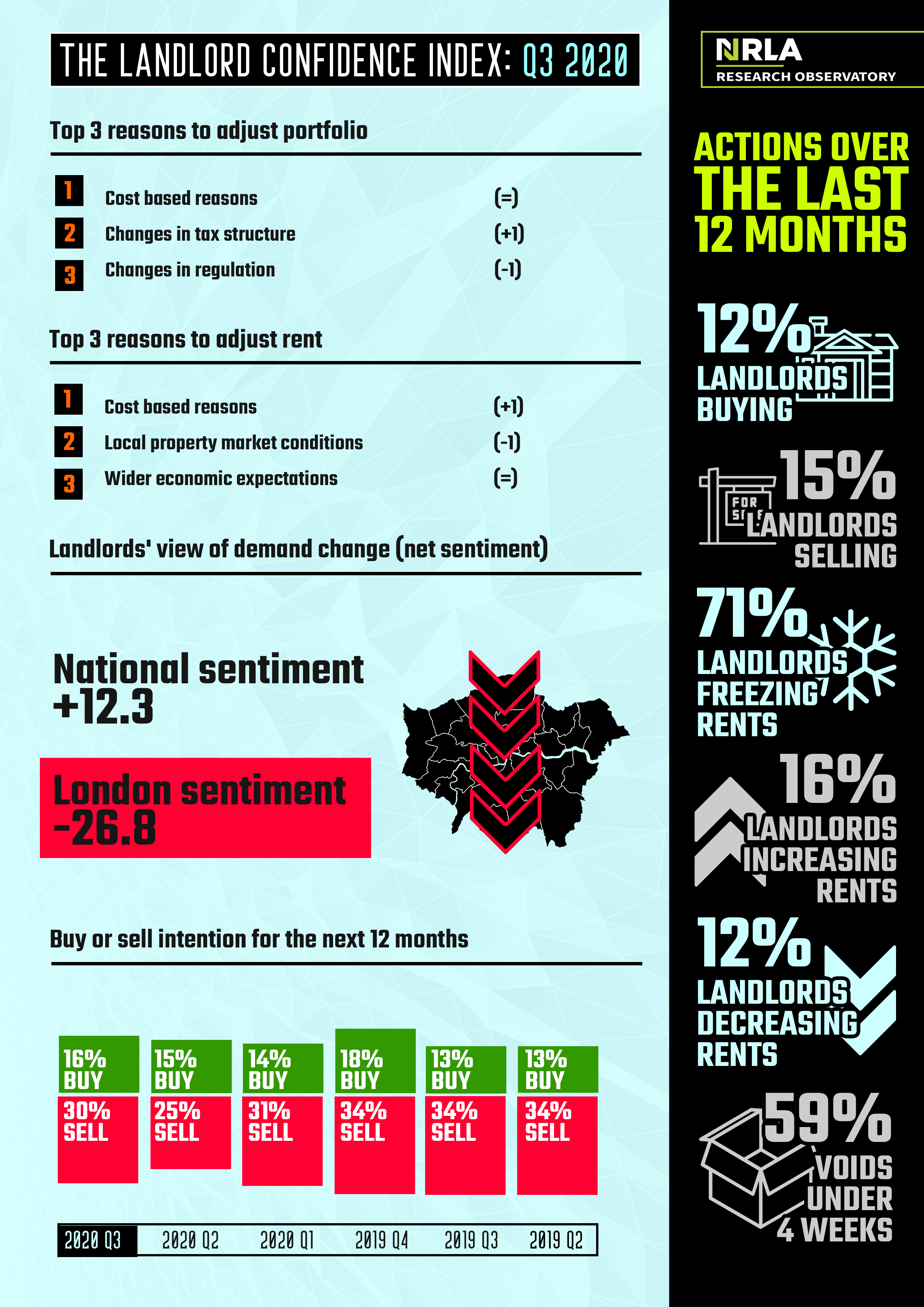

Reasons to change

We ask landlords about their motivations and the factors which have the strongest influence on their key business decisions.

For portfolio change, a long term view needs to be taken to spot any clear trends in the proportions of landlords deciding to either expand or contract their property base. The motivation behind a small independent landlord deciding to adjust their portfolio tends to be based on a common set of factors.

On rents, the shift in landlord response has been more dramatic. There has been a substantial increase in the proportion of landlords who will either hold rents or reduce them over the next twelve months. The motivations for taking this decision are reflected in the responses to our survey – concerns about the direction of the future economy and a growing concern about property market conditions are now much more frequently cited than they were twelve months ago..

Sentiment

Landlords who have been looking for new tenants are asked whether they had noticed demand increase or decrease. The difference gives a crude assessment of net sentiment. It is a measure of sentiment as this is very much a perception-based, rather than transactional, measure.

Nationally, landlords have seen demand for rental properties increase. In London however net sentiment is well below the national figure. This again reflects the current difficulties in the capital city’s private rented sector.

The next twelve months

The bottom stylised chart shows the recent pattern of buy vs sell intentions over the next twelve months. The proportion of landlords stating an intention to sell has increased by about 20% since the previous quarter. The gap between prospective buyers and prospective sellers has widened this quarter after having narrowed earlier in the year.

The results of this confidence index indicate that recent changes in Stamp Duty Land Tax have not resulted in current landlords deciding to purchase more property and expand their portfolios. Rather, they are more likely to see an opportunity to sell and take advantage of lower costs for potential purchasers.