Welcome to the Investor's Hub your all-in-one platform for growing a successful property portfolio.

Created in partnership with the NRLA and GetGround, the Investor’s Hub offers expert guides, legal insights, investment strategies, and tools for UK landlords and property investors. Whether you're starting out or scaling up, access everything you need to manage, grow, and streamline your property business, all in one place.

Let us help you take your property investment to the next level!

Essential investment tools for landlords

To make the most of their rental properties, landlords need reliable investment tools. Financial tracking and budgeting systems help monitor income, expenses, and cash flow, making it easier to evaluate performance and plan for growth. Market research tools offer insights into local rental trends, vacancy rates, and property values, helping landlords make informed decisions about pricing and acquisitions. Legal and tax resources are also essential for staying compliant and maximizing returns.

Market Analysis Tools

Wealth Management

Buy-to-let Market Index

Growing your property portfolio?

NRLA Mortgages can support portfolio landlords with re-financing their property business. Find out more by viewing the flipbook for more information.

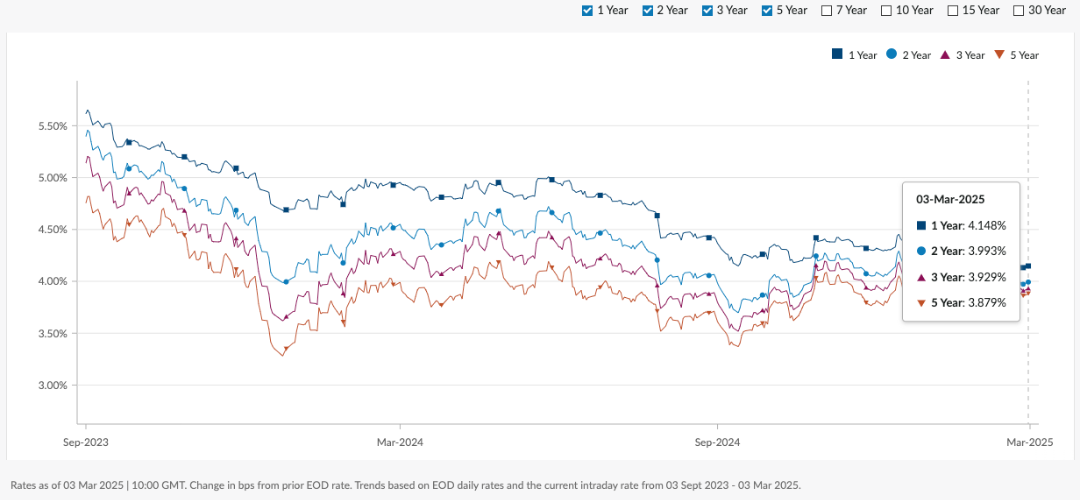

Since 2022, the financial phrase “Swap Rate” has become a popular phrase amongst landlords, homeowners, lenders as well as various media outlets.

When it comes to mortgages, swap rates are what lenders pay to financial institutions to obtain fixed funding for a set period. A lender will then add a margin, to cover their expected profit and running costs, to then launch a product or several products to market. When calculating the product rate, the lender will also take other factors into consideration, including their service levels, expected business levels, risk involved and overall market conditions.

Swap rate movements are often linked to overall economic stability, rather than directly linked to bank base rate changes. The swap rate is the average market view of where interest rates will be, over the duration of the swap period.

The below chart details SONIA Swap Rates courtesy of Chatham Financial. SONIA (Sterling Overnight Index Average) is an interest rate benchmark.

Must-have guides for portfolio landlords

Managing multiple properties requires a strategic approach, and the right guides can make all the difference. Portfolio landlords benefit from in-depth resources on scaling operations, optimizing cash flow, and diversifying property types. Guides on tax planning, financing options, and risk management help protect assets and boost long-term returns. Local market insights and compliance checklists also ensure informed, efficient decision-making across all properties. With the right knowledge, portfolio landlords can stay ahead and grow with confidence.

Advanced training for professional landlords

For seasoned landlords managing multiple units or portfolios, advanced training courses offer valuable insights into strategic growth, risk mitigation, and regulatory compliance. Topics often include advanced tax strategies, portfolio financing, asset protection, and evolving landlord-tenant laws. These courses help professionals stay current, streamline operations, and scale their investments with confidence in an increasingly complex rental market.

Tax and Finance

Property Investment

Compliance

Articles and Content

How to kickstart your plans to own property overseas

NRLA partner Smart Currency Exchange share a guide on how to get started with investing in overseas property.

Buy to Let Market Update: June 2023

Welcome to 'Buy to Let Market', a column aimed at providing you with recent criteria and product updates within the Buy to Let lending markets written by Doug Hall of NRLA Mortgages.

Planning on selling properties? How you can get on top of Capital Gains Tax

When it comes to selling some of your buy-to-lets, this year’s change to the Capital Gains Tax, or CGT allowance, has hit residential landlords hard. And there’ll be more changes to come in 2024. But you do have options to help reduce your tax bill. As an NRLA partner, St. James’s Place can help you manage your CGT tax liability. Which could save you thousands of pounds.

New poll by Tenancy Deposit Scheme reveals common pest issues faced by landlords

A recent poll conducted by the Tenancy Deposit Scheme has shed light on the most common pest-related problems experienced by landlords, tenants, and agents. Here, TDS share the key findings and a new guide for landlords, which provides an in-depth look at the issue of pest infestations.

Rentguard's guide to periodic inspections

Your responsibilities as a landlord go beyond checking tenants in and out at the start and end of their agreements. To keep your property in good order throughout the course of the tenancy, and to ensure that your tenants are happy and safe in the property, it is important to carry out periodic inspections. In this guide, NRLA partner Rentguard explain what you need to know about periodic inspections.