The complete guide to preventing burst pipes in your rental property

Even though we've left the coldest months behind us, many households still worry about rising heating bills, and some tenants may be tempted to use the heating more sporadically. But although they may think they’re saving money by switching the heating on and off, this can actually increase the risk of burst pipes. And the last thing you and your tenants want is the inconvenience and expense of frozen or burst pipes as temperatures fall.

Frozen and burst pipes can cause devastating damage to property, leading to flooding and mould, destroying valued possessions, and potentially leaving people without water and forcing them out of their homes.

Recent figures from the British Association of Insurers show that the average cost of weather related home insurance claims for burst pipes was £9,300. And a severe snap of cold weather can lead to a surge in claims – when the ‘Beast from the East’ hit in 2018 it led to a tenfold increase in pipe claims compared to the previous year.

‘Escape of water’ - for example a burst pipe, is consistently the most common reason why landlords make an insurance claim across the UK. ‘Escape of water’ refers to water damage arising from within the property such as leaking pipes or fixed water tanks, baths, sinks or toilets, or a leaking dishwasher or washing machine.

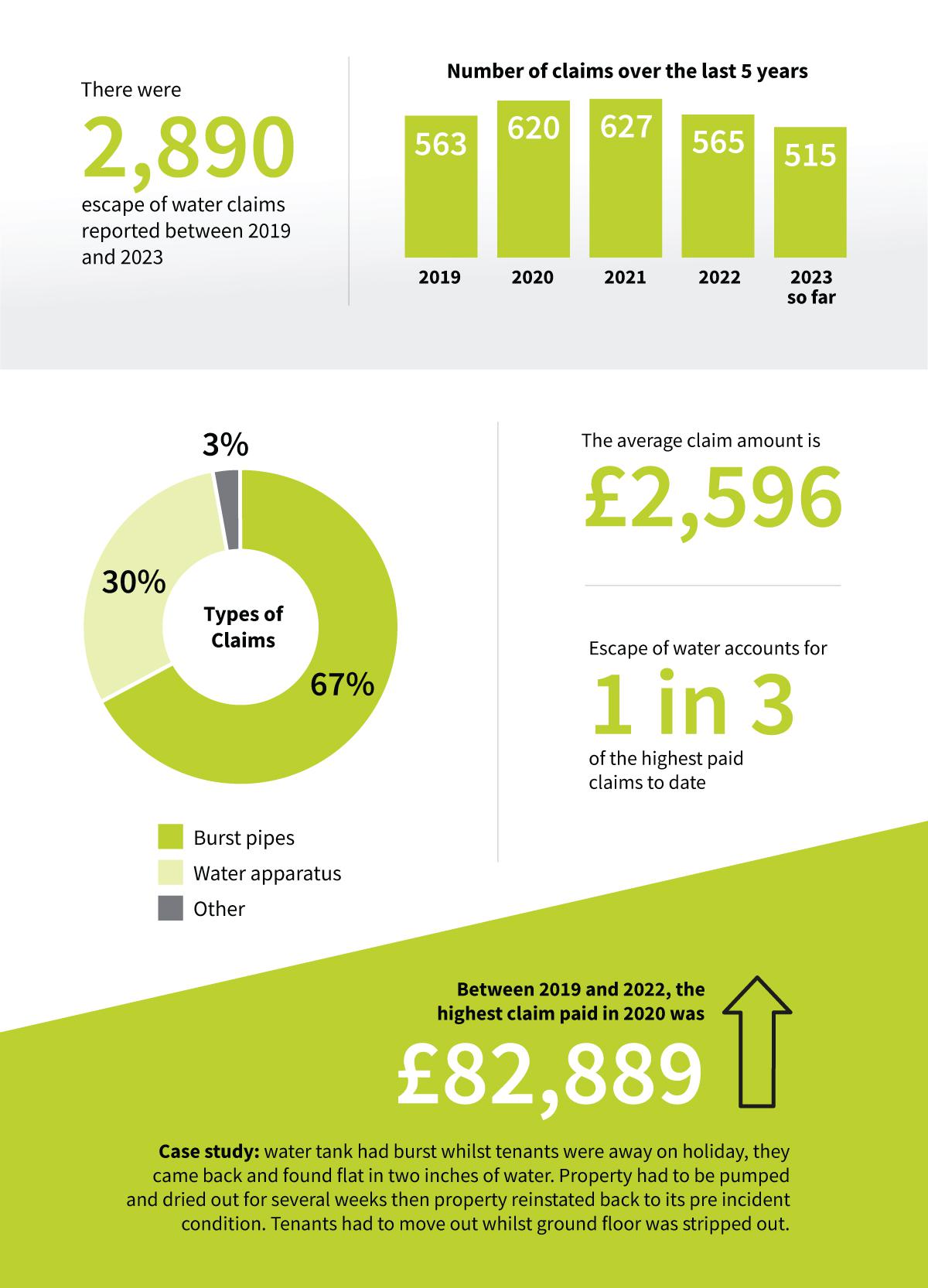

It does not refer to flooding which comes from an external source such as a burst water main, a river or the sea. Over a third of claims paid out by NRLA property insurance partner, Total Landlord, between 2019 and 2023, were for escape of water.

And of these, 67% have been down to a burst pipe – one in three of all claims and the most common claim received by Total Landlord in a decade.

What are the insurance payouts for burst pipes?

Damage caused by burst pipes is expensive and time-consuming to fix. But what is the cost of burst pipes in insurance terms? At Total Landlord, escape of water claims are the third highest paid out type of claim to date, with the average claim between 2019 and 2023 coming in at £2,596. But some individual claims have reached staggering heights - for example, a slow leak underneath a bath which rotted most of the flooring in one landlord’s property, resulted in a payout of £145,855 in 2018. Claims for burst pipes are consistently amongst the highest. What’s more, they are often due to factors outside of the landlord’s control. For example, some of the highest payouts in the last five years were for burst water mains in the road, which flooded the insured’s property, resulting in claims in excess of £100,000.

The highest claim Total Landlord has settled in the last three years was in 2020, when a water tank burst while tenants were away on holiday. They came back to find the flat in two inches of water, which meant that the property had to be pumped and dried out for several weeks before it could be restored to its pre-incident condition, with the tenants having to move out while the ground floor was stripped out. The claim was settled at an eyewatering £82,889.

Despite landlords’ best efforts to protect their property, sometimes claims are inevitable, which is why landlord insurance is a must. But what can landlords do to prevent burst pipes in their property and avoid the hassle of having to make a claim, not to mention the disruption and damage that results from a burst pipe? Here, we’ll consider the consequences and causes of a burst pipe, offer our tips for preventing burst pipes in your home and advise you what to do if the worst happens.

What are the consequences of a burst pipe?

We’ve mentioned that burst pipes can cause damage and disruption not only to your property, but also to your tenants and potentially to neighbouring properties too if a pipe has burst in the main system. Some of the possible consequences of burst pipes include:

- Inconvenience and disruption for landlords, tenants and neighbours due to damage and repair work, loss of water supply and potentially relocation of tenants

- Damage to fixtures, fittings, furniture and appliances in both the rental property and any other properties affected

- Structural and cosmetic damage to both the rental and potentially other properties too

- Loss of rental income due to the property being vacant while repairs are carried out

If left unchecked, even a small pipe fracture can release huge volumes of water, leading to expensive insurance claims and repair bills in the thousands of pounds for water damage to buildings, contents and drying out.

What are the causes of burst pipes?

Several factors can cause burst pipes, but most commonly they are caused by freezing temperatures and unprotected piping, which is prone to freezing, causing water inside to expand, bursting the pipe.

Water coming into the property from outside is much colder during the winter months than it is during the rest of the year. This can cause the pipes to contract, which sometimes leads to leaks where the pipe has weakened over time. Not surprisingly, escape of water claims increase during the winter months, when pipes freeze and begin to leak or burst.

However, Total Landlord claims statistics also show a rise in a similar plumbing problem in the summer, after a dip in spring. While water expands when frozen, metal expands in heat. This means that heat from the summer sun can expand pipes beyond capacity – causing a fracture.

The most common causes of burst pipes are:

- Water freezing in pipes during cold weather

- Pipes expanding and cracking during hot weather

- Increased water pressure due to a blockage in the water system

- Wear and tear

- Ageing pipes

Sometimes pipes burst due to factors outside a landlord’s control - for example when a burst water main floods properties in the area. Water companies keep up to date maps of sewers and water mains for which they are responsible. Most but not all pipes within an individual property boundary are the property owner’s responsibility to maintain – you can find out more about responsibility for pipes here.

Top tips to prevent burst pipes in your rental property

Prevention is better than cure when it comes to burst pipes. It’s important to take steps to prepare your pipes for cold weather and carry out routine maintenance, as well as educating your tenants. This will all help to lower your risk.

Preparation and maintenance to reduce the risk of burst pipes

- Lag internal pipes located in colder areas of your property such as the loft, the garage and the basement

- Lag outside pipes such as drainpipes and overflow pipes to insulate them against frost using foam sleeving, remembering to cover bends, valves and fittings, and not forgetting to fit insulated tap covers over outside taps

- Insulate water storage tanks to prevent them from freezing, taking care not to place loft insulation directly under heater tanks as this will stop heat rising from below

- Identify and seal any air leaks that are allowing cold air to enter your property where pipes are located. These are likely to be found around electrical wiring, dryer vents and pipes

- Replace the washers on any dripping taps as they can cause your drains to freeze and water to back up to your sink and overflow

- Isolate the water supply to any outside taps with an internal shut-off

- Service your boiler and central heating system every 12 months before winter to prevent breakdowns during cold spells, and make sure you arrange an annual gas safety check

- Carry out routine maintenance on your water pump and bathroom fixtures so that you can locate any blockages or problems early

It’s also a good idea to take extra precautions to reduce the risk of burst pipes if a property is empty, particularly during the winter months. Many insurance providers require landlords to take specific steps if their property is unoccupied for over 30 days. Total Landlord stipulates that between 1 November and 31 March, where a property is left without a tenant for between 30 and 90 consecutive days, either:

- The water supply be switched off at the mains and the entire water system and central heating system be drained of all water

Or

- Where the entire private dwelling has the benefit of a central heating system it is set to operate continuously for 24 hours of each day and the thermostat set at not less than 13°C /55°F

- Where fitted the loft hatch door is left open

Tips for tenants to reduce the risk of burst pipes

It’s in your tenants’ interests to take care of your property. Be sure to share the following tips with them when they move in and during cold spells, to help reduce the risks of a burst pipe in your rental property:

- Turn off the water mains at the stopcock if they are going away

- Keep the heating on at a minimum temperature of 13°C when they are away, as this will prevent temperatures dropping below freezing in any areas of the property where water pipes are located

- Leave cupboard doors under the kitchen sink and bathroom cabinets open to allow warm air to circulate

- Keep one or two taps running slowly for some time each day if it is extremely cold outside. Water moving through the system should prevent freezing and a build-up of pressure

- Encourage them to contact you immediately if they spot any issues such as a leak or a blocked toilet

It’s important to make sure your tenants know where the stopcock is located in case they need to turn the water supply off. The area around the stopcock should be kept clear for easy access in an emergency. You should also provide your tenants with the details of an emergency plumber. This information could be shared in a welcome pack when they move in, along with the tenancy agreement.

Steve Barnes, Head of Broking at Total Landlord, adds:

“Carrying out regular maintenance and repairs, particularly in preparation for the colder winter months, is key to being a responsible landlord and preventing burst pipes. But it’s just as important to communicate with your tenants to make sure they know what to do to reduce the risks and that they let you know immediately if they spot any problems. Most landlord insurance policies, including ours, require tenants to inform their landlord if the property is going to be vacant for an extended period and you should make sure this is indicated in the tenancy agreement. It’s also a good idea to include a clause which advises tenants of their responsibility to either leave the heating on a constant setting at a minimum of 13°C, or to have the system fully drained if the property is to be left unoccupied.”

Untitled Section

What should you do if a pipe bursts in your rental property?

It’s important that you and your tenants know what to do if the worst happens. This can help reduce the spread of water and subsequent damage, as well as the size of your claim.

In case of a burst pipe, make sure your tenants know that they should contact you immediately and follow these steps:

- Turn off the water mains at the stopcock to reduce the pressure

- Turn on all the cold taps to drain the system if the flow of water cannot be stopped and relieve any remaining water pressure in the pipes once the water has been shut off at the mains

- If there is a risk of water reaching electrical equipment, turn off the electricity at the fuse box. DO NOT touch anything electrical

- Move any furniture and belongings away from the affected area

- Clear away the excess water as soon as possible to minimise damage

- Blow heat into cold areas by setting up fans, leaving doors open so that the warm air can reach pipes under sinks and in cupboards

- Call a plumber

Once you’ve taken these immediate steps to mitigate the situation, if you need to make a claim it’s important to collect evidence, taking lots of photos of the damage, and to notify your insurers at the earliest opportunity.

As the leading cause of insurance claims in the UK, escape of water is not something that should be taken lightly. Preparation is key to minimising the likelihood of pipes bursting but communication with tenants is also vital to limiting the extent of any damage if the worst happens. Make sure you and your tenants are clear on what to do in an emergency and that both your responsibilities are included in the tenancy agreement.

Having comprehensive landlord insurance in place provides peace of mind that you are protected if your rental property is damaged by a burst pipe. NRLA property insurance partner, Total Landlord, will not only cover the cost of repair work, but also loss of rent while the property is repaired, or alternative accommodation.