What are the most common risks landlords face?

As a landlord, there are a wide range of risks that you might face, whether that’s unreliable tenants, the rising costs associated with rental properties, or maintenance issues and damage within your property.

Because of this, protecting your property from financial risks can be vital for managing a smooth and successful rental business. Understanding what to look out for and having suitable landlord insurance can help.

As such, we’ve summarised what can be the most common causes of damage encountered by landlords, as well as tips to avoid them.

Landlord insurance can cover a range of risks, including these most common causes of damage. Landlords should always check their policy documents to be sure of the cover their insurance provides, as well as any conditions and exclusions.

When it comes to your insurance, what is being covered can also depend on whether you have buildings cover, contents cover, or both.

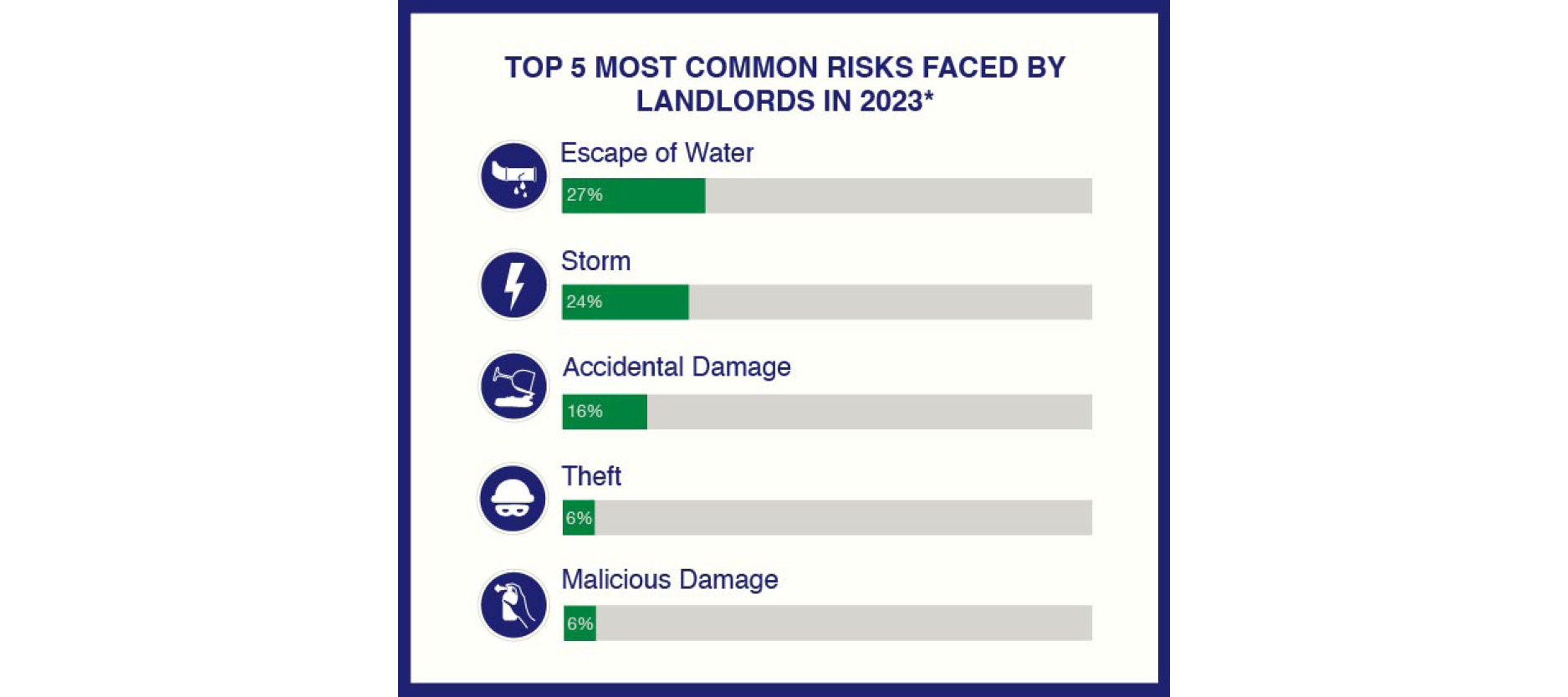

The top 5 most common risks faced by landlords

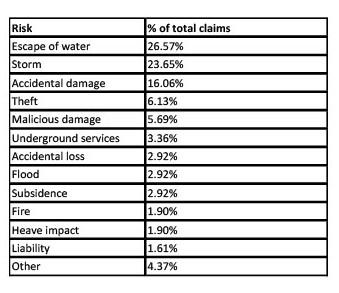

Looking at landlord insurance claims data from insurer Tokio Marine HCC, the top 5 most common risks faced by landlords in 2023 were*:

1. Escape of water

The most common cause of landlord insurance claims was escape of water, amounting to over a quarter of total claims recorded in this data. Escape of water refers to water damage to your property that is caused by water escaping in the property itself, rather than from external sources like flooding or a leaky roof.

How can escape of water be prevented?

Let’s consider the possible causes of escape of water and how you could help prevent these. Burst pipes may occur due to freezing temperatures during winter, particularly if your pipes aren’t correctly lagged or the property is unoccupied and not drained down or heated sufficiently.

So, you might want to leave your central heating switched on (or advise that your tenants do so) to help prevent water pipes from freezing. It can also be advisable to turn off your water supply if your property is unoccupied during winter.

Check your landlord insurance policy for any clauses regarding factors such as unoccupied periods, heating, and lagging pipes.

Ensuring that your appliances are properly maintained and that your boiler is regularly serviced can also help to reduce this risk. Respond quickly to any issues your tenants make you aware of, such as dripping taps or a drop in water pressure, and encourage your tenants to communicate any issues promptly.

2. Storm damage

Close behind escape of water is storm damage, resulting in 24% of claims for this landlord insurance data. As well as water damage from heavy rain, storms may also cause damage due to strong winds hitting your property or resulting in fallen trees or flying debris that could hit your property.

Any external parts of your property could also be at risk during storms, such as garden furniture, fencing, guttering, and garages or garden sheds. Roofs could also be at risk as tiles may become damaged by wind, and a damaged roof could lead to rainwater leaking inside.

How can storm damage be prevented?

You can’t control the weather, but there may be some precautions that can help your property withstand storms better. Periodic inspections can help to make sure the property is in good condition or if any maintenance is required.

For example, you can check the roof for any loose or damaged tiles, check that guttering is clear and secure, and that the weather stripping around doors and windows is intact. Check that your pipes are in good condition, particularly any external pipes, and consider adding insulation if needed to help prevent them from freezing in case of snowstorms.

Be sure to check your insurance policy wording to find out exactly what is covered in the event of a storm.

It can be a good idea to prepare your property in these ways in general, but particularly you may want to prepare ahead of winter when weather can be more severe. If specific weather warnings have been given, there may be some short-term preparations you can make, such as asking tenants to bring garden furniture inside and placing sandbags around the property to help prevent flooding.

3. Accidental damage

Accidental damage to rental properties comes in third place as the reason for 16% of claims. This refers to any damage suddenly and unintentionally caused by either the landlord, tenant, or a third party such as a friend visiting the tenant. For example, this may include a tenant spilling red wine on a carpet or a child accidentally kicking a ball through a window.

Accidental damage insurance does not typically cover wear and tear, as this occurs over time as a result of ordinary use. There are certain other circumstances that are usually not covered as accidental damage, including damage to the tenant’s belongings and damage as a result of poor maintenance or faulty workmanship.

How can accidental damage be prevented?

You may not be able to predict or prevent accidents, but having suitable accidental damage cover in place can help to give you peace of mind. Similarly, fully vetting and acquiring references for tenants can help to ensure you entrust your property to reliable and sensible people. Try to establish a good relationship with tenants and communicate openly with each other. This may encourage them to take better care of the property and to promptly inform you if any accidental damage does occur.

Keeping in mind that accidental damage insurance may not cover poor maintenance or faulty workmanship, it can also be important to stay on top of all maintenance and servicing duties and to not cut corners or choose the cheapest options when renovating, repairing or maintaining the property. A comprehensive inventory can also help you in the event you need to make a claim for accidental damage.

4. Theft

Theft is the next highest risk at 6%. In particular, this refers to theft by an outside party, whereas theft by tenants would be considered a separate risk by many insurers.

Theft can refer to anyone permanently removing items that do not belong to them from the property without permission. This could be technology, furniture, appliances or even the pipes from your plumbing. Check that your landlord buildings and contents insurance covers theft, and you may also want to encourage your tenants to have their contents insured, too.

Your landlord insurance policy wording may require you to report theft to the police immediately, often within 24 hours of discovery.

How can theft be prevented?

Properly securing your property can be an effective way to help prevent theft from external parties. Ensure that all doors and windows have functioning locks fitted, and inform your tenants of the importance of keeping these locked. A security system such as a burglar alarm and visible security cameras outside the property can also help to deter thieves.

Tenants may want to leave a spare key outside in case they ever get locked out or a friend or partner wants to get in. You may want to consider encouraging tenants to avoid doing this, as intruders could also find the key. If there are no signs of forced entry, this could also invalidate an insurance claim for theft. You could also suggest that they keep valuables away from windows and out of view and keep curtains or blinds closed at night to help prevent people from seeing in.

To help prevent theft by tenants, similar to the previous category, it is important to fully vet and reference potential tenants to give you peace of mind about their overall trustworthiness. Again, a comprehensive inventory reviewed and signed by the tenants will let them know that missing items wouldn’t go unnoticed at the end of their tenancy.

5. Malicious damage

As opposed to accidental damage, malicious damage refers to any damage that is caused intentionally. Malicious damage also accounted for 6% of claims in this landlord insurance data from 2023.

Malicious damage may include smashing windows, breaking in doors, graffiti, and intentionally damaging furniture or appliances. Like with theft, if you suspect any damage to your property was done with intent, landlord insurance policies can require you to report this to the police immediately, often within 24 hours of discovery.

Check your landlord insurance policy to determine whether it covers malicious damage by tenants or only damage by those not legally allowed to enter the property.

How can malicious damage be prevented?

Similar to the prevention of theft, installing sufficient security measures such as security cameras, a burglar alarm and motion sensor outdoor lights can help to protect your property from malicious damage. While fully vetting potential tenants and building a good relationship with your tenants can help reduce the likelihood of them causing malicious damage .

It is also typical to take a security deposit, ensure that you protect it properly, and inform your tenants that compensation for any intentional damage caused by them could be deducted from this deposit at the end of the tenancy.

Landlord Insurance from Rentguard

With vast experience handling insurance policies for a wide range of landlords, and with relationships with a number of leading insurers, Rentguard Insurance aims to simplify your insurance arrangements and help to protect your property, its contents, and your liabilities.

What are the most common risks landlords face?

Or speak to our specialist team on 0333 000 0169.

The sole purpose of this article is to provide information on the issues covered. This article is not intended to give legal advice, and, accordingly, it should not be relied upon. It should not be regarded as a comprehensive statement of the law and/or market practice in this area. We make no claims as to the completeness or accuracy of the information contained herein or in the links which were live at the date of publication. You should not act upon (or should refrain from acting upon) information in this publication without first seeking specific legal and/or specialist advice. Arthur J. Gallagher Insurance Brokers Limited trading as Rentguard and National Residential Landlords Association, an Introducer Appointed Representative of Arthur J. Gallagher Insurance Brokers Limited, accepts no liability for any inaccuracy, omission or mistake in this publication, nor will we be responsible for any loss which may be suffered as a result of any person relying on the information contained herein.

*Claims data for the period 01/01/2023 - 30/11/2023 from Tokio Marine HCC’s Landlord Insurance product, provided by Vasek Insurance, a trading name of Arthur J. Gallagher Insurance Brokers Limited.

These risks are covered by insurer Tokio Marine HCC’s Landlord Insurance policy. Please refer to your own insurer’s policy wording for a list of covers and exclusions.