The complete fire safety guide for landlords

A fire in your property can cause devastating damage, leaving your home uninhabitable in a matter of minutes and resulting in costly, time-consuming repairs and lost rental income.

More importantly, a fire can put your tenants’ lives in danger. The risks are particularly high in properties that house multiple, unrelated tenants, such as student lets, which is why the fire safety rules are much tighter for HMOs than single lets.

In fact, the risks of experiencing a fire are seven times higher for people who live in rented or shared accommodation, according to fire safety experts, Firemark.

Fire safety should be a priority throughout the year, but as we approach the festive season it’s important to be particularly vigilant. Every year, firefighters warn of a spike in house fires caused by increased use of heating and electrical appliances.

Alcohol consumption combined with candles, Christmas trees, fairy lights and decorations can also play a part.

Read Total Landlord’s NRLA guide to protecting your property from electrical hazards for more detailed advice.

Causes of fire

There are many causes of fires in a property. Total Landlord has received claims for fires caused by a range of hazards, including candles, faulty or unattended appliances, overuse of extension leads, cigarettes, deep fat fryers and portable heaters.

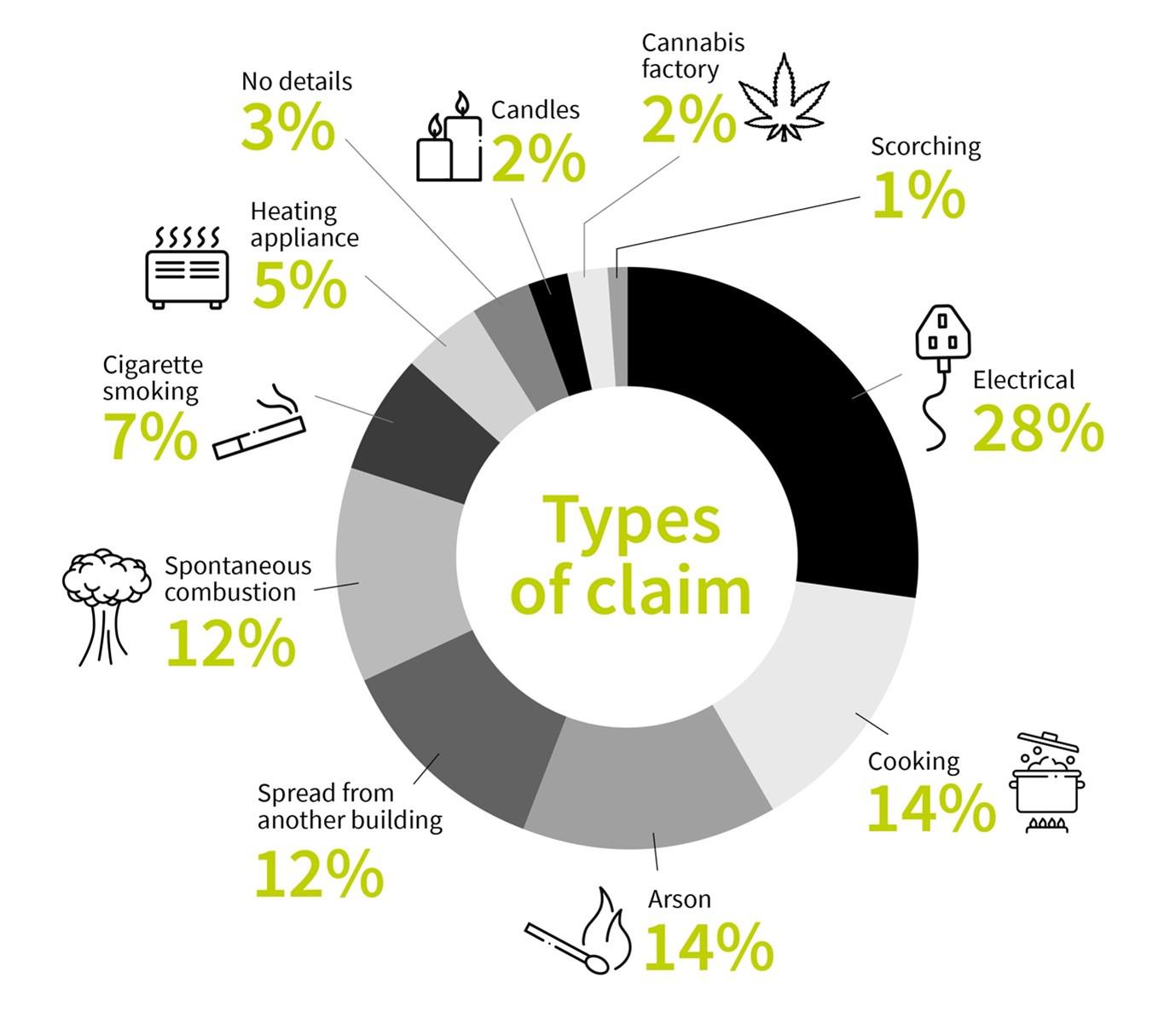

Our most reported reason for a fire claim in the five year period up to November 2023 was electrical causes, which accounted for 28% of all fire claims, followed by cooking and arson, both of which accounted for 14%.

Although fires in dwellings have been steadily decreasing over the years, fire and rescue incident statistics for England for the year ending March 2023 show that the fire and rescue services still attended 26,822 primary dwelling fires in England.

The greatest proportion of these - 37% - were caused by accident due to misuse of equipment or apparatus, followed by placing articles too close to heat and faulty appliances (both 11%). Alarmingly, over 10% of fires in England in 2022-23 were caused deliberately.

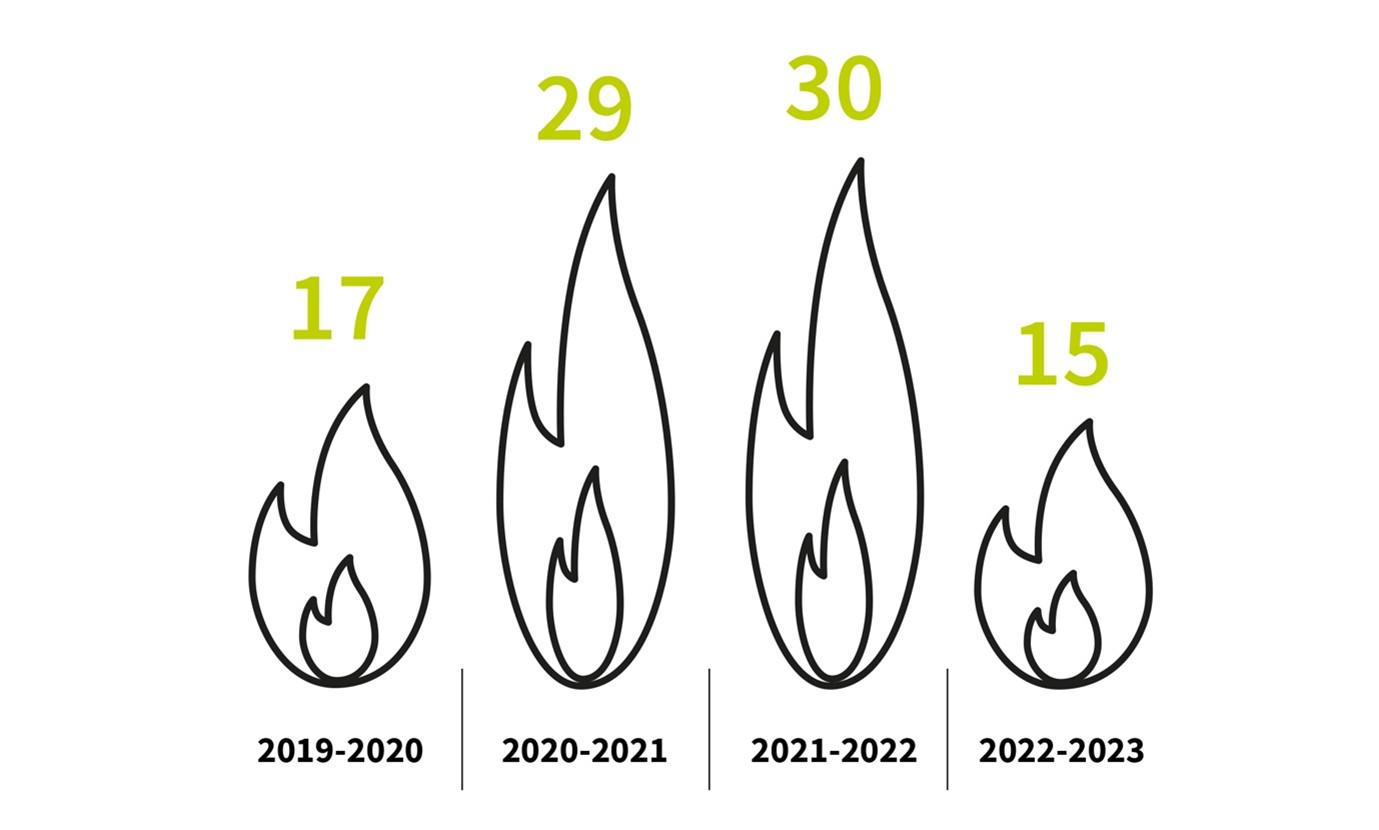

Fire damage claims are among the highest that insurers receive. While fire claims are only the seventh most common claim type at Total Landlord over the last five years to November 2023, they were the highest paid peril.

The average claim for fire paid by Total Landlord during this period was over £26,552 and the highest claim paid out was for a staggering £360,200. Over the 2019-2023 period, 91 fire claims totalling £2,416,256 have been paid to date, with a current reserve of £268.998.

At the time of writing, 14 claims remain open while 77 have been finalised and closed.

How to reduce the risks of fire

While accidents unfortunately do happen, there are practical steps both landlords and tenants can take to prevent a fire from starting and spreading. More importantly, there are fire safety regulations that apply to the private rented sector that landlords need to comply with.

Landlords’ fire safety responsibilities

Landlords are legally required to take a number of safety precautions to protect their property and their tenants. As a bare minimum, landlords must:

• Provide a smoke alarm on each storey and a carbon monoxide alarm in any room with a solid fuel burning appliance (for example a coal fire or wood burning stove)

• Check tenants have access to escape routes at all times

• Make sure the furniture and furnishings supplied are fire safe

• Provide fire alarms and extinguishers if the property is a large house in multiple occupation (HMO)

Here, we break down in more detail landlords’ legal responsibilities when it comes to reducing the risks of fire.

1. Smoke and carbon monoxide alarms

The most common cause of death for fire related fatalities (where the cause of death was known), in the year ending March 2023, was due to being overcome by gas or smoke, given in 32% of fire related fatalities. Working smoke alarms save lives. Landlords are required by law to have at least one working smoke alarm installed on every floor of their rental properties and a carbon monoxide alarm in any room containing a solid fuel burning appliance. Landlords must also make sure alarms are in working order at the start of each new tenancy and should encourage tenants to continue to check alarms on a monthly basis. It’s also a good idea to inspect smoke and carbon monoxide alarms when carrying out routine property inspections.

Since the rules were changed in October 2022, landlords must also make sure smoke and carbon monoxide alarms are repaired or replaced once informed and found they are faulty. GOV.UK provides a useful booklet on smoke and carbon monoxide alarms for landlords with all the latest legislation updates.

In addition to the legal requirements, the London Fire Brigade strongly recommends an additional heat detector in the kitchen, and a smoke alarm in the lounge and hallway of individual flats and houses to give early warning to residents.

2. Access to escape routes

Landlords are legally responsible for making sure tenants have access to a safe and reliable escape route at all times. Escape routes can be external, such as stairways fixed to the sides of buildings, or internal. To make sure they can be used if there is a fire, escape routes need to have emergency lighting, and floors and walls should be made of fire-resistant materials.

They should also be accessible from every floor and every room in the property to avoid tenants becoming trapped, and tenants should be made aware of what to do in an emergency to make sure they can exit the property as quickly as possible.

There are more stringent rules for HMOs, which can be large and harder to get out of. More complex rental properties should be assessed by a person who has comprehensive training or experience in fire risk assessment.

3. Fire-safe furniture and furnishings

Landlords must make sure that any furniture and furnishings provided meet fire safety standards and are made from fire-resistant materials. This information can usually be found by checking that the manufacturer’s label carries a fire-safety symbol.

The only items that don’t have to meet these standards are mattresses, bed-bases, pillows, cushions and bed covers, but of course it is best to go above and beyond minimum requirements and do all you can to make sure that you are meeting high safety standards.

Landlords are not responsible for tenant-owned furniture and appliances – everything the tenant brings inside the property is their own responsibility.

4. Fire extinguishers and blankets

Fire extinguishers are only obligatory in large HMOs, according to government guidance. However, it is best to check with your local authority what the specific rules are in your area as these can vary.

The body which co-ordinates local authority regulators, LACORS, provides fire safety guidance which emphasises that, although fire extinguishers can be useful in tackling small fires and limiting their spread in their early stages, it is best to evacuate the building and call the fire and rescue service.

LACORS does not recommend supplying fire extinguishers unless there are resident staff who are trained in their use, as they can lead to problems if they’re not properly maintained or where they are discharged through malice. In HMOs and buildings containing flats, LACORS recommends one simple multi-purpose extinguisher on each floor in the common parts.

Basic advice should be offered to tenants on how to use them at the start of the tenancy and extinguishers should be checked at the start of each tenancy and rechecked periodically during inspections. Fire blankets are recommended as good practice in kitchens in all premises.

5. Fire risk assessment

Periodical fire risk assessments are a legal requirement for many rental properties and best practice in all. They identify possible causes of fires, highlighting potential hazards and the precautions the landlord should take to reduce the likelihood of a fire.

It is a good idea to review the risk assessment every two years and update it every four years.

For older buildings or those over three storeys, the risk assessment should be reviewed annually and updated every three years.

There is no mandatory method of fire risk assessment, but it’s worth noting that most fire and rescue services offer free home visits as part of their ‘Safe and Well’ initiative to identify potential fire risks within the home.

This includes knowing what to do in order to reduce or prevent the risk of fire, making sure working smoke alarms are present and putting together an escape plan in case a fire does break out.

New rules came into force from 1 October 2023 making a fire risk assessment a legal requirement if you are responsible for a building that isn’t a single private dwelling. Find out more and check your fire safety responsibilities on GOV.UK.

What to do if there’s a fire in your property

6. Fire doors

Currently only HMOs are legally required to have fire doors. It’s important to check out your legal obligations for the installation, siting and operation of fire doors if you operate any HMOs.

From 23 January 2023, under The Fire Safety (England) Regulations 2022, there’s a new requirement for the responsible person to undertake annual checks of flat entrance doors and quarterly checks of all fire doors in common parts, where the residential building is more than 11 metres in height (more on this below).

Fire doors are very effective at containing fires once they break out, delaying the spread of both fire and toxic smoke, minimising damage and giving tenants more time to get to safety.

Since many fires start in the kitchen, it is worth considering fitting one in the kitchens of other rental properties as an extra precaution beyond minimum legal requirements. It’s also important to advise tenants on how to make sure fire doors are working as intended, for example by reminding them not to prop them open.

7. Electrical safety inspection

Landlords are responsible for making sure that electrical wiring, sockets and fuse boxes are safe throughout the tenancy. New regulations announced in January 2019 brought all rental properties in line with legislation that already applied to HMOs. These regulations require landlords to have the electrical installations in their properties inspected and tested by a person who is qualified and competent, at least every five years.

Landlords have to provide a copy of the electrical safety report to their tenants, and to their local authority if requested.

The regulations came into force for new tenancies on 1 June 2020 and have applied to existing tenancies since 1 April 2021. While these measures are primarily designed to protect tenants, improvements to electrical safety should also lead to a reduction in electrical fire risk for landlords, Total Landlord’s most reported fire claim.

8. Portable appliance testing

Landlords should also check that any electrical appliances provided are in safe working order and have a British or European safety mark. Portable appliance testing (PAT) isn’t compulsory, but it is recommended if electrical appliances of any kind are provided in the rental property. The majority of accidental domestic fires in the UK are caused by electricity and most of these by electrical products, often in the kitchen, for example by cooking appliances and white goods, so it’s worth paying particular attention to these.

It is a good idea to use a licensed PAT specialist to help with larger properties such as HMOs, where it is likely that more electrical appliances will be provided, increasing the risk of something going wrong.

It’s also important that landlords warn tenants about the hazards of using extension leads to overload sockets and that sufficient sockets are provided in each room to prevent this from happening.

9. Gas safety check

Landlords are required by law to make sure any gas equipment they supply is safely installed and maintained by a Gas Safe registered engineer and that they have a registered engineer do an annual gas safety check on each appliance and flue. Landlords must also provide their tenants with a copy of the gas safety check record before they move in, or within 28 days of the check. This is a legal requirement and each individual certificate has to be renewed every year. Gas safety isn’t just about complying with the law, it’s ultimately about tenant safety. Gas is volatile and highly flammable, and if it leaks, it can cause an explosion or fire. Gas safety checks will also check for the presence of carbon monoxide, which is poisonous and can be deadly.

10. Banning smoking indoors

There are already restrictions in place around where tenants can and can’t smoke in HMOs, for example in shared areas. But although it is not against the law for tenants to smoke in rental properties, landlords can include a clause in the tenancy agreement stating that smoking is not permitted.

A significant proportion of accidental house fires are caused by cigarettes. In the last five years, seven per cent of Total Landlord’s claims were for fires caused by cigarette smoking. Banning smoking indoors also reduces the likelihood of burns to floors, carpets and surfaces.

Fire safety for HMO landlords

Regulations are particularly stringent around HMOs, so if you’re an HMO landlord, it’s important to contact your local council to understand the specific regulations that apply if you’re letting an HMO.

New rules came into force in January 2023 in response to the recommendations made by the Grenfell Tower Inquiry.

The Fire Safety (England) Regulations apply to responsible persons in high rise residential buildings, and impose duties on you if you are the responsible person for any building which contains two or more sets of domestic premises and / or contains common parts through which residents would need to evacuate in the case of an emergency.

Fire Safety (England) Regulations 2022

The Fire Safety (England) Regulations 2022 introduce new duties under the Fire Safety Order for building owners or managers (responsible persons).

For high-rise residential buildings (a multi-occupied residential building at least 18 metres in height or seven or more storeys), responsible persons must:

- Share electronically with their local fire and rescue service information about the building’s external wall system and provide the fire and rescue service with electronic copies of floor plans and building plans for the building

- Keep hard copies of the building’s floor plans, in addition to a single page orientation plan of the building, and the name and UK contact details of the responsible person in a secure information box which is accessible by firefighters

- Install wayfinding signage in all high-rise buildings which is visible in low light conditions

- Establish a minimum of monthly checks on lifts which are for the use of firefighters in high-rise residential buildings and on essential pieces of firefighting equipment

- Inform the fire and rescue service if a lift used by firefighters or one of the pieces of firefighting equipment is out of order for longer than 24 hours

For multi-occupied residential buildings over 11 metres in height, responsible persons must:

Undertake quarterly checks on all communal fire doors and annual checks on flat entrance doors

In all multi-occupied residential buildings, responsible persons must:

- Provide residents with relevant fire safety instructions and information about the importance of fire doors

- The Fire Safety Act clarified the scope of the Fire Safety Order to make clear it applies to the structure, external walls (including cladding and balconies) and individual flat entrance doors between domestic premises and the common parts.

For more information, particularly about high-rise blocks of flats, here is comprehensive government guidance on the 2022 Regulations.

Tenants' fire safety responsibilites

Although landlords must make sure they meet their legal fire safety responsibilities and duty of care to their tenants, the responsibility for preventing fires in rented properties falls to tenants too.

Tenants need to make sure they are doing all they can to mitigate fire risks throughout the property. Good landlord and tenant communication can help facilitate this. For example, landlords should:

- Fully outline fire safety measures, such as the importance of carrying out regular (ideally monthly) smoke alarm tests and ask tenants to contact them without delay if they are worried about fire safety in the property

- Provide advice to prevent electrical fires – switch off and unplug appliances when not in use, don’t overload extension leads and plug sockets

- Remind tenants to take care when in the kitchen – remove pans from the heat if leaving the kitchen, keep tea towels and cloths away from the cooker and hob, clean the oven, hob and grill frequently as a build-up of grease can ignite a fire

- Ask tenants to keep Christmas cards and decorations away from heaters, fireplaces and candles and not to leave candles and open flames unattended

- Advise tenants to minimise the use of flammable substances and never to leave any near a heat source. Clothes dried near heaters cause thousands of house fires every year

- Make sure tenants know how to be prepared – agree a safe place to keep the window and door keys so that everyone can find them in case of an emergency, make sure everyone knows the escape route and have a second exit in the event a fire is blocking the first one

- Remind tenants to keep escape routes and exits free of obstructions and not to prop open fire doors

- Make sure tenants don’t store combustible objects near boilers or fuse boxes

Of course, in practice it can be hard to enforce some of these measures and tenants won’t always follow the rules.

What to do if there's a fire in your property

In the event of a fire, it’s vital to act quickly to save lives:

- Use a fire extinguisher or fire blankets to combat the fire if it is safe to do so

- Call the emergency services on 999 and ask for the fire brigade

- Make sure that the property is safe before allowing anyone to re-enter

- Take time-stamped photos if it is safe to do so

- Contact your insurers to notify them of the situation and begin the claims process. They will advise you on the next steps to take

The importance of insurance

It is vital to make sure you have landlord insurance in place to mitigate against fire risk. Cover won’t stop damage from being caused, but it will provide peace of mind that you will not be out of pocket for the cost of any repairs or rebuilds – and potentially the cost of lost rental income or temporarily rehousing tenants in the event of a deliberate arson attack or an accidental fire.

Steve Barnes, Head of Broking at Total Landlord, offers his advice:

“Prevention is always best when it comes to fire. Making sure you have working fire alarms that are regularly tested and showing tenants how to test them, is vital in the event of a fire.

"Unfortunately, we are seeing an increase in arson claims, so always thoroughly reference check tenants.

"Of course, despite doing all you can to protect your property from fire, accidents do happen and the costs of repairing fire damage can be very high. This is why landlords should make sure they have comprehensive landlord insurance cover in place.”

For any fire claim to be paid out, you’ll also need to make sure that you comply with relevant fire safety regulations. If you don’t keep up with the fire safety regulations and do all you can to reduce the likelihood of fire, you risk hefty fines or even a prison sentence.

More importantly, you are jeopardising the safety of your tenants and potentially risking their lives.

Is your rental property insured in the event of a fire? Find out more about Total Landlord Insurance.

For more information on claims, Total Landlord’s A to Z of Property Claims eBook is a practical guide, packed full of useful advice to help you understand more about claims, their causes and what your policy will and won’t cover.

Download your free copy in exchange for a landlord insurance quote.