The Impact of Unprotected Deposits on Evicting your Tenant and Serving a Section 21 Notice

At the NRLA we receive a lot of calls to our helpline from members who want to know the impact that an unprotected deposit can have on their tenancy, and particularly on evicting a tenant and serving a Section 21 notice.

This article will draw on the combined expertise of Suzy Hershman, Head of Dispute Resolution at mydeposits, and Paul Sowerbutts, Head of Legal at Landlord Action. It will explain the law around tenancy deposit protection and what constitutes a breach of tenancy deposit rules, and features example scenarios and case studies to illustrate how this can impact your ability to evict a tenant by serving a Section 21 notice. The article includes useful tips and comment from both Suzy and Paul to underline certain situations.

What is tenancy deposit protection?

While taking a tenancy deposit is not a legal requirement, tenancy deposit protection is designed to protect both the tenant’s money and the landlord’s property and can cover unpaid rent or damage caused to the property during a tenancy. Taking a deposit also gives the tenant an incentive to look after the property. But if you do choose to take a deposit, it is important to comply with the tenancy deposit protection rules.

Landlords and letting agents who rent properties on an assured shorthold tenancy (AST) in England or Wales (from December 2022 this will be an occupation contract in Wales), that started after 6 April 2007, are legally required to protect any tenancy deposits taken in a government authorised tenancy deposit scheme, within 30 days of receiving the deposit. mydeposits is the only scheme authorised to operate in England, Wales, Scotland, Northern Ireland and Jersey.

At the end of the tenancy, the tenant will then get the deposit back, so long as they have met all their deposit related responsibilities as laid out in their tenancy agreement, including not causing damage to the property and its contents, and paying all the rent.

What happens if a deposit is not protected?

If a deposit has not been protected in a government approved tenancy deposit protection scheme, the tenant can - at any time during or after the tenancy – take the landlord to court and claim compensation for failure to protect the deposit. The tenant will have to pay a court fee (currently £308), which can be claimed back from the landlord if they win their case. The tenant has the right to seek the deposit returned plus compensation.

It may be quicker and cheaper for everyone to reach a mutual agreement and avoid going through the courts, for example with the support of a mediation service such as the Property Redress Scheme’s tenancy mediation service.

If the tenant does go to court and wins the case, the court can order the landlord to either:

- repay the deposit to their tenants or;

- pay it into a custodial tenancy deposit protection scheme’s bank account within 14 days and / or

- pay the tenant up to three times the deposit amount within 14 days of the order

A court may also decide any Section 21 is invalid, which may leave the landlord unable to end the tenancy without, for example, serving a fresh Section 21 – see below.

What do landlords need to know to be compliant with deposit protection regulations?

The introduction of tenancy deposit protection in 2007 as part of the Housing Act 2004 represented a key turning point for the private rented sector, offering much needed security and protection to landlords, tenants and agents. However, despite having been around for 15 years now, there is still some confusion when it comes to what landlords need to know to be compliant with deposit protection regulations. To recap:

- Landlords should follow the process for both protecting deposits AND serving the prescribed information to the tenant or anyone who contributed to the deposit

- You must use a tenancy deposit protection scheme even if the deposit is paid by someone else, like a rent deposit scheme or a tenant’s parents

- You must be aware of the rules under the Tenant Fees Act 2019 when it comes to taking the deposit – for example that landlords in England are limited to five weeks’ rent (equivalent under £50,000) per year deposit for new and renewed tenancies (or six weeks if the annual rent is £50,000 or more), and that there are restrictions on the fees landlords and agents can charge to tenants

- To avoid issues, keep the deposit protected for the entire tenancy as it’s there to cover any breach of the tenancy agreement

- Make it clear to tenants that it is not to be used as the last month’s rent (this can be written into tenancy agreements)

- Be careful of agreeing to use any, or all of the deposit during the tenancy. While this will not make you non-compliant, it will mean there is nothing left to use for any breaches

Note: If you receive a valuable item as a deposit instead of money (for example a car or watch), you do not have to put it in a tenancy deposit protection scheme.

You can read more at https://www.gov.uk/deposit-protection-schemes-and-landlords

What is Section 21?

Most landlords will be familiar with Section 21, often referred to as a ‘no fault’ eviction – a notice served by a landlord to a tenant in order to regain possession of their property once an AST comes to an end, or during the periodic phase after an AST has ended. Currently landlords have the right to issue a Section 21 notice without reason, providing the tenancy has passed the fixed term and is within a periodic phase. Because it enables landlords to repossess their properties from tenants without having to establish fault on the part of the tenant, it is sometimes referred to as the ‘no-fault’ ground for eviction.

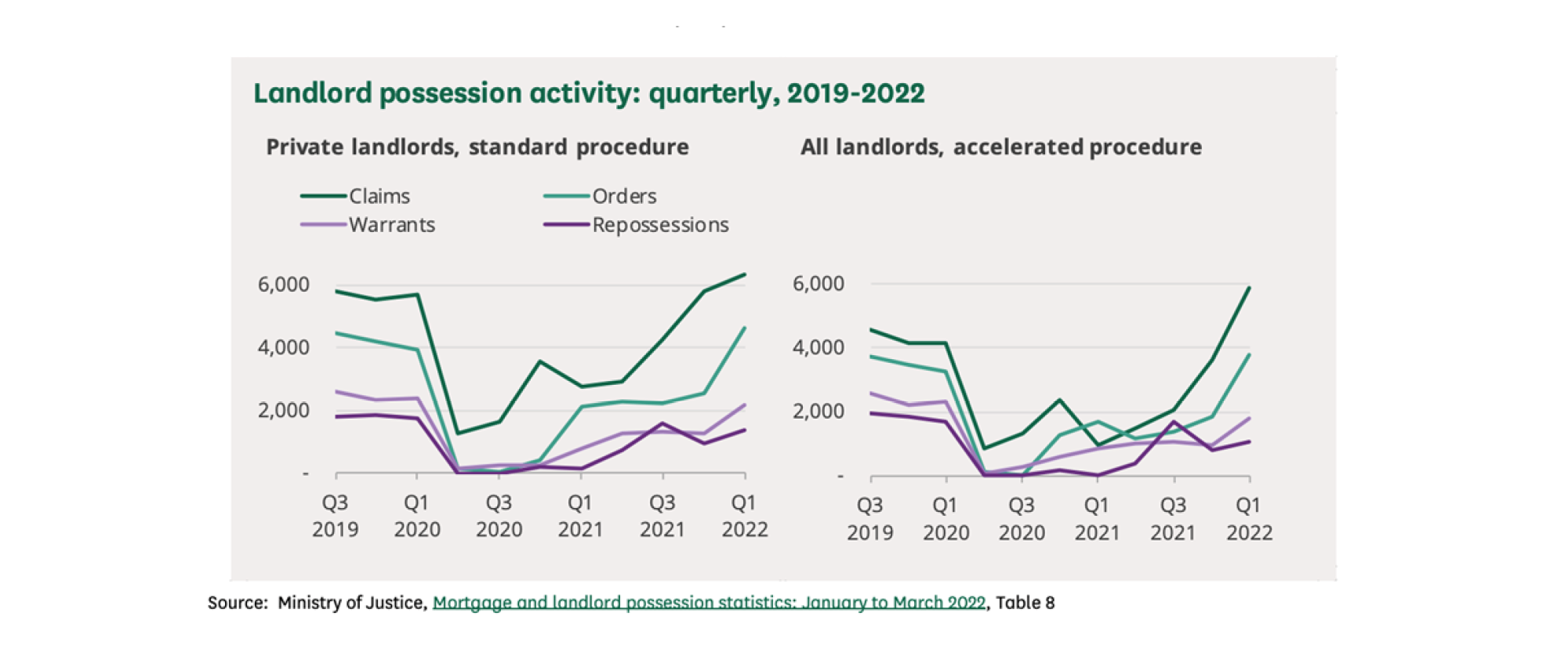

The Government has now confirmed that controversial Section 21 ‘no fault’ evictions will be outlawed under its proposed reforms as set out in its recent White Paper, ‘A fairer private rented sector’, which will most likely involve transitioning all tenancies to periodic, meaning that the tenancy will only end if the tenant chooses to leave or if the landlord has a valid reason (to be defined in law). However, the transition will be in two stages with at least six months’ notice of the dates when they will take effect, and at least 12 months between the two dates. So, for now Section 21 remains and landlords need to make sure they are complying with the existing law.

What do landlords need to know to be compliant with Section 21 regulations?

A landlord cannot use a ‘no fault’ Section 21 notice in the following circumstances:

- The landlord has not given the tenant valid gas safety and energy performance certificates

- The landlord has not given the tenant the current copy of the GOV.UK How to Rent booklet

- The property is required to be licensed by the Housing Act 2004 but is not licensed

- The landlord is in breach of the provisions relating to the protection of tenancy deposits

- The landlord has taken payments prohibited by the Tenant Fees Act 2019 and not repaid them

- The notice is given in retaliation for a complaint about the condition of the property

With the private rented sector on the cusp of a major shake-up and the rules changing all the time, it is vital that landlords keep up to date with the basic legal requirements of letting a property. A 2018 Government survey found that a surprising number of landlords do not comply with lettings legislation. For example, some 38 percent did not check a tenant’s right to rent, while 48 percent did not issue tenants with the Government’s ‘How to Rent’ guide. More worryingly, over 30 percent of landlords failed to provide adequate carbon monoxide alarms in their properties; a negligence with potentially significant issues for all parties involved.

Understandably, breaches of lettings legislation involving safety issues such as gas and electrical compliance by landlords always make the headlines. But this article will focus on the ‘breach of the provisions relating to the protection of tenancy deposits’ - and specifically how a failure to meet certain tenancy deposit protection obligations can invalidate a Section 21 notice to regain possession of your property.

What should landlords do if they haven’t complied with deposit protection legislation and need to serve a notice?

There are an estimated 586,000 unprotected tenancy deposits in the UK, so this is a problem that can and does affect landlords today, 15 years after deposit protection was first introduced.

At a time when many landlords are looking to exit the sector, it is not surprising that this issue is a cause concern for some NRLA members.

Paul says: “Landlord Action has never been busier with Section 21 notices because many landlords have decided to sell up so are seeking vacant possession. For many the high rent arrears accrued during the pandemic are very difficult to sustain; they are not confident the arrears can be recovered so they take the Section 21 route. It is unclear at present whether the impending ban on Section 21 has had an effect, but I have one client who is struggling with the extra costs associated with improving her property and another is looking to seek possession, refurbish his property and let at a higher rent.”

If the landlord hasn’t complied with the provisions relating to the protection of tenancy deposits but wants to serve their tenant with an eviction notice, the situation depends on specifically how the landlord has breached the regulations.

Paul: “If the deposit has been protected but the prescribed information has not been served, serving the prescribed information will mean a valid Section 21 notice can be subsequently served. If the deposit has not been protected in the first place, handing back the deposit is an option. However, this can be a problem if the tenant does not accept it and/or does not have a bank account as posting the cash is too risky.

“One landlord we know of has had a claim against her for £28,000 for multiple breaches of the deposit protection rules. The landlord protected the deposit but failed to serve the prescribed information. She handed the deposit back eventually having obtained advice, but not before, at the request of the tenant, signing a new tenancy each year for a number of years hence the multiple counterclaim for breach of the rules.”

If a landlord forgets to protect the deposit and wants to evict, protecting late will not help. The landlord must give the deposit back, and if they can’t return it, they may never be able to get their property back.

I operate an HMO; am I exempt from protecting deposits?

The regulations around deposit protection and the impact on serving a Section 21 are often queried by landlords renting out HMOs. This is largely because many landlords operating HMOs issue a tenant with a licence agreement rather than an Assured Shorthold Tenancy (AST). Often called ‘sham licensing’ it is an unfair commercial practice often done in an attempt at removing or reducing the legal rights and protections a tenant is entitled to through the Rent Act and the Housing Act. It is though the reality of the situation and not the label attached to an agreement which determines whether an occupier is a tenant or licensee.

Case Study: In 2019, Tower Hamlets council in London successfully prosecuted a landlord for offences under the Consumer Protection from Unfair Trading Practices Regulations 2008. The court found that failing to issue the correct agreement was an unfair practice as it led the occupiers to believe that they had limited rights in the property. The landlord was subsequently fined £22,000 for issuing ‘licence agreements’ to occupants who should have been given tenancy agreements.

Suzy: “There does seem to be a common misconception around HMOs and deposit protection. The mydeposits call centre team is often asked, ‘My property is an HMO, does the deposit need to be protected?’ The answer is fairly straightforward. HMOs are usually ASTs so if a deposit has been taken, it needs protecting. If a landlord (or their agent) has forgotten to protect a tenant’s deposit at the start of the tenancy and is looking to evict them, as well as looking at making deductions to the deposit, they will have to protect it in a custodial scheme. We will protect a deposit late in our insurance scheme unless the member is aware of a dispute. Then they must use the custodial scheme.”

How do I comply if I’m using a deposit replacement?

Instead of taking an upfront deposit a landlord may offer the tenant the choice to pay a monthly ‘subscription’ to help reduce moving-in costs. The landlord still receives the same protection against any damages, as well as any breaches of the tenancy agreement such as unpaid rent or bills, just like if they’d taken a cash deposit. However, because the landlord doesn’t collect any tenant money, there is no potential of deposit related fines. mydeposits is the only deposit protection provider to offer all three deposit protection solutions, in partnership with deposit replacement provider, Ome, also part of the Hamilton Fraser Group.

Does rent to rent make compliance more complicated?

Because of its increasing popularity and the specific risks involved, rent to rent deserves a special mention. Rent to rent is where a company, a local authority (corporation) or an individual (the ‘rent to renter’) rents a property from a landlord (owner) and the landlord receives a guaranteed rental income for an agreed term, regardless of whether the property is occupied or not.

The rent to renter then sublets the property to an ‘occupier tenant’ or tenants, at a higher rent than is paid to the landlord owner, making a profit in return for the risk taken and their efforts.

It is ultimately the responsibility of their landlord (the rent to renter) to protect any deposit in one of the government approved tenancy deposit protection schemes, as Sean Hooker, Head of Redress at the Property Redress Scheme (PRS) explains: “As a landlord owner you are vulnerable if your rent to renter fails to protect their tenants’ deposits. You could find yourself having to repay deposits in this situation, even if you never received them yourself. It’s therefore a good idea to make it a requirement that your rent to renter supplies you with proof of deposit protections.”

Suzy: “At the Property Redress Scheme, we see complaints where a deposit has been taken, by agents who believe it does not need protecting, often in ‘rent to rent’ situations.

Case Study: Juliette lives in Essex but looks after a portfolio of property in south London. She instructed a specialist rent to rent agent to rent out one house for a guaranteed monthly rent over three years as a ‘corporate let’. A few months later the rent stopped being paid and she found out that the agent had sub-let to a South American company who had an extended family living in the property at a greatly increased rent. With no tenancy deposit protection in place and the tenants saying they’d been paying to the ‘Brazilian agent’ it took nearly two years – with the help of Landlord Action - to evict the family and no compensation was received from the original agent.

Paul: “The problem with rent to rent deals like this is that there are so many companies and people in the chain paying rent to each other that it’s difficult to even identity who to evict. In our experience, these kinds of scam rent to rent schemes are becoming more and more common; it needs regulating so that landlords have peace of mind.”

In summary

As we’ve seen, failure to follow deposit protection regulations can have serious consequences for landlords, particularly those seeking to gain possession of their rental property.

Although in the longer term Section 21 ‘no fault’ evictions will be abolished under the Government’s plans to reform the private rented sector, for now it’s vital that landlords make sure they are compliant with both the deposit protection regulations and Section 21 regulations outlined in this article.